State Bank of India – Gold Coins Scheme | Features | Benefits | FAQs | 2023

Gold Coins From SBI

Gold has been considered the most valuable metal for Indian society as it carries a legacy over a period.

Especially Indian women prefer to buy gold ornament as a way of investing presuming the metal is the smartest way of investing their savings.

People love to gift this metal to relatives and friends during weddings and it’s considered auspicious to buy gold on Dhanteras or Akshaytritia.

Even the most renewed & trusted State Bank of India offer gold coins in 2023.

Gold coins from SBI come with a lot of prominences in terms of value, usage, religion, and gifting.

Features

| 1. SBI Bank offers Gold Coins of 24 Carat – 999.9 purity. |

| 2. The Coins can be purchased as an investment or for gifting/marriage purposes. |

| 3. SBI Gold Coins are packaged in tamper-proof packets to maintain authenticity and purity. |

| 4. The Gold Coins or Bars are priced competitively based on the daily market rates of Gold. |

| 5. Round coins are available in denominations of 2, 4, 5, 8 and 10 grams. |

| 6. Rectangle bars are available in 20 & 50 grams. |

| 7. Gold coins can be purchased from designated branches only. |

Read also Gold Investment: What | Why | Pros and Cons | Schemes | Returns

Documents Required

- PAN number/copy of Pan Card

- Application Form

Recommended Articles

Sovereign Gold Bond SBI

SBI Prepaid Cards

YONO SBI Registration

How to Create VPA in SBI?

SBI Express Remit Review

Plot and Construction Loan From SBI Bank

SBI Yono Digital Account

Locker Charges in SBI

SBI Loan Against FD

Why Should I Buy Gold Coins?

| 1. Market experts have corroborated that at least 6-10% of your investment portfolio must be invested in gold. |

| This not only assists you to have a diversified portfolio. However, also assists you to balance the risk. |

| 2. The purest form of gold (99.9% purity) can be purchased in coin or bars form. |

| 3. The gold coins come with advanced security and anti-counterfeit features, every pack of coins or bars has a unique barcode and serial number. |

| When you purchase gold from a jeweller, the price can be an issue as you can never be sure about the gold content. However, when you buy gold coins from SBI, you can be sure that you get the best quality gold and the pricing is right. |

| 4. Reduces making charges otherwise lost when selling. |

| 5. It is an attractive investment proposition that can fetch amounts in case of an emergency. The gold coins or bars promise quick liquidity. |

| 6. You can sell coins or bars to buy the latest designs in gold jewellery at the time of the wedding. |

| 7. All gold coins/bars minted in the Government mint and sold are certified as per the Bureau of Indian Standards Hallmark. |

| 8. You don’t have to pay capital gains tax until you sell. |

Read Also Comparison Gold and Real Estate: Which is better in 2021-22 ?

Important Points to Know While Buying SBI Gold Coins

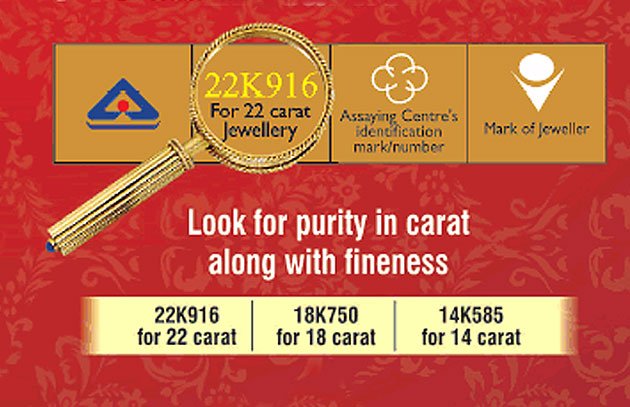

| 1. While buying a coin apart from purity, one should also verify if it is hallmarked. |

Indian Government has set up the BIS to ensure that consumers are not cheated while buying gold coins. Source: BIS Website |

| There are 4 components that are hallmarked on gold. These are: BIS logo, Purity in carat and Fineness, Logo of Assaying and hallmarking center and Bank identification mark and number. |

| 2. Please contact SBI Call Center / your nearest Gold Coin dealing branch for further information. The bank has two toll-free numbers for customer support: 1800 11 2211 1800 425 3800 |

| 3. Rates are exclusive of Sales Tax / VAT and other local levies, which are payable extra, as applicable. |

Read Also Jewellers Scheme

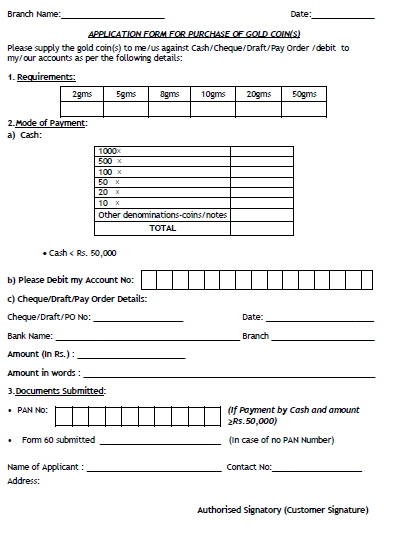

Application Form

How to Buy Gold Coins From SBI?

Time needed: 5 minutes

Following are the main steps for buying gold coins from SBI.

- Application Form

Visit the nearest designated SBI branch and fill in the Gold Coin Application form.

Gold coins are available in select cities and come with a host of security features that leave no scope for tampering. However, SBI is one of the few banks to have approval from the RBI to import and sell gold to its customers in India.

- KYC Document

You should carry your PAN Card and Aadhar card photocopy.

A PAN number is mandatory to buy gold from the SBI if the value of your gold purchase is INR 50,000 or more. However, to buy a Gold coin of less (<50,000) value than that, a PAN card or other special documentation is not required.

- Coin Information

Mention the weight and the number of coins required along with other relevant details.

- Submission

Submit the application along with the required amount.

- Delivery

The SBI will process your application and deliver the Gold Coins and the Invoice to you.

Do SBI Buy Gold Coins?

If you have bought gold coins/bars or are thinking to buy from an SBI, do keep in mind that they will not buy back those coins as per an RBI i.e. Reserve Bank of India guidelines.

Read also India Post Gold Coin – Gold Coin Rate | Can I Purchase Gold Coin from Post Office?

Coin Rate of SBI

Please contact call center or your nearest branch for current gold rate information.

- Toll-free number: 1800 11 2211

- Toll-free number: 1800 425 3800

- 080-26599990

Read also Best Gold ETF in India | How to Choose Best Gold ETF?

| Links | |

| What is the difference between Bond and Equity? | NPS vs PPF: NPS vs APY |

| What is the difference between Bond and Debenture? | SGB vs FD |

| RBI Bonds 2021 vs Tax Saving Fixed Deposits vs SGBs |

FAQs

Yes, SBI has approval from RBI to sell Gold Coins & bars.

SBI Bank sells 24-carat gold coins that come in tamper-proof packaging to prevent any damage.

The coins are being sold in the denominations of 2, 5, 8, and 10 gms.

Rectangle bars are available in 20 & 50 gms.

The Gold coins are available in the form of round/rectangular bars coins with the SBI logo on the back.

The gold coins are being sold at designated branches only.

Yes. Both SBI customers, as well as noncustomers, can buy Gold Coins from branches.

Existing customers can purchase gold coins by the issue of cheques from their accounts or by providing debit instructions.

Non-customers can deposit cash to buy Gold Coins if the value is less than INR 50,000/-.

In case the buy value is INR 50,000/- or more, then the payment will have to be made by cheque or Demand Draft(DD), on the realization of which the Gold Coins will be handed over.

The rate as applicable on the date of realization of the cheque will be charged for the Gold Coins. PAN card copy duly signed by the customer is also required in case of Purchase for INR 50,000/- and above, and for all Cash Purchases.

No. SBI does not buy the Gold Coins back.

Disadvantages

Would like to highlight a few drawbacks before you make a decision to buy gold coins as a bank in India doesn’t buy back sell gold coins, in case one likes to liquidate the same has to contact the jewellers.

This would mean that reputed gold jewellery chains do not buy gold for cash. The coins can be sold to them but in exchange for jewellery only.

These coins or bars are generally imported from international mining companies, which is why banks charge 8 to 10% higher than the market rate. However, times are changing. There are multiple ways to buy gold these days, especially if you are looking at it from an investment perspective.

SBI Sovereign Gold Bonds are another option, these offer an assured interest rate of 2.5 percent per annum.

You can enjoy the ease of investing through internet banking.

The SGBs have a tenure of 8 years, with an exit option starting from the fifth year.

Issued by the central government, they are tradeable on the stock exchange. TDS is not applicable to them and they can be used as collateral for loans.

More Features Sovereign Gold Bond – Features