How to Apply for IPO and FPO in SBI (ASBA)? | Eligibility | Benefits | Withdrawal Conditions

Initial Public Offering & Follow on Public Offer in SBI(ASBA)

Securities and Exchange Board of India (SEBI) has notified a list of banks through which a retail investor can apply online for an Initial Public Offering (IPO) or Follow on Public Offer (FPO).

These banks are known as SCSBs.

State Bank of India is one of the members of the SCSBs which allows its account holders to apply for an IPO online through SBI net-banking (online) as well as offline.

Here we will discuss How to Apply for IPO in SBI online or offline?

State Bank of India is glad to offer you a simple and convenient facility for investing in IPOs and FPOs via the ASBA facility.

Now, What is the ASBA facility?

ASBA means “Application Supported by Blocked Amount”.

In the facility, whenever you will apply for an IPO and FPO, you can apply via your bank.

It means that your expense for the money to be paid for applying for the IPO and FPO will be paid by the SBI only, and this will be transacted only when you get the final allotment of shares.

What are the Benefits by Applying through SBI Online?

- The process of allocating funds for IPO and FPO is made easy.

- You do not have to visit the designated SBI Branch for submitting the form.

- While applying for IPO and FPO via SBI Net-Banking the money will be debited from your saving or current account to the extent of successful allotment ONLY at the time of allotment.

- Until such allotment, the money will remain blocked in your account.

- The amount blocked in the account, will continue to earn interest during the entire IPO and FPO application processing period, if held in an interest-bearing account.

Also Read Benefits of IPO for Investors in India : Why Should You Invest in an IPO?

Recommended Articles

Today’s New IPO Listing – How to Choose Best IPO for Investment?

Face Value in IPO – How to Calculate Face Value or Nominal or Par value?

Lot Size in IPO – How to Calculate Lot Size? | Can I Modify IPO Lot Size?

Book Built Issue IPO – Process | Steps | Types | Pros & Cons

Price Band in IPO – How is the Price Band of an IPO Decided?

Undersubscribed IPO – What Happens if the IPO is Undersubscribed?

Listing Gains in IPO | Highest Listing Gain IPO in India

When Can I Sell IPO Shares? Can I Buy & Sell an IPO in the Same Day?

IPO Applying Time – Cut Off Time for Online IPO Application

Types of Investors in IPO – What is the difference between RII, NII, QIB & Anchor Investors?

How Many Lots Can We Buy in IPO to increase the chances of an allotment?

Oversubscribed IPO: What happens if the IPO is oversubscribed?

Eligibility

- Resident Indian individual.

- The investor can be from any of the approved categories eligible to apply for IPO and FPO, as per SEBI norms.

- Demat account with NSDL or CDSL.

- Valid Permanent Account Number (PAN).

- The investor can maintain a Internet enabled Savings or Current account with SBI.

- The investor can have sufficient clear credit balance in his/her account to block funds to the extent of application money.

Also Read What is SME IPO? | SME IPO Vs Regular IPO | How to Invest in SME IPO?

Who can Apply through SBI?

The following categories can apply through SBI NetBanking process

Through Retail Internet Banking:

- Retail Individual Investors

- Employees

- Shareholders

Through Corporate Internet Banking:

- FIIs other than Individuals or Corporate

- Mutual Funds

- Insurance Company

- Banks and FIs

- Other QIBs

- Bodies Corporate

- NII – others (All entities other than QIBs, Bodies Corporate and Individuals)

Also Read Add IPO Applicant in SBI

How to Apply IPO through SBI NetBanking?

Time needed: 5 minutes

The process to apply for an IPO through SBI internet banking involves the following steps-

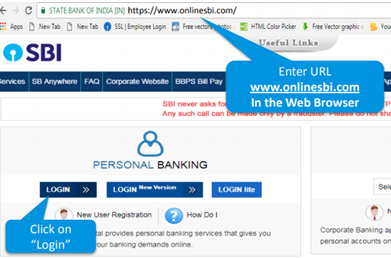

- Login to your SBI online account

Enter www.onlinesbi.com URL in the web browser and Click on Personal Banking login.

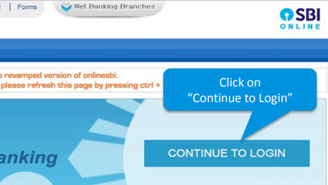

- On the personal banking page click on “Continue to login”.

- Enter your net-banking User ID and Password.

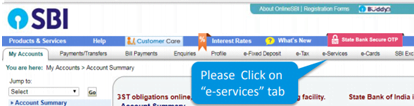

- e-Services Tab

Click on “e-Services” Tab in your accounts page.

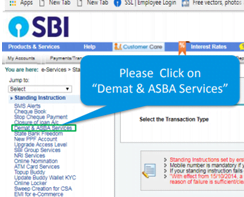

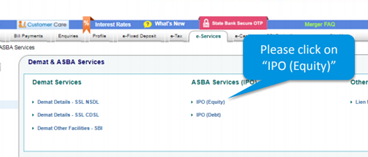

- Click on Demat and ASBA services

Now click on ‘Demat and ASBA services’ option in the menu appearing on left side of account screen.

- Click on ‘IPO Equity’

Under the “ASBA Services“, click on “IPO Equity” and then click on “Accept” after reading the terms and conditions.

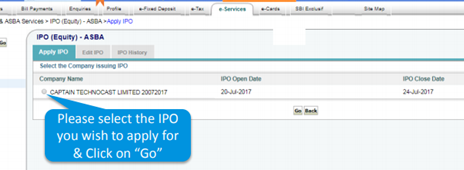

- Now select the IPO you wish to apply from the list.

This page will provide you with a list of companies issuing IPO at that time with open and closing date of bidding.

- Display IPO Details

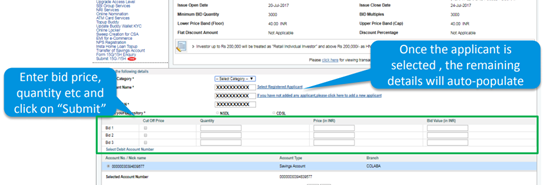

This page will display details like minimum bidding quantity, price of each share, IPO open and closing date etc.

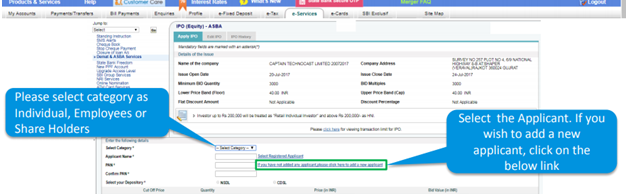

- Select the applicant

1. You need to choose from individual, employees or shareholders.

2. If you have added yourself as an applicant then select applicant name.

Once the applicant is selected, other information like PAN and depository name will be automatically populated.

3. You can also add new applicant.

- Enter IPO Details

Now enter the IPO details like quantity, bid price etc.

Ticking on “Cut-off price” means that you approve to accept the allotment at the price decided by the organization.

- Click on “submit”.

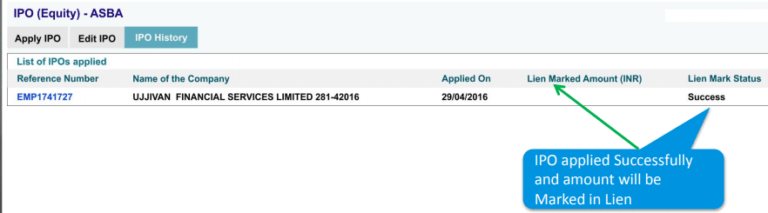

Once you click on the submit button it will redirect to IPO Confirmation Page.

This page will have the list of IPOs successfully applied and

you can verify the IPO details

Also Read IPO through UPI – Google Pay, BHIM | UPI Registration

IPO Withdrawal Conditions in SBI

As per the SBEI norms, If all bids are submitted directly to the SBI Online,

are withdrawn during the bidding period by the Retail Individual Investor,

the SBI deletes the bid and unblocks the applicable amount in the account.

If the withdrawal request comes after the bid closure date,

the SBI will unblock the application amount only after getting appropriate instruction from the Registrar, which is after the finalization of the basis of allotment of the issue.

Also Read Oversubscribed IPO: What happens if the IPO is oversubscribed?

How to Apply for IPO through SBI Branch?

The process to apply for an IPO through SBI Branch (Offline) involves the following steps-

- Visit a SBI branch that offers a service for making IPO investments.

It does not matter if your account is with some other SBI branch.

Although, that only select branches offer this service.

Therefore, it is best to call and check with SBI in advance. - Fill in the ASBA – Application Supported by Blocked Account application form. You will have to provide your SBI account number, PAN card number details along with demat account.

Submit the form to the branch and collect the acknowledgement slip.

Use the acknowledgement number on the slip to follow up on your ASBA status. - Make an application to invest in the IPO of your option.

Mention the number of shares and quote the price acceptable to you (Based on price band of the IPO).

Fill in the information correctly and ensure that you have sufficient funds in your linked saving/current account. - The SBI bank will block the application amount in your account.

It will then forward your IPO application to the specified stock exchanges.

Also Read Listing Gains in IPO | Highest Listing Gain IPO in India

Source – SBI Bank