Best Sector to Invest in Indian Stock Market after China+1 Strategy

For a long, I was thinking about what to pen down as getting queries from my customer “What kind of kind stock they should invest in” that could help in generating wealth by growing with the Indian economy. In this article, we will not cover specific stocks. Instead, the focus will be on Best Sector to Invest in Indian Stock-Market based on China One Plus Policy.

Invest in the Indian Stock-Market

The Corona Virus pandemic, followed by the conflict in Russia and Ukraine, has affected global supply chains at unprecedented speed and scale. That’s why a group of 18 economies, including the United States, the United Kingdom, and India, unveiled a roadmap for building collective supply chains that would be resilient over the long term.

It also included measures to address supply chain dependencies and vulnerabilities.

This can be seen as a part of the overall China-plus-one strategy.

China Plus One is the business strategy to avoid investing only in China and diversify business into other countries.

Through this strategy, it is a huge opportunity for Indian manufacturers.

In major manufacturing sectors like pharmaceuticals, engineering products, and chemicals, a new world of opportunity has opened up. The cost advantage of manufacturing in India is always an important factor in terms of lower-cost supply for global businesses.

So what is the objective of this article? well to let you guys know which are the best sector to invest in the Indian stock-market for a long-term horizon after the China-plus-one strategy.

Best Sector to Invest in the Indian Stock-Market

Chemicals

As global investors move out of China investors eyeing India as a potential market. Thus, the chemicals sector could be a promising one this year.

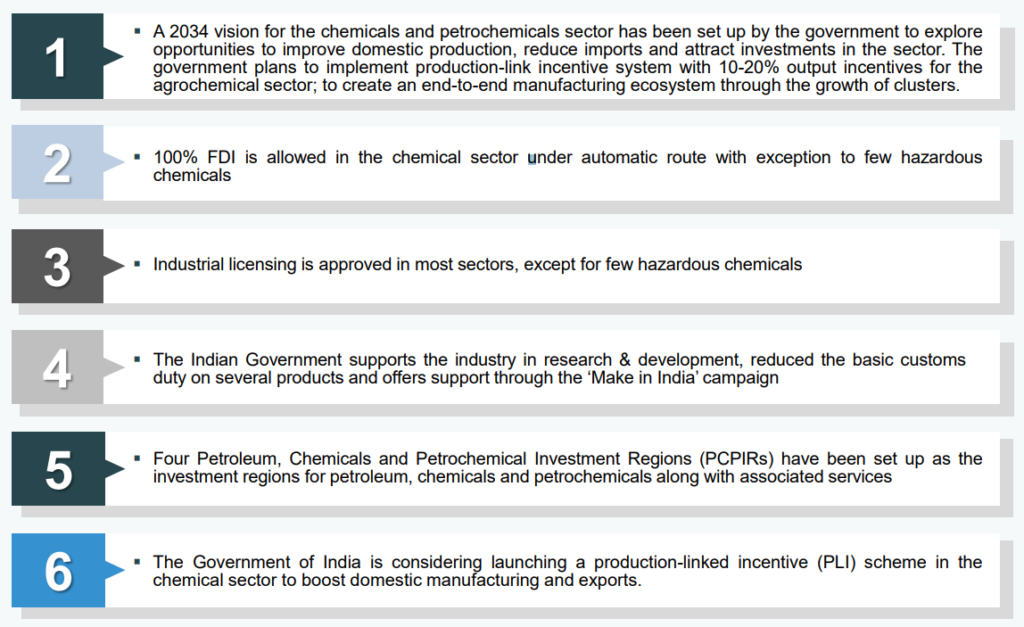

With India’s global market share increasing in this sector, the future of our economy in this sector has got huge potential. Therefore, several big companies are investing in expansion and distribution. However, Government has launched 12 PLI schemes for different sectors which will directly or indirectly benefit the chemicals sector.

Here are initiatives by government for chemical industry in India:

For Indian investors, this is one of the most profitable options for sectoral funds.

Key Highlights

▪ The industry is expected to reach US$ 304 billion by 2025 at a CAGR of 9.3%, driven by rising demand in the end-user segments for specialty chemicals and petrochemicals segment.

▪ The agrochemicals market in India is expected to register 8.6% CAGR to reach US$ 7.4 billion between 2021 and 2026.

▪ Specialty chemicals account for 20% of the global chemicals industry’s US$ 4 trillion, with India’s market expected to increase at a CAGR of 12% to US$ 64 billion by 2025. This gain would be driven by a healthy demand growth (CAGR of 10-20%) in the export/end-user industries.

Pharmaceuticals

The Ministry of Pharmaceuticals has recently notified the Production Incentive Plan (i.e., PLI) to encourage domestic production of more than 41 active pharmaceutical ingredients, key starting materials, and drug intermediaries.

These products are essential inputs in the production of more than 53 APIs for which India depends heavily on China. However, the PLI plan has helped the government to reduce imports by encouraging the domestic manufacturing of pharmaceuticals.

Key Highlights

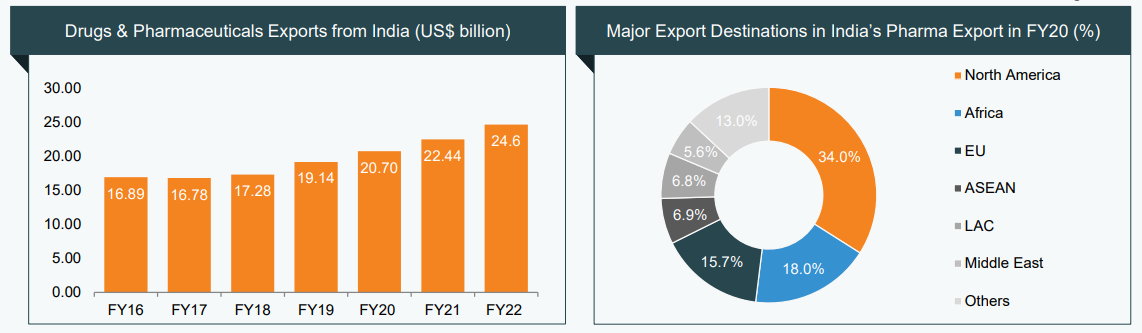

▪ Globally, India ranks 3rd in terms of pharmaceutical production by volume and 14th by value. The domestic pharmaceutical industry includes a network of 3,000 drug companies and ~10,500 manufacturing units.

▪ According to the Indian Economic Survey 2021, the domestic market is expected to grow 3x in the next decade.

▪ India’s domestic pharmaceutical market stood at US$ 42 billion in 2021 and likely to reach US$ 65 billion by 2024 and further expand to reach ~US$ 120 billion by 2030.

▪ The Ayurveda sector in India reached US$ 4.4 billion by 2018 end and grow at 16% CAGR until 2025.

Auto and Auto Components

Based on the “China plus one” strategy, several automakers has started moving their component supply operations, or at least a portion of them, out of China. The decision is based on the fact that the United States and others have accused China of manipulating its currency and making it non-competitive for them.

This is an excellent opportunity for manufacturers in India. Given the scale of China’s exports, India will have significant opportunities. While we must compete with other countries in this regard, in major manufacturing sectors such as the auto industry and its components, a new world has opened up.

Global companies cannot avoid India as they have to deride their supply chain.

The cost advantage of manufacturing in India is still a significant factor in terms of lower-cost supply to global companies.

Now, these industries are working together to develop technologies and take advantage of the global market while leaving imprints on the global value chain. The government also introduced a production-linked incentive (PLI) scheme to encourage manufacturing.

The Government of India has come out with Automotive Mission Plan (AMP) also which will help the automotive industry to grow and will benefit Indian economy.

The following are the benefits AMP:

1. Contribution of auto industry in the country’s GDP will rise to over 12%.

2. End of life Policy will be implemented for old vehicles.

Key Highlights

▪ The exports in the auto components sector saw an increase of 76% to reach US$9.3 billion in the first half of FY 22. The forecast of the ACMA (Automobiles Components Manufacturers Association) projects the exports of this sector to increase up to US$ 80 billion by 2026.

▪ The India passenger car market was valued at US$ 32.70 billion in 2021, and it is expected to reach a value of US$ 54.84 billion by 2027, while registering a CAGR of over 9% between 2022-27.

▪ The electric vehicle (EV) market is estimated to reach Rs. 50,000 crore (US$ 7.09 billion) in India by 2025.

Bottomline

As per current analysis, the above three sectors have got huge potential to invest. Depending upon the category of funds or stocks, you can try investing in those companies which are directly or indirectly involved in these sectors.

Source – ibef.org