How to Buy Sovereign Gold Bond through Bank? | Key Features | Allotment

What is Sovereign Gold Bond?

The RBI i.e. Reserve Bank of India had started the Gold Bond plan for investors in Nov’ 2015 to reduce the demand for physical gold.

Under the plan, the citizen gets the opportunity to invest in gold. However, don’t need to buy the yellow metal in physical form. Investors can redeem their bonds in cash upon maturity.

In addition, investors also get interested in their gold bonds at an annual rate of 2.5%.

In this article, we are going to discuss “How to Buy Sovereign Gold Bond” online or offline.

Before we go deeper, let’s look at the common features of the bonds.

- These SGBs are issued for 8 years. However, the RBI provides investors an option to exit the scheme after five years.

- These bonds are sold by commercial banks, stock holding corporations, post offices, and stock exchanges BSE and NSE.

- GOI, in consultation with the RBI, has decided to offer a discount of Rs 50 per gram on the nominal value of the SGB.

- Interest on the SGB will be taxable as per the provisions of the Income-tax Act, 1961.

- The capital gains tax arising on redemption of bonds to an individual has been exempted.

- Tax Deducted at Source(TDS) is not applicable to the bond. However, it is the responsibility of the bond subscriber to comply with the tax laws.

Also Read Sovereign Gold Bond : Best Returns on Gold Investment

How to Buy Sovereign Gold Bond?

Sovereign Gold Bonds can be bought online and offline as well.

To understand how to buy gold bonds, let’s look at the process point-wise,

Who Can Buy?

Indian citizens, HUF i.e. Hindu undivided families, trusts, universities, and charitable institutions can purchase gold bonds.

Who are the Authorized Banks Selling the SGBs?

Gold Bonds are sold through Nationalised Banks, Private Banks, Foreign Banks, designated Post Offices, SHCIL i.e. Stock Holding Corporation of India Ltd., and the authorized stock exchanges either directly or through their agents.

Few examples are

- State Bank of India

Also Read Sovereign Gold Bond SBI | How to Buy SGB Online?

- Bank of Baroda

(Including Vijaya Bank and Dena Bank) - Bank of India

- Bank of Maharashtra

- Canara Bank (Including Syndicate Bank)

- Central Bank of India

- Indian Bank (Including Allahabad Bank)

- Indian Overseas Bank

- Punjab National Bank (including Oriental Bank of Commerce and

United Bank of India) - Punjab & Sind Bank

- Union Bank of India (including Andhra Bank and Corporation

Bank) - UCO Bank

- HDFC Bank Ltd.

- ICICI Bank Ltd.

Also Read How to Buy Sovereign gold Bond from ICICI Bank or ICICI Direct?

- IDBI Bank Ltd.

- Axis Bank Ltd.

- Kotak Mahindra Bank.

- BNP Paribas.

- Barclays Bank.

- National Stock Exchange (NSE).

- Bombay Stock Exchange(BSE).

- Designated post offices.

- Zerodha App

Read How to Buy & Sell Sovereign Gold Bond in Zerodha? Gold Bond Taxation | Gold ETF vs Gold Bond

When Can You Buy SGBs?

Sovereign Gold Bonds can be bought on the following dates only. However, RBI opens up a window of 5 days each.

| S. No. | Tranche | Date of Subscription | Date of Issuance |

| 1. | 2023-24 Series I | June 19 – June 23, 2023 | June 27, 2023 |

| 2. | 2023-24 Series II | September 11-September 15, 2023 | September 20, 2023 |

What are the Key Features?

| Denomination | The bonds will be denominated in units of one gram and multiples thereof. |

| Minimum and Maximum limit | In a fiscal year, an individual and HUF can invest for a minimum of 1gm and a max of 4kgs wherein for trusts and similar entities max ceiling is 20kgs. |

| Interest rate | Investors will be paid interest on the initial investment at the rate notified by RBI for each tranche and is paid semi-annually. |

| Tenure | It comes with the tenor of 8 years and one can exit at the end of 5 years onwards and can be exercised on the payment dates. |

| Redemption | The redemption price will be decided on the average closing price of gold of 999 purity for the last 3 Business days from the date of redemption. |

| Premature withdrawal | Premature withdrawal is applicable only after the 5th year onward on the coupon payment date and is also tradeable if held in Demat form. |

| Joint holding | Yes, joint holding is allowed. |

| Nomination | Yes, the nomination facility is available as per the provisions of the Government Securities Act 2006 and Government Securities Regulations, 2007. A nomination form is available along with the Application form. |

| Payment option | Payment for the Bonds will be through cash payment (up to a maximum of Rs. 20,000) or demand draft, cheque, or electronic banking. |

| KYC Documentation | Know-your-customer (KYC) norms will be the same as that for the purchase of physical gold. KYC documents such as Voter ID, Aadhaar card/PAN, or TAN /Passport will be required. |

Returns on Sovereign Gold Bond

The return from Sovereign Gold Bonds is in terms of interest and capital appreciation. Investors get a fixed interest rate of 2.5 percent per annum. Furthermore, it is over and above the gold price return.

The interest payments are made half-yearly. However, the tenure of these bonds is 8 years, and the bonds mature after this period.

Also Read Sovereign Gold Bond – Return Calculation 2021 | Dates | FAQs

How to Buy Sovereign Gold Bond through Banks?

Time needed: 5 minutes

You can buy online either via listed banks, Stock Holding Corporation of India, and Demat accounts.

Let’s first look at how can we buy them online through banks

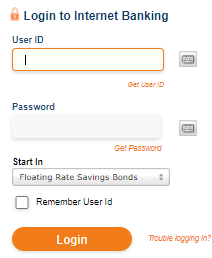

- Login

To invest via banks, you will need to have a valid internet banking account.

Log in to your banking account using your credentials.

- Investment Section

Click on the Sovereign Gold Bond option which will normally be available on the bank’s investment section from the menu.

- Application Forms

Since you have an internet banking a/c, it is safe to assume that you are already KYC compliant.

Therefore, when you land on the registration page, you might or might not get a pre-filled form depending on the bank you are associated with.

Application forms ask for your name, address, nominee details, guardian’s name in case you are a minor, PAN number, and so on and so forth. - SGBs Units

In conclusion, You will be entered the number of units you want to purchase. However, we already know the price of the units which have been declared by the government.

In addition, you will get a discount of INR 50/gram to complete the entire process online.

Allotment of Sovereign Gold Bond

If the investor meets the eligibility criteria, produces a valid identification document, and remits the application amount on time, he/she will receive the allotment.

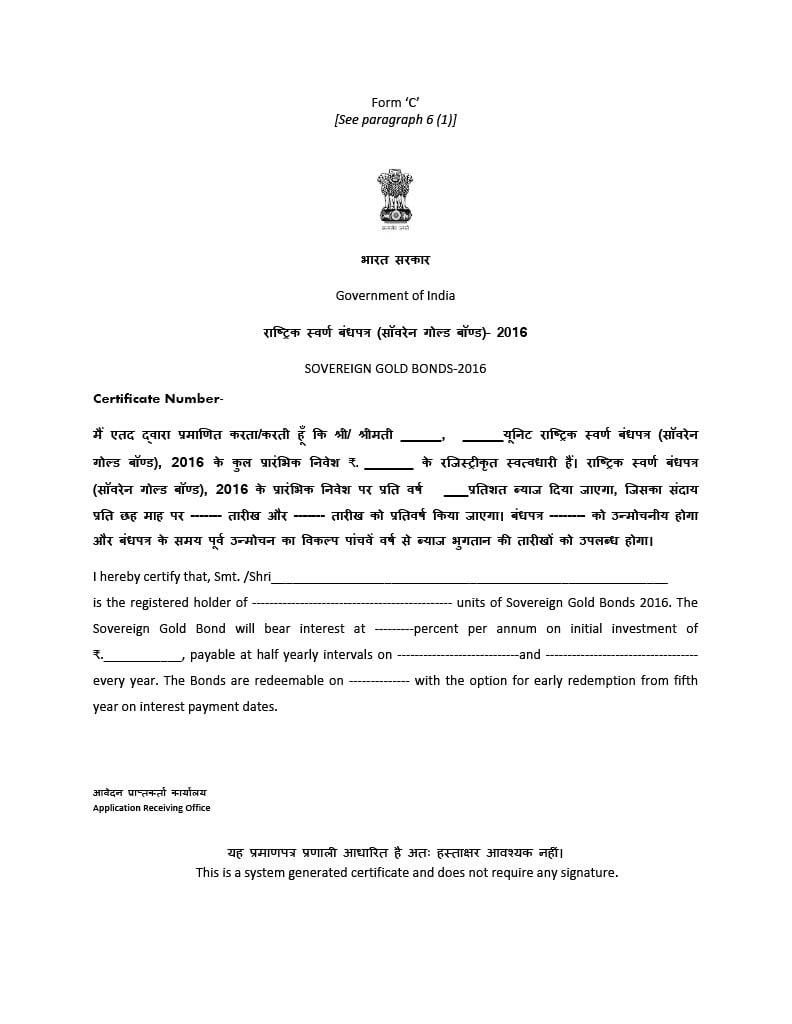

How Do I Download SGB Certificate?

You can not download the certificate from the RBI. The customers will be issued a Certificate of Holding on the date of issuance of the gold bonds.

The SGB certificate will be mailed to your registered email ID in case you have opted for a physical form else it will reflect in your bank account on the date of issuance of SGB.

You can collect the ‘Certificate of Holding’ from your nearest Bank branch if you do not have an email ID.

I did not receive a Certificate of Sovereign Gold Bond

The customer can send the email to RBI for a “Certificate of Holding”.

sgb@rbi.org.in

Reserve Bank of India