Future of Gold Price: Should I buy gold now ?

Future of Gold Price

Advertisement

| In this article, We will discuss about future of Gold Price. Gold – yellow metal is an important part of Indian wedding is primarily used as a hedge against inflation. |

| Considered as a safe haven for investors during periods when stock markets fall across the world, investors prefer to park their funds in gold commodity. |

| Because of Covid 19 entire world markets had crashed, putting uncertainty among the investor led strong sentiment for gold metal. |

| A key reason, behind this robust performance is that availability of gold has changed little over time led to increase by 1.6 per cent per year over the past 20 years. |

| Gold is regarded as the reserve asset as highly liquid, no one’s liability, carries no credit risk and is scarce, since ages preserving its value over time. |

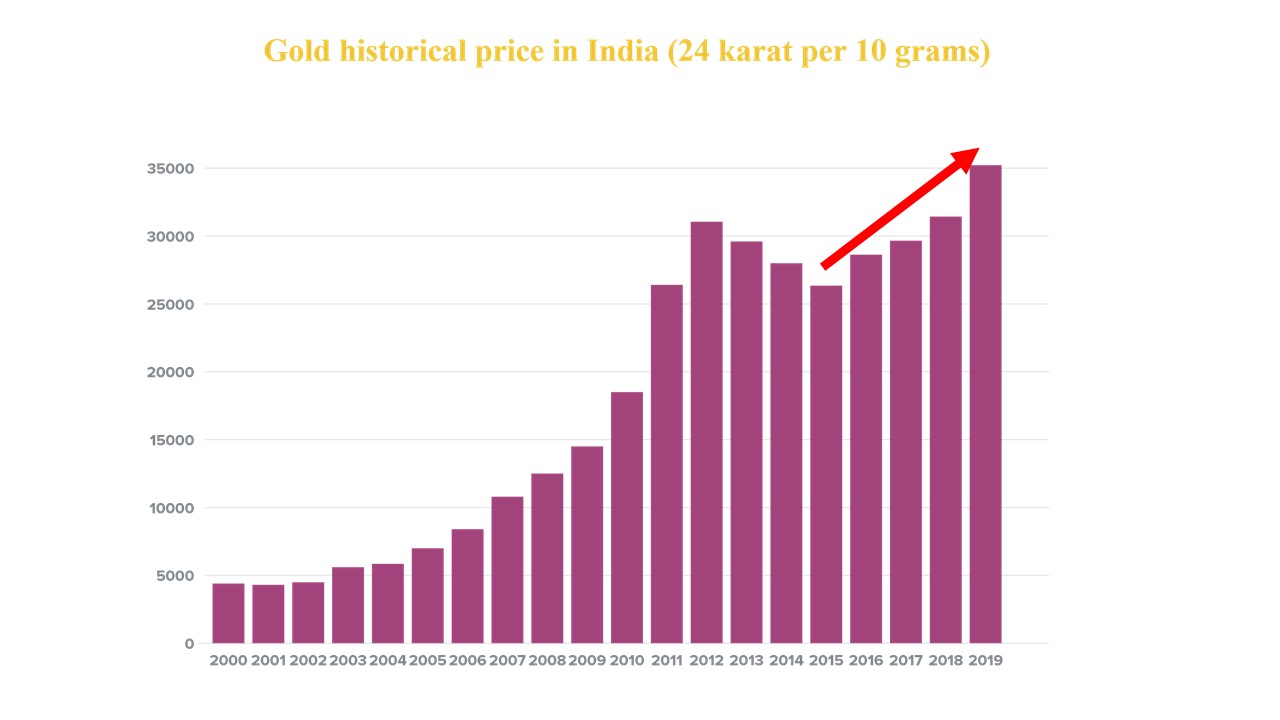

Gold historical price in India

Will gold prices continue to rise?

| Commodity analyst has revised their price targets saying that prices could go up to Rs 6400 per 1 gram in the next 2 years. |

| The market is bullish for gold metal as the fundamental factors like lower interest rates, negative rates in some economies, the enormous amount of liquidity and expanded fiscal balance sheets of governments which are trying to push growth during a pandemic is expected to drive the price trend. |

| We expect this bull run in gold price hike till covered comes under control or effective vaccine is launched to boost the positive sentiment of investing in equity and bond market. |

| As prices are soaring, investors start investing gold in 2020 as a key portfolio hedging strategy. |

| Irrespective of other factors, the Covid 19 will likely have a long-lasting effect on asset allocation. |

“It will also continue to reinforce the role of gold as a strategic asset and we believe that the combination of high risk, low opportunity cost and positive price momentum looks set to support gold investment and offset weakness in consumption from an economic contraction,” says a World Gold Council report. (Source Gold Org) |

Should I buy gold now ?

| Having reviewed gold price over decade and negligible depreciation in terms of price, yet again gold metal has proved its worth, and gives a decent return of 7-8% in long term and for short term eye popping return of 43% in last six month. |

| Hence best way of making investment in gold would be SIP or SGB to earn best return from market. |

Advertisement

Advertisement