How to Buy Bharat Bond ETF in Zerodha? – What is it? | Features | Returns | Income Tax

As we are heading towards a new year, let’s start the new beginning with new hopes. Whatever you could not achieve in the last year you can push harder this year. With that thought, I’m beginning new series of bonds and shares to give you more exposure to both asset classes to make the right mix in your portfolio. Today’s article will discuss How to Buy Bharat Bond ETF in Zerodha. Before that, we will understand what is it with features, returns, and tax liability on the same.

Also Read Pros and Cons of Investing in NFO – Is It Good to Invest in New Mutual Funds?

What is Bharat Bond ETF in Zerodha?

Bharat bond ETF is an initiative by the Department of Investment and Public Asset Management owned by the Government of India. To manage and launch the product, GOI has given a license to Edelweiss Mutual fund Company. Now they are planning to launch the fourth tranche of Bharat Bond ETF. Edelweiss MF has won the bid to launch the Bharat Bond ETF in 2019. Since then they have already launched three tranches and a fourth is on the way which we will cover in our article. With this scheme, they help government-owned companies to borrow as and when required as per their need instead of issuing multiple instruments over some time. Thereby, it reduces the cost of borrowing too.

Also Read How NFO Work? What is NFO in Mutual Fund? | NFO vs IPO | FAQs

To understand this bond in layman’s language, it’s a passively managed debt fund, that invests your money in fixed-income securities. It has got a fixed tenure and on maturity, only the investors get their money back. This fund parks your money in AAA securities only which are backed by Government. In other words, it’s a highly secure fund in terms of safety and predictability of returns.

As per the mandate signed by Edelweiss Asset Management, the scheme only invest in AAA-rated companies owned by the Government which means GOI has already decided the boundaries of investment so chances of predictable returns are high.

Now we got a fair understanding of the Bharat Bond ETFs, let’s check out their features and benefit in brief:

Features & Benefits

| 1 | The objective of the scheme is to track the Nifty Bharat Bond Index |

| 2 | It only invests in AAA-rated securities owned by the government of India. |

| 3 | It is a fixed tenure fund that comes with a maturity of ten and a half year. |

| 4 | It's a passively managed fund hence the expense ratio is as low as 0.0005%. |

| 5 | No exit load if you wish to exit from the fund. |

Benefits:

- Bharat Bond ETF gives a high degree of predictability in returns as money gets invested in AAA-rated public sector bonds.

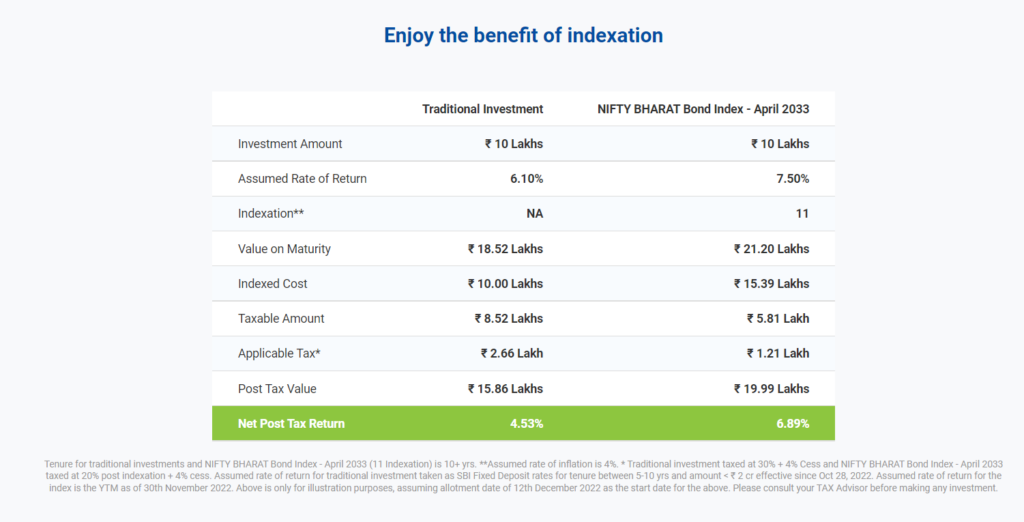

- It enjoys tax advantage in the form of indexation benefits like other debt mutual funds (20% with Indexation).

- As it's an ETF fund so it facilitates retail investors to buy/sell like a normal mutual fund.

- With a very low-cost expense ratio, you can enjoy a yield of 6.9% after indexation.

- It's beneficial if you stay invested until maturity to return closer to the yields prevalent at investment time.

Let's move on to the steps involved in How to buy Bharat Bond ETF Via Zerodha:

Also Read What is OFS in Share Market? | How can I Invest in Offer for Sale?

How to Buy Bharat Bond ETF via Zerodha?

Time needed: 2 minutes

Please find the steps involved in buying Bharat Bond ETF via Zerodha:

- Login to Zerodha Kite App with your Credentials

You can log in on Zerodha Kite via Mobile App or desktop version. On opening the page, you can enter your username, and pin and follow with the Mobile App code

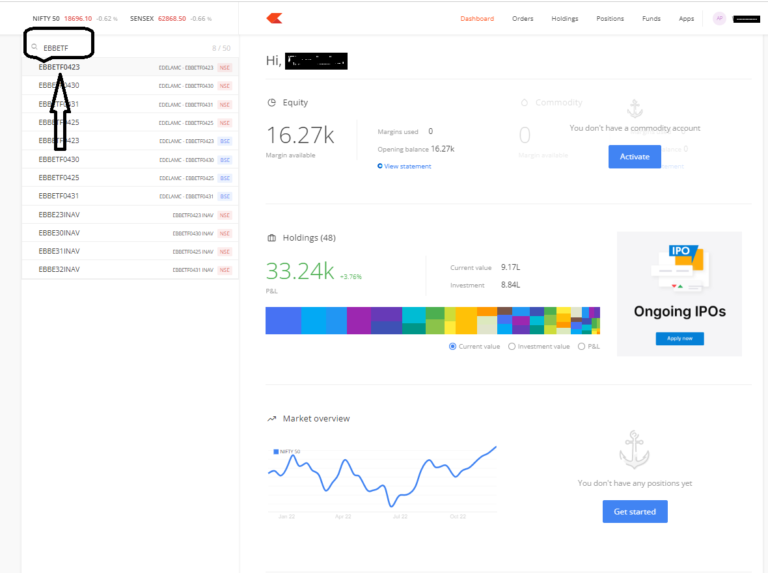

- Enter keyword EBBETF on Searchbar

Once you log in to Kite Dashboard, you can search for Bharat Bond Etf with the Keyword EBBETF. And then select the ETF series in which you want to park your funds.

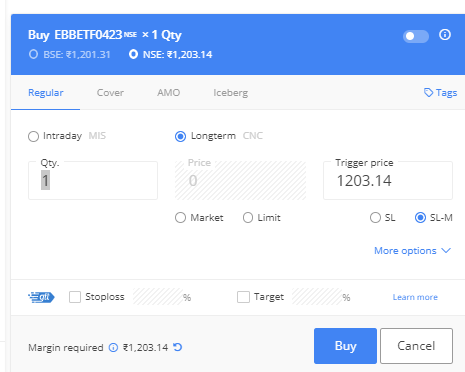

- Choose the series and click on Buy Option

As per your investment horizon and analysis, you can choose the series and click on the buy option to fill in your order details.

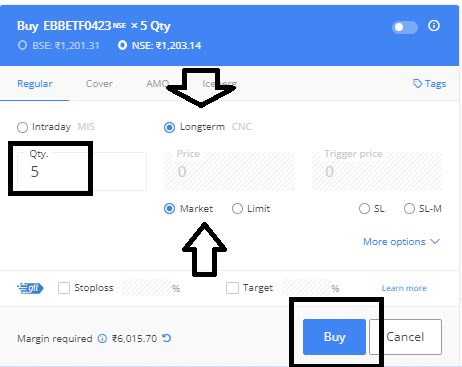

- Enter Order details and click on the Buy button:

As it's a bond with a combination of ETFs so choose Long term CNC and enter the no. of units choose the market radio button to buy at the prevailing rate. At the end click on Buy to complete the order.

- Order is placed

After clicking on the buy button, you will get a message on your screen order is placed.

These steps are to buy the existing Bharat Bond ETFs from the secondary market. And if you want to sell the ETF then instead of choosing Buy select Sell and place the order in the same manner.

Also Read IPO vs Shares(Listed) – Difference between IPO and Listed Stocks in India

How to Apply for NFO of Bharat Bond ETF April 2033?

But in case you're interested in applying for the new NFO of Bharat Bond ETF in April 2033 then just follow the simple steps:

- Login to Zerodha Coin App with your credentials.

- On the left-hand side under Dashboard choose ETF and SGB.

- Currently, the NFO is open for the fourth tranche from Dec 2nd to 8th Dec you can see the open NFO.

- Choose the NFO and click on place order.

- Enter the amount you want to apply in NFO of Bharat Bond ETF April 2033 and click on confirm button.

Also Read NFO in Zerodha - Which is Better NFO or IPO? Is Demat Account Required for NFO?

Returns with Tax Applicability

As called out the returns are quite predictable if you stay invested until maturity and it does provide indexation benefits like other debt funds. Returns will be high as compared to normal traditional investment in any other fixed maturity bond as the expense ratio is merely 0.0005%.

FAQs

You can invest with a min of Rs 1000/- to a maximum of 2lac.

No, it's an ETF so there is no lock-in period. However, there is one condition in Funds of Funds, if you withdraw within 30 days of investment, then an exit load of 0.10% is applicable on the payout.

Also Read What is a Rights Issue of Shares? | Rights and Bonus Issue | Example | Eligibility | Types