How to Buy REITs in India via Zerodha? – Best REITs in 2023

Let’s have a close look at How to Buy REITs in India via Zerodha? But before I set you in motion the context, I will brief out what exactly REITs mean so that you know the hack of it.

What is a REITs Investment in Zerodha?

A REIT, or Real Estate Investment Trust, is a type of investment vehicle that allows individuals to invest in real estate assets such as commercial properties, residential properties, and other real estate-related assets. REITs are publicly traded on stock exchanges, and they are required to distribute at least 90% of their income to shareholders in the form of dividends.

REITs in Zerodha can be bought and sold just like stocks, and they provide investors with a way to earn income through rental payments and capital appreciation.

In Zerodha, REITs can be traded on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) during market hours. To buy or sell REITs in Zerodha, you will need to have a trading account and sufficient funds in your account.

However, It's important to note that the performance of REITs can be affected by various factors such as economic conditions, interest rates, and the real estate market.

When looking for REITs to invest in, some of the factors that you may want to consider include:

- The REIT's track record of performance and dividends.

- The quality and diversification of the REIT's portfolio of properties.

- The REIT's management team and their experience in the real estate industry.

- The REIT's financials, including its revenue, expenses, and debt levels.

- The overall economic conditions and the real estate market.

- The regulatory environment for REITs in your country.

Benefits of REITs in India

There are several benefits of investing in Real Estate Investment Trusts (REITs):

- Regular Income: REITs pay out a portion of their income to shareholders as dividends, providing a regular income stream.

- Diversification: REITs provide investors with an opportunity to diversify their portfolios, as they allow individuals to invest in real estate properties through the stock market.

- Liquidity: REITs are traded on stock exchanges, providing investors with the ability to buy and sell shares quickly and easily.

- Professional Management: REITs are managed by professional managers who take care of the day-to-day operations of the properties, which saves investors time and effort.

- Tax Benefits: Income earned from REITs is taxed at a lower rate as compared to direct investments in real estate.

- Economies of Scale: REITs can purchase properties at a cheaper rate due to their large size and can also spread their operational costs over a larger number of properties.

- Low barrier to entry: Investing in REITs has a low barrier to entry as they can be purchased with a small amount of money and also they are available in the form of mutual funds, ETFs which makes it more accessible to a broader range of investors.

Best REITs in 2023

It's difficult to say which REITs are the best performing in India as the performance of REITs can be affected by various factors such as the overall real estate market conditions, the specific properties in the REIT's portfolio, and the management's ability to generate income. However, here are a few REITs that have performed well in India in recent years:

- Embassy Office Parks REIT: India's first listed REIT, Embassy Office Parks is one of the largest office space providers in India. It has a portfolio of 33 million sq ft across the major Indian cities, with a strong tenant base of well-established corporates and multinational companies.

- Mindspace Business Parks REIT: Mindspace Business Parks is another leading office space provider in India, with a portfolio of 12.4 million sq ft across the major Indian cities. It has a strong tenant base of well-established corporates and multinational companies.

- DLF Cyber City Developers Ltd: DLF Cyber City is one of India's largest commercial real estate developers and landlords, with a portfolio of 17 million sq ft of office space across the major Indian cities. It has a strong tenant base of well-established corporates and multinational companies.

It's important to note that the REITs market in India is relatively new and it's still evolving, so it's always a good idea to do your own research and consult with a financial advisor before investing in REITs. Also, the performance of these REITs can change over time and it's always good to keep an eye on the market conditions and the company's performance.

How to Buy REITs in India via Zerodha?

Here is a general overview of how to buy REITs in India via Zerodha:

Time Needed : 3 minutes

Open a Zerodha account

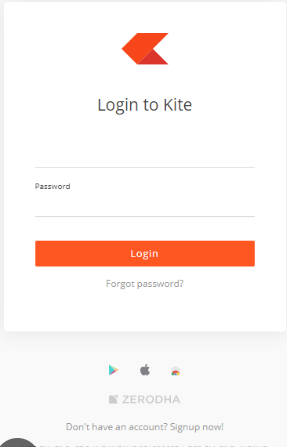

To buy REITs in India via Zerodha, you will first need to open a trading account with Zerodha. You can do this by visiting the Zerodha website and filling out the required forms.Here is the URL for Kite login: https://kite.zerodha.com/You can key your username, password followed by the account pin for login.

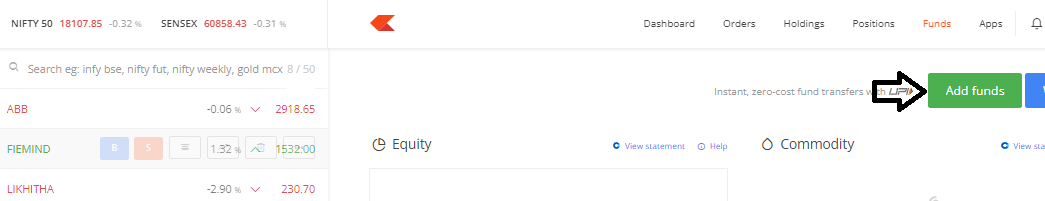

Fund your account

After opening your account, you will need to fund it with the amount you wish to use to buy REITs. You can do this by transferring money from your bank account to your Zerodha account.

Research the REITs:

Before you buy REITs, it's important to do your research and understand the fundamentals of the REITs you're interested in. You can read the company's prospectus, check the management's track record, and look at the REITs' financials.

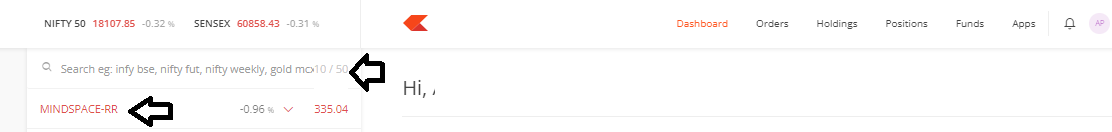

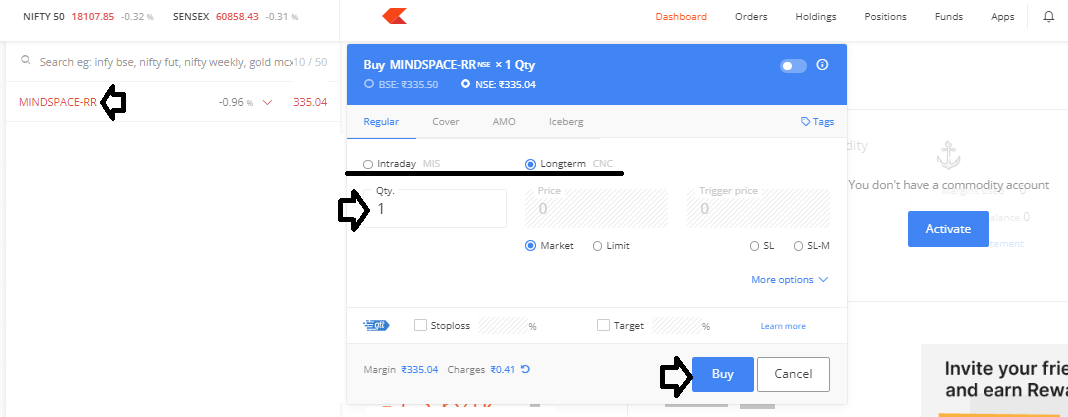

Place a buy order:

Once you've decided on the REITs you want to buy, log in to your Zerodha account, navigate to the "Stocks" section, and place a buy order for the desired REIT. Be sure to specify the number of shares you wish to buy and the price at which you want to buy them.

Wait for execution:

After you've placed your buy order, it will be executed at the next available market price. The REIT shares will be credited to your demat account once the trade is settled.

FAQs

How do REITs work?

REITs work by pooling money from multiple investors to purchase and manage real estate properties. The REIT then collects rent from tenants and distributes a portion of this income to shareholders in the form of dividends.

Are REITs publicly traded?

Yes, REITs are publicly traded on stock exchanges, just like stocks, which allows individual investors to buy and sell shares in the trust.

Are REITs a good investment?

REITs can be a good investment option for those looking for a way to gain exposure to the real estate market without the hassle of buying and managing property themselves. However, like all investments, REITs come with their own set of risks and it's important to do your own research and consult with a financial advisor before investing.

How are REITs taxed?

REITs are required to distribute at least 90% of their taxable income to shareholders, which means that the majority of the income received from REITs is subject to taxes at the shareholder level. However, REITs can offer a high yield, which can make them an attractive option for some investors.

How do I invest in REITs?

You can invest in REITs by purchasing shares on a stock exchange, much like you would buy stocks. You can also invest in REITs through mutual funds or exchange-traded funds that hold a diversified portfolio of REITs.

How do I research REITs?

You can research REITs by looking at the financial statements of the REIT, including its income statement, balance sheet, and cash flow statement. You can also look at the REIT's portfolio of properties, management team, and the overall real estate market. Additionally, You can also look up the REIT's historical performance, dividends, and analyst ratings to get a better idea of its potential risk and return.