Zerodha Kite App | Charges | Review | Demo | Tips| 2023

Buy IPO using the Zerodha Kite

In this article, we will discuss the exact steps to buy the IPO using the Zerodha Kite App.

Anyways, before getting into the steps in this article, let me tell you “What is the Zerodha Kite App“.

Zerodha is regulated by SEBI i.e. Securities and Exchange Board of India under the registration number INZ000031633 CDSL and is a member of both the BSE i.e. Bombay Stock Exchange and the NSE i.e National Stock Exchange of India (NSE).

The Zerodha is available on the desktop as well as a mobile web browser, is considered by many as one of the fastest and most powerful trading platforms, particularly as a stock market app.

Kite App is a free mobile trading application from Zerodha, termed as a better mobile trading platform as compared to those provided by other brokers.

The mobile trading application is available on both Google Play Store and Apple’s App Store for users and can be downloaded on smartphones free of charge.

Let’s have look at the important features in Kite App.

- Ones can open demo & a trading account on Zerodha fully online by using adhar card and pan card details within 1-2 day you can use the Zerodha kite app.

- Ones can easily buy and sell shares in Kite app.

- Amount withdrawal or Amount from Demat account to saving account takes 1 -2 days, better if transferred within the same day.

- No minimum deposit requirement.

- Zerodha does not provide access to international markets.

- No Live chat support.

- Does not offer social trading.

- No demo account.

Read IPOs Definition | Types of IPOs | Fixed Price vs Book Building | Investors Types | Eligibility

Does Zerodha Kite Charge for IPO?

The kite doesn’t charge any fee for applying in IPO.

As Zerodha offers brokerage-free equity delivery trades, they don’t charge any commission when you sell allocated IPO shares via Kite app.

However, when selling IPO shares through the kite app, you still have to pay GST & Demat debit transaction changes.

Recommended Articles

Today’s New IPO Listing – How to Choose Best IPO for Investment?

Face Value in IPO – How to Calculate Face Value or Nominal or Par value?

Lot Size in IPO – How to Calculate Lot Size? | Can I Modify IPO Lot Size?

Book Built Issue IPO – Process | Steps | Types | Pros & Cons

Price Band in IPO – How is the Price Band of an IPO Decided?

Undersubscribed IPO – What Happens if the IPO is Undersubscribed?

Listing Gains in IPO | Highest Listing Gain IPO in India

When Can I Sell IPO Shares? Can I Buy & Sell an IPO in the Same Day?

IPO Applying Time – Cut Off Time for Online IPO Application

How Many Lots Can We Buy in IPO to increase the chances of an allotment?

Oversubscribed IPO: What happens if the IPO is oversubscribed?

Zerodha Account Opening Charges

| Transaction | Charges |

|---|---|

| Trading & Demat Account Opening | Rs 200 |

| Trading Account AMC | Rs 0 |

| Demat Account AMC | Rs 300 per year |

Zerodha Equity Charges

| Charges | Delivery(Equity) | Intraday(Equity) | Futures(Equity) | options(Equity) |

|---|---|---|---|---|

| Brokerage | Zero Brokerage | 0.03% or Rs. 20/executed order whichever is lower | 0.03% or Rs. 20/executed order whichever is lower | Flat Rs. 20 per executed order |

| STT/CTT | 0.1% on buy & sell | 0.025% on the sell-side | 0.01% on sell side | 0.05% on sell side (on premium) |

| Transaction charges | 0.00345%(NSE) 0.00345%(BSE) | 0.00345%(NSE) 0.00345%(NSE) | 0.002%(NSE) | NSE: 0.053% (on premium) |

| Stamp charges(INR) | 0.015% or 1500 / crore on buy side | 0.003% or 300 / crore on buy side | 0.002% or 200 / crore on buy side | 0.003% or 300 / crore on buy side |

GST – 18% on (brokerage + transaction charges).

SEBI charges – INR 5 / crore.

Tips before Buying IPO in Zerodha?

The following are some of the tips you can put to use to increase your chances.

- First and foremost, make sure that you fill the IPO application form rightly and are not rejected on technical grounds.

- During the IPO process for XYZ company, a total of 785,165 applications were made for 375.059.792 equity shares. With a quota limit of 1,599,565 shares for RII i.e Retail Individual Investors, the issue was oversubscribed by 11.35 times. Though, after technical rejections, this came downward to 11.122 times.

Consider an issue with the price band of INR 90-100.

Now, if you make a bid at INR 95 and the discovered price is INR 98, your bid will be rejected. So, the optimal strategy is to make a bid at the highest possible limit of the price band.

However, RII(s) have an even better strategy available, make cut-off bids instead of price bids.

For this, you can select the right checkbox that says cut-off bid. This will secure that your bid will be honored at the discovered price regardless of what the bid price entered. - As all applications are treated equally, the optimal strategy is to make as many applications as possible with different demat accounts.

You could do this by either asking all your family person to apply or by using multiple demat a/c for the purpose. - While applying later is a good strategy, as this allows you to gather data based on bids already submitted, do not wait until the very last moment to submit your application.

Doing anything in haste can backfire. Give yourself some breathing space while submitting the bid.

Read: How to Apply for IPO and FPO in SBI Bank (ASBA)?

How to Buy IPO in Zerodha?

Time needed: 5 minutes

An investor can apply for an IPO through the Kite app using any supported UPI app.

Once an investor installs the UPI app (BHIM, GPay, etc.) and register your UPI ID, follow the below steps to apply for IPOs:

- Kite App

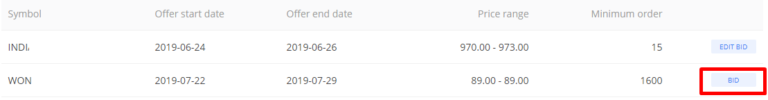

Log in to the Kite app and select ‘IPO’ in the ‘Portfolio’ menu.

Also Read: IPO through UPI | UPI Registration | Trading Account – Zerodha - IPO

Select the IPO from the list of open issues.

- UPI ID

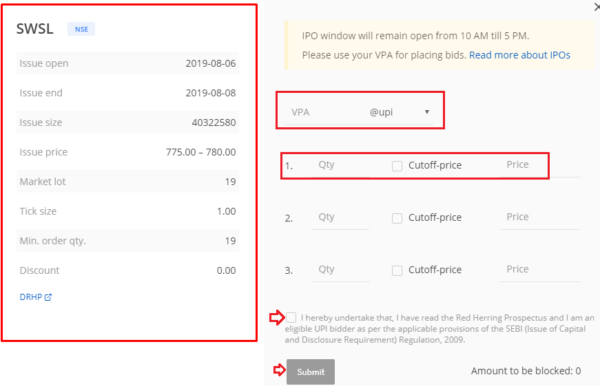

Enter your UPI ID (XXXXXXXXXX@upi). The investor should make sure this UPI ID is mapped to a personal bank account.

The application is liable to get rejected if the person who is applying is different from the one whose bank account is used to apply. - Bid

Place your bid. Select the type for your application. While placing the bid, only quantity that is a multiple of the lot size is allowed.

If you want to apply at the cut-off price, simply click on the checkbox next to ‘Cutoff-price’.

If you wish to place a bid at a different price, you can do so by entering a price in the ‘Price’ field.

- T&C

Once you’ve completed all these steps, click on the checkbox to confirm that you have read the terms & conditions and click on submit.

- Accept

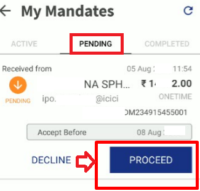

Accept mandate requests on your UPI App.

- SMS

At the end of the day, you will receive an SMS from the exchange confirming your application.