Central Bank of India Locker Charges 2023 | How Can I Open Central Bank of India locker?

Locker Facility

As part of its service, the Central Bank of India can provide safe deposit services to its customers.

These safe deposit lockers, as they are formally known, are available in different sizes depending upon the contents that would be placed in the lockers, the demand from customers for various types of lockers, and the price or rent that you charge.

Normally, safe deposit lockers are boxes that are in an iron-gated room with well-equipped emergency alarm systems, surveillance systems, and security guards. Moreover, there are two people who own the locker when it opens, first you and your bank.

Let’s look at the Central Bank of India Locker Charges along with locker sizes.

Central Bank of India Locker Charges

| Type | Dimensions Type | Height | Width | Depth | Volume in cu.cms | Rural/ Semi-urban | Urban/ Metro |

|---|---|---|---|---|---|---|---|

| 1 | A A A-1 A | 11.74 11.43 11.43 11.43 | 13.33 14.92 16.19 19.05 | 34.29 51.75 51.75 55.88 | 5366.18 8825.21 9576.42 12167.39 | 900 900 900 1100 | 1200 1200 1200 1500 |

| 2 | B B B-1 | 14.76 15.55 14.76 | 18.41 19.68 19.68 | 51.75 46.99 77.72 | 14062.11 14380.06 22575.85 | 1500 1500 1500 | 2000 2000 2000 |

| 3 | C C-1 C | 11.74 11.43 11.43 | 34.29 32.86 34.13 | 46.99 51.75 51.75 | 18916.51 19436.77 20187.98 | 2000 2000 2000 | 3000 3000 3000 |

| 4 | D D-1 B | 17.78 17.78 11.43 | 23.81 25.08 38.01 | 51.75 51.75 55.88 | 21907.93 23076.48 24277.30 | 2000 2000 2000 | 3000 3000 3000 |

| 5 | H-1 E E | 31.43 15.55 14.76 | 18.41 41.27 40.16 | 51.75 46.99 51.75 | 29943.91 30155.76 30675.41 | 3000 3000 3000 | 4000 4000 4000 |

| 6 | F F G F | 26.67 26.67 17.78 22.86 | 34.29 32.86 50.64 38.01 | 46.99 51.75 51.75 55.88 | 42973.02 45352.47 46594.62 48554.61 | 4500 4500 4500 4500 | 6000 6000 6000 6000 |

| 7 | H H L-1 | 31.11 31.43 29.21 | 41.27 40.16 50.64 | 46.99 51.75 51.75 | 60330.91 65320.34 76548.31 | 6000 6000 6000 | 8000 8000 8000 |

| 8 | L | 39.37 | 50.64 | 51.75 | 103173.80 | 8000 | 10000 |

Rentals may vary between branches under the same location. Please check applicable rentals via Internet/Mobile banking or by visiting the branch.

Service Charges

| Particulars | Particulars Service charges |

|---|---|

| Locker Operations | 18 times FREE during one Financial Year More than 18 times during the Financial Year—Rs.100/- per occasion |

| Open of Locker | Rs.1000/ Plus actual expenditure incurred for breaking open the locker and changing the lock by the manufacturer of lockers. |

| Security/ Caution Money Deposit | The locker holder (the Lessee) is required to keep an amount equivalent to three years of rent charges for break opening of the locker +Rs1000/- in the form of a Term Deposit |

| Saving/ Current Account | While letting out the locker, the customer must have a Saving/ Current A/C or open a Saving/ Current A/C, link with locker account, and submit Standing instructions to debit his/her a/c for recovery of annual rent and overdue, if any, as per Banks’ norms. |

| The existing locker holders without linked Saving/ Current A/C must also open Saving/ Current A/c link with locker account, and submit Standing instructions to debit his/her a/c for recovery of annual rent and overdue,if any, as per Banks’ norms. |

What is the Term and Condition of Bank Locker?

- New – As per the RBI guideline, Banks are allowed to obtain a TD (i.e. Term Deposit), at the time of allotment, which would cover 3 years’ rent and the charges for breaking open the locker in case of such eventuality.

- Rental depends on the size of the lockers & location of the branch.

- Annual rental is payable in advance. In addition, one-time registration charges is also payable.

- KYC(Know Your Customer) norms are applicable for locker hirers.

- Safe Deposit Locker can not be allotted to minors either singly or jointly with others. However, a nomination facility is available.

- In case of locker remains unoperated for more than 1 year. After that, the bank has the right to cancel the allotment of the locker and open the locker even if the rent is paid regularly.

- Annual or monthly rent collected will NOT be refunded to the customer on surrender.

- Generally, the Allotment of lockers is on a first-come-first-served basis. For this reason, a waitlist is maintained.

- Operation in the Deposit Locker will be stopped if rent is not paid on the due date.

- In case of Locker Custody with survivorship clause the bank will demand only the following papers:

Firstly, a copy of the death certificate. Secondly, duly filled in the claim application. Thirdly, and most importantly, a stamped receipt for discharged safe custody receipt/Locker. - Loss of key should be immediately informed to the Bank’s Branch. In other words, the bank shall not be responsible for any loss. Charges for opening the locker, replacing the lost key, and for changing the lock shall be payable by the Renter.

- New- The liability of banks will be limited to 100 times its annual rent in case of fire, theft, building collapse, or fraud by bank employees.

What are the Documents Required for Bank Locker?

- KYC documents

- Passport size Photograph

- Current or Savings account

- Security Deposit

Also Read Bank of India Locker Charges in 2023 – How Can I Get Locker in Bank of India?

How Can I Open the Central Bank of India locker?

Time needed: 5 minutes

Follow the steps given below for getting the locker in the Central Bank of India

- Locker facility

Central Bank of India Locker facility is offered at select branches and allotment of lockers is subject to availability.

- Online Application for Locker Request

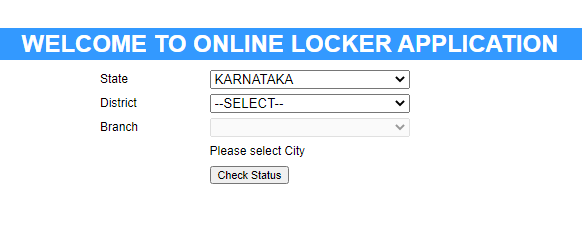

Click here to check the vacancy without login.

Enter the state where you have the account in the Central Bank of India. Similarly select district, and branch and click on the status button.

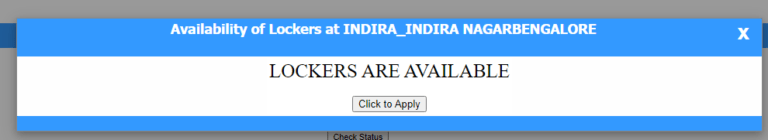

- Online Status

After entering the details, a screen will flash with the availability option. Now, click on the “Click to Apply” button.

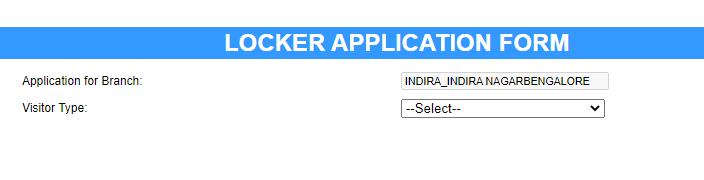

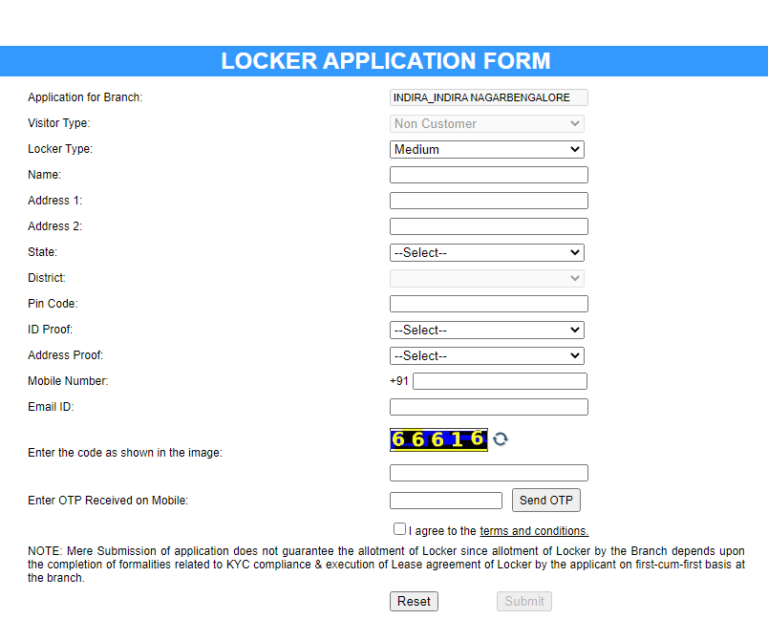

- Visitor Type

Next, visitors type as a customer or noncustomer.

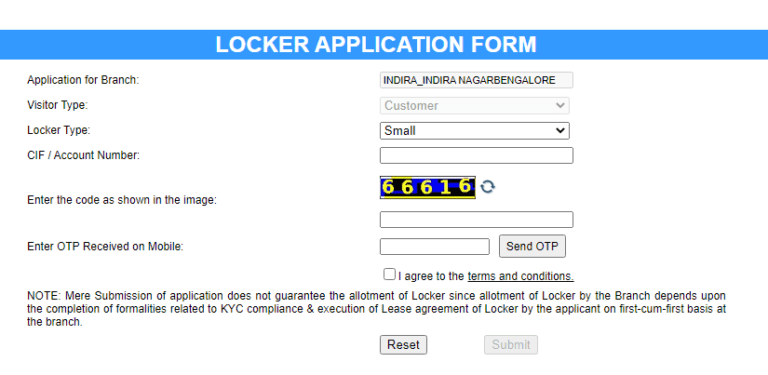

- For Customer

Now, enter all the details such as locker type, and account number.

Enter the OTP received on your registered mobile number. (After clicking on Send OTP)

However, the locker will be allotted on a first-come-first-served basis and a separate register will be maintained.

- For Non Customer

Now, enter all the details such as locker type, address, ID proof, Mobile number, etc.

Enter the OTP received on your mobile number. (After clicking on Send OTP)

- Submit

Next, click on the “Submit” button. You will receive a reference number, keep it with you.

Icon & Source – https://www.centralbank.net.in/