IPO through ICICI Bank | Cancellation Process | Eligibility

IPO and FPO through ICICI Net banking

ICICI Bank is one of the members of the Self Certified Syndicate Bank (SCSBs).

SCSBs are allowed by the Securities and Exchange Board of India (SEBI) to accept online IPO or FPO applications from investors.

An investor can invest in an Initial public offering (IPO) or Follow on Public Offer (FPO) online through ICICI Bank with the same convenience of investing in equities – hassle-free and with no paperwork.

You can look IPO calendar along with recent IPO listings, prospectus/offer documents, and live prices that will help you keep on top of the IPO or FPO markets.

Here we are going to share How to Apply for IPO through ICICI Netbanking?

This bank offers you a simple and convenient facility of investing in IPO or FPO through the Application Supported by Blocked Amount (ASBA) facility.

ASBA facility does not available through the mobile App.

You may apply for an IPO or FPO through ICICI net banking only.

Recommended Articles

Today’s New IPO Listing – How to Choose Best IPO for Investment?

Face Value in IPO – How to Calculate Face Value or Nominal or Par value?

Lot Size in IPO – How to Calculate Lot Size? | Can I Modify IPO Lot Size?

Book Built Issue IPO – Process | Steps | Types | Pros & Cons

Price Band in IPO – How is the Price Band of an IPO Decided?

Undersubscribed IPO – What Happens if the IPO is Undersubscribed?

Listing Gains in IPO | Highest Listing Gain IPO in India

When Can I Sell IPO Shares? Can I Buy & Sell an IPO in the Same Day?

IPO Applying Time – Cut Off Time for Online IPO Application

How Many Lots Can We Buy in IPO to increase the chances of an allotment?

Oversubscribed IPO: What happens if the IPO is oversubscribed?

Eligibility

- Savings Bank or Current Account in ICICI Bank.

- Holder should have a sufficiently clear credit balance in his/her account, NOT including any overdraft limit, sweep-in/sweep-out facility.

- One also needs to have a valid Demat account with any Drawing Power(DP).

- It is required that the investor interested in applying a share in an IPO and FPO has a PAN card.

- Holds shares in dematerialised form and has applied for entitlements and /or additional shares in the issue in dematerialized form.

- Has not renounced his/ her entitlements in full or in part.

- Is not a renouncee to the Issue.

Read Can I Apply for IPO through bank without a Demat Account

How to Apply for IPO through ICICI Netbanking

Time needed: 5 minutes

Follow the steps given below for applying IPO through ICICI Net-banking

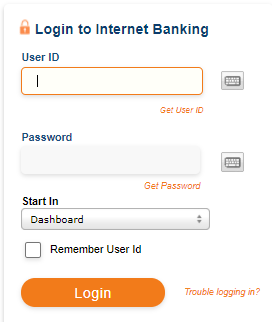

- Login

Visit ICICI Bank website and log in using your ICICI credential.

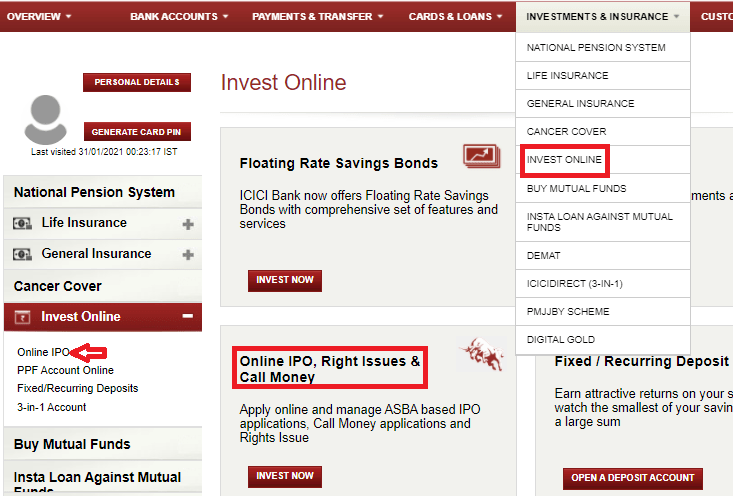

- Investments and Insurance

Now go to “Investments and Insurance” option from the main menu and then select the “Invest Online” option.

Click on “Online IPO, Right Issue & Call Money” button from the Online IPO section.

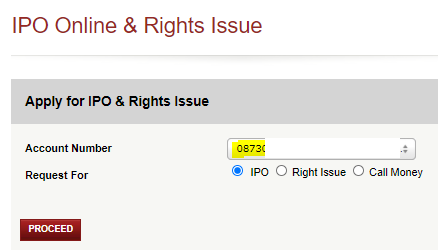

- Select your account number

In the next screen, select the account number from which you wish to apply and choose the IPO option then click on “submit” button.

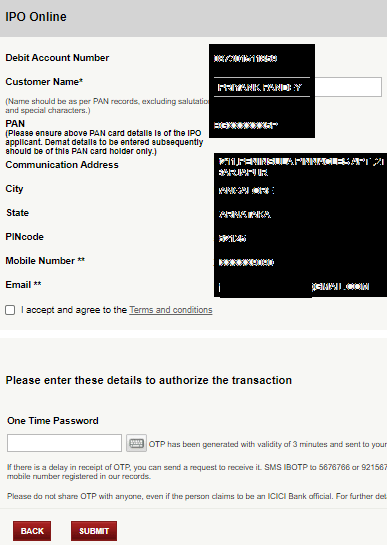

- Authorize Details

Account holder details will be auto-filled.

Check the “terms and conditions” box and authorise the transaction using the OTP.

- Submit

Confirm Your Details and click on the submit button.

Your page will be directed to the IPO page in ICICI Direct. - Select the IPO

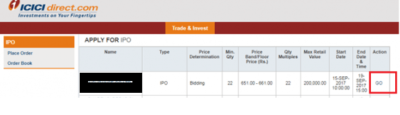

In the next screen, Now Select the IPO you wish to apply and click on Go.

- Enter IPO details and click on “Submit”.

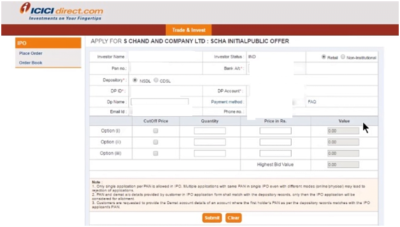

1. Investor Type– Retail or HNI (High Net Worth Individual).

If you are investing more than Rs. 2L then you need to select HNI, else select retail.

2. Bid details– Enter the number of shares you want to bid for and price per share in case of a book building issue.

3. Cut-off price- if you agree to buy the shares at the price decided by the company during allotment.

4.Applicant details– Select the applicant. if it’s single account then applicant details like name, PAN, etc., will be automatically populated in application.

5.Depository Details– Enter the depository details like NSDL or CDSL, DP name and Demat ID.

Demat ID – This is a 16-digit number used to identify your demat account.

- Verify and Confirm the details

Check all the details and confirm. You will get a success message on confirmation.

Cancel the IPO through ICICI Netbanking

An investor can cancel the IPO or FPO only before the end date of the IPO or FPO by following the below-mentioned steps:

- Login to Internet Banking and select the option for Investment & Insurance.

- Click on Invest Online.

- Click on Invest in IPO under Online IPO option.

- Submit the request.

- Please enter the grid values and click on Submit.

- A confirmation page will be triggered which the customer has to verify and click on Submit.

- Select the option of Order Book and click on the Trans ID.

- Click on the option of withdrawal application.