Health Insurance : A Complete Guide | Truth behind Policy | Best Plan

In this article hide

Introduction

Advertisement

| Health insurance has become one of the necessities due to increasing medical cost and kind of the lifestyle we as a generation opted for. |

| One should always buy health insurance for self and family to avoid any emotional, mental, and financial stress arising out of unforeseen medical situations. |

| Due to Corona Pandemic, the cost of medical treatment and hospitalization has increased many folds. |

| We are going to cover how the health insurance plan will be our rescuer in case of any medical emergency. |

What is Health Insurance?

Advertisement

| Health insurance is a type of insurance which covers medical and surgical expenses for the insured member in case of any medical exigencies. |

| It provide cover to major illness or injury occurred during the insurance period provided that illness does not fall in any waiting period. |

| Illness/Injury is highly unpredictable in current scenario basis the lifestyle we live in so in case of any medical emergency you can rely on health insurance plan. |

Why should I buy health insurance?

Advertisement

| As we all know life is so unpredictable and the cost of medical expenses rising every year many fold so in order to put any financial strain on our saving, its best to opt for health insurance plan so that one does not have to compromise on other goals set for our life. |

| No one likes to get hurt or fall sicks, but we never know what our destiny has plan for us, so to live a life peacefully without any stress one should opt for health insurance plan. |

| In case one fall prey to deadly diseases like cancer or organ failure which require treatment exceeding 25 lacs and plus and no common people keep these large sums in their saving bank account or else even if someone has then also to meet the demand of medical treatment, anyhow it will drain out your savings. |

| So considering these unforeseen situations health insurances has a become a necessity and now insurance company seeing the pandemic COVID 19 has made changes in their insurance exclusion to cover this deadly virus which does not distinguish people on the basis of rich or poor. |

| But in case one does not hold insurance policy then definitely it will make you poor by paying expensive medical cost incurred to treat this illness. |

Truth behind health insurance policy

Advertisement

As we have already discussed why one should have health insurance. Now let’s discuss about the Myths associated with health insurance plans.

| Health insurance is only need once we cross the age of 40 Being into health insurance industry for 8 years, don’t fall in this trap. It's best to have health insurance plan as early in your life as it will provide a protection to your investment goal. As illness/injury does not sees one age and its best to opt when you are fit and healthy then insurer will provide the policy at a lower premium considering the risk. |

| Having corporate insurance, no need to buy private insurance It’s good your employer is providing you the medical coverage, but sum insured would be restricted to certain limit basis the rank you hold in your organization. So, at the time of medical emergency, there are good chances that group insurance might not provide sufficient cover so it best to opt for the private insurance with deductible benefit which comes at a lesser cost. |

| Low premium policy is the best policy Do not buy health insurance plan comparing the premium as this should be the last factor to consider. One should always buy health insurance basis the features and cover it will going to provide and compare insurance with the right version. |

| Insurer will provide cover from Day 1 Generally, all health insurance policy comes with the initial waiting of 1 month in which hospitalization pertaining to any illness will not be covered except accidental hospitalization. |

| All benefits will be lost if I don’t renew a policy Insurance company provide the grace period of 30 days to renew the policy with continuity benefit, But in case during the grace period if any illness/injury occur then to insurance company not liable to pay any expenses. So its best to renew the policy before the end date to avoid any loss of cover in case of unfortunate event. |

| Non-disclosure of pre-existing diseases At times insured misinterpret this clause presuming insurance company will going to provide cover for all pre-existing diseases after specified waiting period that waiting period is applicable for the diseases which you have disclosed to insurer at the time of purchase, In case you don’t disclose these factual information and your insurer get to know after years when you need treatment for pre-existing illness, your insurer hold all right to null and void all your claims and policy on fraudulent grounds. |

| Hospitalization covers for more than 24 hours Buying a health insurance does not guarantee all your claim to be paid for which hospitalization was not even needed. Some illness does not require hospitalization of 24hours or can be treated on OPD or day care basis. If you get admit for such instance, your insurer will reject the claim on ground of misuse of health insurance cover. |

| Presuming insurer will cover 100% medical cost This should never be presumed as there are several sub limit pertaining to room rental or day care procedure, In case you have opted for the higher category room or taken treatment exceeding the sublimit then insured individual will be required to pay overhead charges along with non-medical charges. |

Features of Insurance Plans

Advertisement

| 1. Provide cashless or reimbursement facility for hospitalization of more than 24 hours or day care treatment outlined by the insurer. |

| 2. Covers pre and post hospitalization expenses for 30 and 60 days respectively. |

| 3. Covers domiciliary expenses in lieu of hospitalization. |

| 4. Few plans provide annual health check up facility for the adult insured once in a policy period. |

| 5. Reimburse ambulance expense if the ambulance was a necessity in emergency upto specified limit. |

| 6. Tax benefit up-to Rs 25000 under section 80D. |

| 7. In case of no claim during the policy period, companies provide no claim bonus up to 150% of the sum insured. |

Best Private Health Insurance Plan

Advertisement

| Health insurance plans | Maximum sum insured | Renewal option |

|---|---|---|

| Aditya Birla Active Assure Diamond Plan | 2 Crores | NA |

| Universal Sompo Essential Privilege Plan | 10 Lakhs | Lifetime Renewability |

| Care Health Plan (formerly known as Religare) | 6 Cores | Lifetime Renewability |

| Max Bupa Health Companion Individual | 1 Crore | Lifetime Renewability |

| Star Family Health Optima Plan | 25 lakhs | Lifetime Renewability |

| HDFC ERGO Optima Restore | 50 lakhs | Lifetime Renewability |

| HDFC ERGO my:Health Suraksha | 75 lakhs | Lifetime Renewability |

| Royal Sundaram Lifeline Supreme | 50 lakhs | Lifetime Renewability |

| Star Health Senior Citizen Red Carpet Plan | 25 lakhs | Lifetime Renewability |

| ManipalCigna Prohealth Plus | 50 lakhs | Lifetime Renewability |

How to buy insurance?

Advertisement

In this section, we will be going to discuss “How to buy insurance?”.

| One can buy this maternity coverage from the company’s website or visiting their company branches in person. |

| One can buy these insurance plan from the insurance advisors also accredited by IRDA. |

| To buy insurance, one has to fill the application form with the required details your insurer may need in order to examine whether to give you an insurance or not. |

| In case of online buying, you can make the payment by credit card, debit card , net-banking or UPI payment mode. Offline one can make the payment by cheque or demand draft. |

Health Insurance Plan from Government of India

Advertisement

| Considering the importance of health insurance, central and state government come up with health insurance policies designed to offer the sizeable sum insured at the nominal premium to maintain the health quotient of their citizen. |

| Let us discuss few plans from GOI: |

Pradhan Mantri Jan Aarogya Yojana

Advertisement

| This scheme also known as Ayushman Bharat scheme and offered by Indian Government specially to the poor and vulnerable section of the society who can’t afford to avail private health insurance. It provides a coverage of 5 lacs and offered on floater basis by issuing a golden card to the beneficiary families. There is not limitation on the number of people in the family. Insured member can avail cashless facility by showing golden card. |

Employment state insurance scheme

Advertisement

| It provides cover to the employees of non-seasonal factories and have strength of more than 10 workers at least. Provide cover for hospitalization for self and dependent in case of illness and disablement. During the course of employment if worker dies then the dependent is entitle for death benefit. |

Central Government health scheme

Advertisement

| This scheme provides health insurance benefit specifically hospitalization, domiciliary procedure and OPD to central government employees, pensioners and their dependents. |

Pradhan Mantri Suraksha Bima Yojana

Advertisement

| This scheme is applicable to all Indian resident aged between 18 to 70 years and holds bank account. Provide coverage in case of death or partial or permanent disability. |

Rashtriya Swastha Bima Yojana

Advertisement

| This scheme is designed for people working in the unorganized sector that hardly provide any health insurance cover. This scheme is launched as initiative by Indian Ministry of labors and employment and provide for poor people working in unorganized sectors to avail the benefit in case falling sick. |

Health Insurance claim settlement ratio?

Advertisement

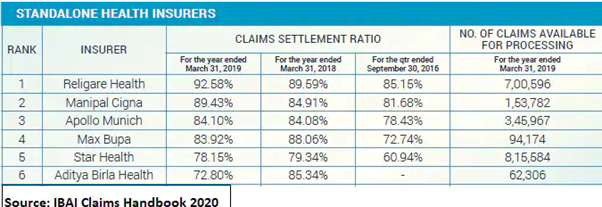

Its best to check claim settlement ratio of the insurer before narrowing down on your choice of the plan.

Higher the claim settlement ratio and quicker is claim settled, it is better for the customers.

Question and Answer Session

Advertisement

| Health insurance premium? Is the amount that insured pay to insurance company to get the health cover for self and dependent. One should not lure towards cheap premium policy. In order to compare the plan, always ensue you compare same version and premium should be the last factor for deciding on plan. |

| Tax Benefit? One can claim deductions up to Rs. 25000 (under 80D) towards the premium paid for self and dependents. |

| Premium calculator? It will facilitate in calculating health insurance premium and helps in comparing health plan offered by the different insurer as these are designed considering different factors for issuing a health plan to the insured |

| Health insurance renewal? One can renew the health insurance with the same insurer for next policy period or can switch current plan to some other insurer by using portability options which would help in getting the continuity benefit of the previous insurer like waiting period waiver. |

| Health Insurance waiting period? There are generally three waiting period in health insurance policy: Initial waiting period: It’s of 30 days from the issuance date of the policy. No claim will be permissible except the accidental claims from the enforcement date of the policy. Specific Waiting period: Few listed diseases will have the waiting period of 24 months, hospitalization related to these illnesses will be entertained once you complete a specific period with your insurer. Pre-existing waiting period: Pre-existing diseases are the one that insured has declared to the insurer before issuance of the policy. If the insurer has accepted that policy by putting a waiting period, then those declared illness hospitalization will be covered post the expiry of waiting the period. |

| Can health insurance be cancelled at any time? The plan can be cancelled within freelook period or anytime, but refund will depend on the insurer terms and conditions. Free look in the period: Is the period within which policyholders hold the right to cancel the within 30 days of issuance in case not satisfied with policy terms and conditions, then refund will be made to the policyholder for deducting the premium for the no of days policy remain active during the policy period. Standard cancellation: If due to personal reason, policy holder wishes to cancel the policy then their refund will be made as per the slab issued by the insurer. |

| How much health insurance do I need? That depends on several factors to decide the sum insured one would be required likewise the type of hospital one would prefer for treatment, age of the insured, health status of the insured, your affordability quotient. In general family of 4 members, two adults and two kids should opt for 7-10 lac covers on family floater plan considering above factor. |

| Health insurance portability and accountability act? Is a federal law that helps in switching to different insurer with carry forward benefit to the new insurer. |

| Deductible plan in health insurance scheme? Now a day’s insurer provides top up plan that comes with a deductible feature. Deductible would be the amount that insured have to pay from his own pocket during hospitalization as a part of the claim if it arises. Let’s says claim arises for 50000 Rs and you have chosen deductible of 25000 Rs then insurers will provide cover 25000 Rs and above claim arises. |

| Insurance plans for family? Family health insurance plans covers you and your loved ones depending upon the plan you opt that could be floater or individual basis. |

| Health insurance TPA claim? TPA acts as intermediaries between insurance provider and policy holders which helps in claim management, client servicing, expert opinion and manages the network of health care providers. |

| Health Insurance GST? Currently, GTS of 18% is charged on the basic premium offered by the insurers. |

Conclusion

Advertisement

| Well to live life peacefully one must have health insurance plan for yourself and your loved ones. |

| The burden of paying medical expenses will be lessen in case you hold health insurance policy that at least will relieve you from financial distress in case of medical emergency as medical cost is inflating every year by 15% |

Advertisement

Advertisement