How to Buy Corporate Bonds in Zerodha? – Pros & Cons | Types | Investing in Bonds

Corporate Bonds in Zerodha

Zerodha is an Indian online brokerage firm that allows its customers to trade in various financial instruments, including corporate bonds.

Corporate bonds are debt securities issued by companies to raise capital.

Zerodha allows its customers to buy and sell corporate bonds on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

Customers can also view real-time prices, historical prices, and other details about the corporate bonds available for trading on Zerodha’s trading platform. However, Zerodha does not directly issue corporate bonds.

Types of Corporate Bonds in India

In India, there are several types of corporate bonds that are available for investors. Some of the most common types include:

- Secured bonds:

These bonds are backed by assets of the issuing company, providing a higher level of security for the investors. - Unsecured bonds:

These bonds are not backed by any assets and are considered to be riskier than secured bonds. - Tax-free bonds:

These are bonds issued by government-owned companies and institutions, and the interest earned on them is exempt from income tax. - Fixed rate bonds:

These bonds have a fixed coupon rate and pay a fixed interest rate to the investors. - Floating rate bonds:

These bonds have a coupon rate that is tied to a benchmark interest rate,

and the interest rate paid to investors may fluctuate based on changes in the benchmark rate. - Perpetual bonds:

These bonds do not have a fixed maturity date, and the issuer is not obligated to redeem them at a specific date. - Masala Bonds:

These are bonds issued by Indian entities in international markets, denominated in Indian Rupees. - Inflation-indexed Bonds:

These are bonds whose principal and interest payments are linked to the rate of inflation.

All these types of bonds have different risk-return profile and investors should study the credit rating of the company and other factors before investing in them.

Pros & Cons

Corporate bonds can be a valuable addition to an investment portfolio, but like any investment, they come with their own set of pros and cons. Here are some of the key benefits and drawbacks of investing in corporate bonds in India:

Pros:

- Regular income: Corporate bonds provide a regular stream of income in the form of interest payments.

- Diversification: Corporate bonds can help diversify an investment portfolio, reducing the overall risk.

- Credit rating: Corporate bonds are rated by credit rating agencies, which provide an indication of the issuer’s creditworthiness and the risk associated with the bond.

- Liquidity: Corporate bonds are traded on stock exchanges, and they are usually easy to buy and sell.

Cons:

- Credit risk: The issuer may default on interest or principal payments, resulting in a loss for the bondholder.

- Interest rate risk: The value of the bond may decline if interest rates rise.

- Lack of control: Bondholders do not have control over the issuer’s operations and cannot vote on company matters.

- Inflation risk: The value of interest payments may decline due to inflation.

- Illiquidity: Certain bonds may not have a active trading market and may be difficult to buy or sell.

It is important to consider your investment goals, risk tolerance, and overall financial situation before investing in corporate bonds in India. It’s always a good idea to consult a financial advisor or professional before making any investment decisions.

Corporate Bond Rates

Generally, bonds issued by companies with a higher credit rating will have a lower interest rate,

while those issued by companies with a lower credit rating will have a higher interest rate.

The interest rates on corporate bonds in India range from around 6% to 9% for investment-grade bonds, and from around 9% to 15% for high-yield bonds.

However, these are just general ranges, and the actual interest rate can vary widely depending on the specific bond and issuer.

It's important to note that the interest rate on corporate bonds is fixed throughout the tenure of the bond, unlike bank fixed deposits where the rate is reviewed periodically.

It is also worth noting that the interest rate on corporate bonds is taxable, unless they are tax-free bonds. The tax will depend on the investor's income tax slab.

How to Buy Corporate Bonds in Zerodha?

Time Needed : 5 minutes

Here is the general process for buying corporate bonds in Zerodha:

Open an account with Zerodha

To buy corporate bonds, you first need to open an account with Zerodha. You can do this by visiting their website, filling out the required forms and completing the account opening process.

Fund your account

Once your account is open, you will need to transfer funds into it. You can do this via online banking or by depositing cash or cheques at a Zerodha branch.

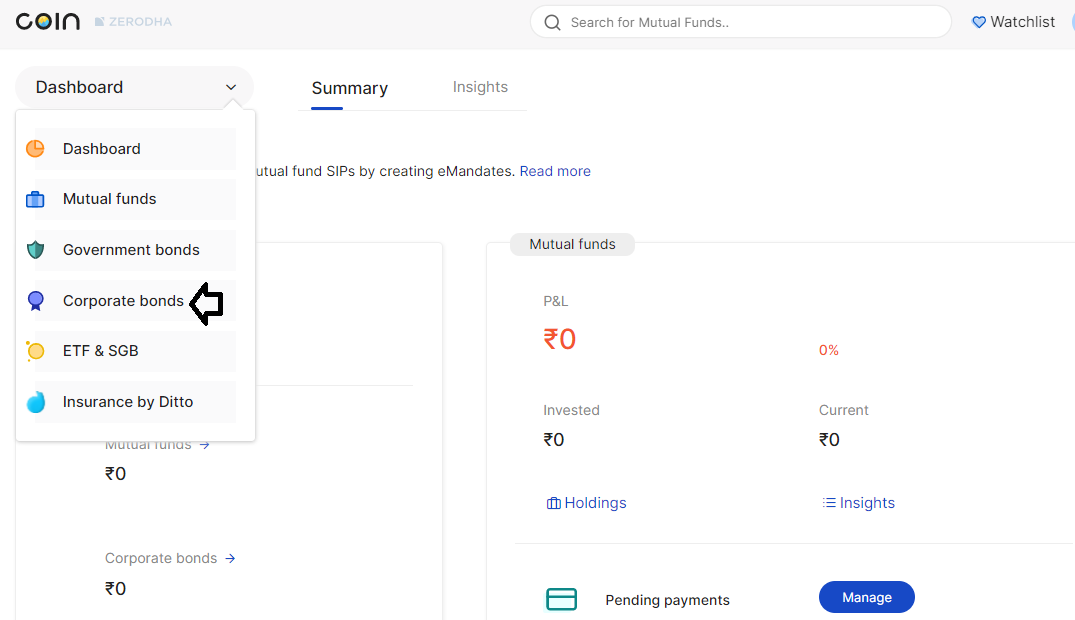

Search for the bond you want to buy

Once your account is funded, you can log in to the Zerodha coin platform and search for the corporate bond you want to buy. You can search by issuer name, bond series, or ISIN number.

Place a buy order

When you have found the bond you want to buy, you can place a buy order. You will need to specify the quantity of bonds you want to purchase and the price you are willing to pay.

Wait for the trade to execute

Once your buy order is placed, you will need to wait for the trade to execute. The time it takes for the trade to execute will depend on the bond you are buying, and the current market conditions.

Confirm the trade

Once the trade is executed, you will receive a trade confirmation. You can check your Zerodha account to confirm that the bonds have been credited to your Demat account.

It's worth noting that Zerodha charges brokerage for trading in corporate bonds, the same way it charges for other securities. The brokerage charges are subject to change, and it's always a good idea to check the charges before trading.

FAQs

Here are some additional frequently asked questions about corporate bonds in Zerodha:

Can I invest in corporate bonds in Zerodha using a SIP?

No, SIP (Systematic Investment Plan) is not available for corporate bonds in Zerodha.

What happens if the issuer defaults on a corporate bond I own in Zerodha?

In case of a default, the issuer will not make the scheduled interest or principal payments on the bond, which can result in a loss for the bondholder. Credit rating agencies will also downgrade the issuer's credit rating, making it more difficult for them to raise capital in the future.

How do I know the maturity date of a corporate bond in Zerodha?

You can find the maturity date of a corporate bond on the details page of the bond on Zerodha's trading platform, it is also mentioned on the bond certificate.

Can I use my corporate bonds as collateral for a loan in Zerodha?

Yes, corporate bonds can be used as collateral for a loan. Zerodha offers loan against securities, where you can pledge your corporate bonds to get a loan.

Are there any fees for holding corporate bonds in Zerodha?

Yes, there are fees for holding corporate bonds in Zerodha, such as annual maintenance charges on the Demat account where the bonds are held. These charges can vary and you should check with Zerodha for the most up-to-date information.