How to Buy Sovereign Green Bonds Online? – Features | Benefits

Sovereign Green Bonds

Today’s article will discuss How to Buy Sovereign Green Bonds Online? Before that, we will understand what is it with features and benefits on the same.

Sovereign green bonds are debt securities issued by the government of a country to raise funds for environmentally friendly projects.

In India, sovereign green bonds are issued by the Government of India to raise capital

for green projects, such as renewable energy, sustainable transportation, and clean water.

These bonds are issued to the public, and the proceeds are used to fund green projects

as per the guidelines of Ministry of Finance and Ministry of New and Renewable Energy.

These bonds are traded on stock exchanges, like the National Stock Exchange (NSE),

and the Bombay Stock Exchange (BSE), allowing investors to buy and sell them in the secondary market.

Sovereign Green Bonds are rated by credit rating agencies, like CRISIL, ICRA, and CARE.

Features

SGFs are issued by the government to raise funds for environmentally friendly projects, such as renewable energy, sustainable transportation, and clean water. Here are some of the key features of these bonds:

- Purpose: The proceeds of these bonds are used to fund green projects, as per the guidelines of Ministry of Finance and Ministry of New and Renewable Energy.

- Eligibility: These bonds are eligible for investment by individuals, corporates, and institutional investors.

- Minimum Bid Size: The Stocks will be issued for a minimum amount of ₹10,000/- (nominal) and in multiples of ₹10,000/- thereafter.

- Tenure: The tenure of these bonds can vary and is decided at the time of issuance.

- Interest: The bonds offer a fixed rate of interest, which is decided at the time of issuance and is paid to the bondholders on a periodic basis.

- Tax Benefits: Interest earned on these bonds is tax-free under Section 10(15)(iv)(h) of Income Tax Act 1961.

- Secondary Market: These bonds are traded on stock exchanges, like the NSE and BSE, allowing investors to buy and sell them in the secondary market.

- Rating: Sovereign green bonds are rated by credit rating agencies, like CRISIL, ICRA, and CARE.

Benefits

SGBs offer a variety of benefits, both for investors, and for the country’s efforts to promote environmentally friendly projects. Some of the benefits include:

- Environmental benefits:

The proceeds of these bonds are used to fund green projects, which can have a positive impact on the environment. For example, proceeds can be used to fund renewable energy projects, sustainable transportation, and clean water initiatives. - Investment benefits:

These bonds offer a fixed rate of interest, which can provide a steady stream of income for investors. Additionally, the interest earned on these bonds is tax-free under Section 10(15)(iv)(h) of Income Tax Act 1961. - Market liquidity:

These bonds are traded on stock exchanges, like the NSE and BSE, allowing investors to buy and sell them in the secondary market. - Credit rating:

These bonds are rated by credit rating agencies, like CRISIL, ICRA, and CARE, which can provide investors with an independent assessment of the creditworthiness of the issuer. - Diversification:

By investing in sovereign green bonds, investors can diversify their portfolio and reduce the overall risk of their investment. - Long-term growth:

These bonds typically have a long-term maturity, which can provide a good opportunity for long-term growth. - Encourages transparency:

By issuing green bond, Government of India is providing transparency to the public on the usage of funds and the environmental impact of the projects they are funding.

How to Buy Sovereign Green Bonds Online?

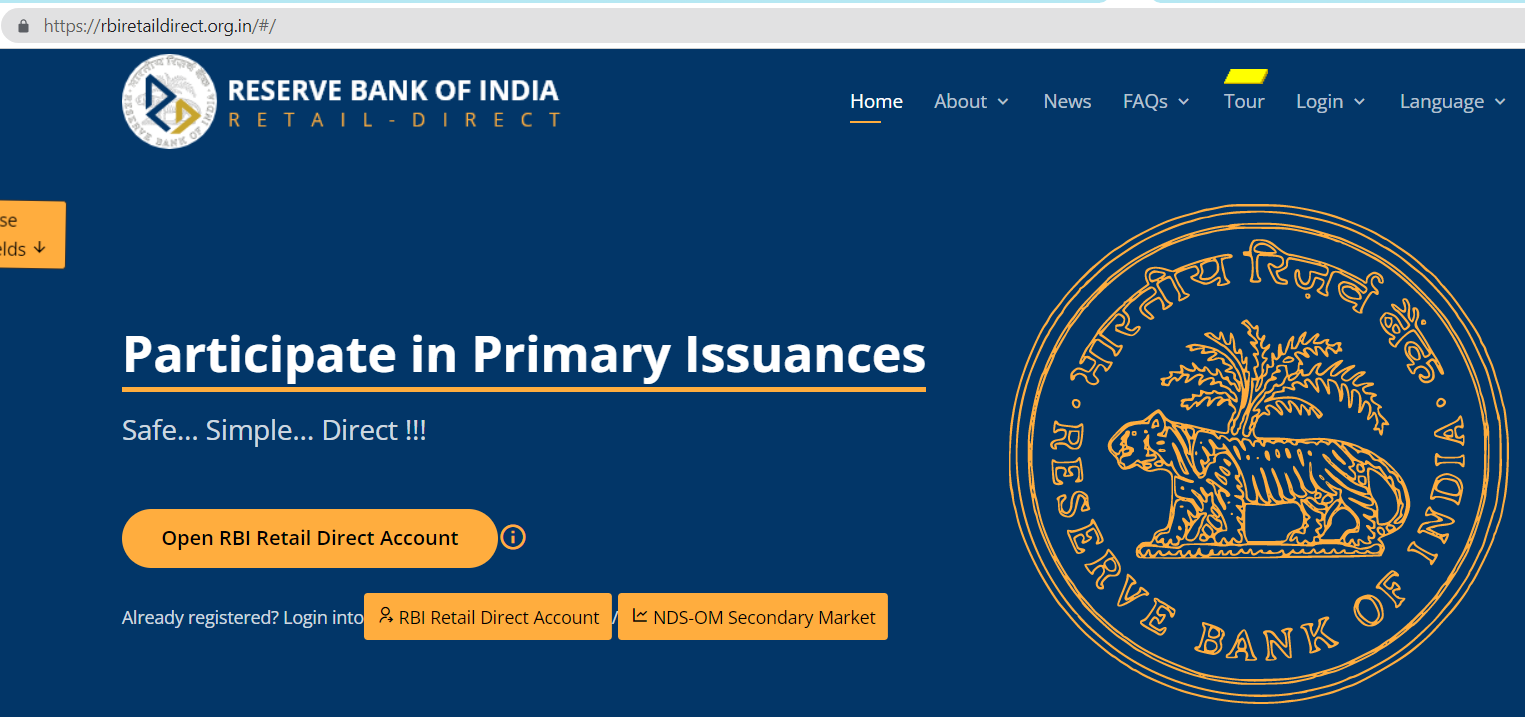

RBIRetailDirect is a platform launched by the Reserve Bank of India (RBI) for retail investors to directly invest in government securities, including sovereign green bonds. Here are the general steps to follow to apply for sovereign green bonds through RBIRetailDirect:

- Register on the RBIRetailDirect website using your PAN number and other personal details.

Also Read – RBI RDG Account – Buy & Sell G-Secs, Bonds, T-bills, and State Development Loans - Log in to the portal and navigate to the “Investment” section.

- Select the “Government Securities” tab and then choose “Sovereign Green Bonds” from the options available.

- Follow the instructions on the screen to complete the application process, including providing your bank details for electronic clearance system (ECS) mandate.

- Submit the application and wait for the confirmation of your investment.

It’s important to note that the availability of sovereign green bonds on the platform might be based on the issuance and auction schedule decided by the Government of India.

Trading Account

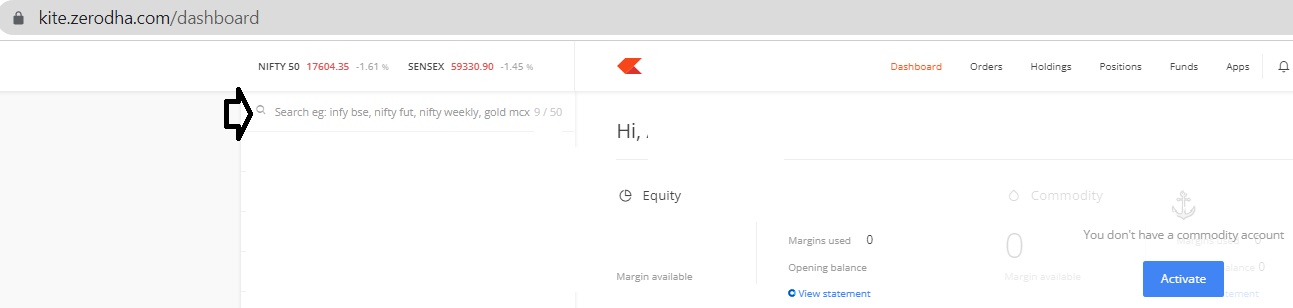

- Open a trading account:

To buy sovereign green bonds online in India, you will need to open a trading account with a broker or a trading platform like Zerodha, Upstox, Angel Broking etc. - Search for the bond:

Once you have an account, you will be able to search for the bond using its ISIN number or bond name.

- Place an order:

Once you have located the bond, you can place an order to buy the bond. You will need to specify the quantity you want to buy and the price you are willing to pay. - Fund your account:

Before you can complete your purchase, you will need to fund your trading account with the necessary amount.

This can typically be done via online banking or by depositing a cheque. - Review and confirm the order:

Before you confirm your order, make sure to review the details of the bond, including the interest rate, maturity date, and credit rating. - Track your investment:

Once you have purchased the bond, you can track your investment on the trading platform.

FAQs

What are the Eligibility criteria for Sovereign Green Bonds?

Individuals, corporates, and institutional investors are eligible to invest in sovereign green bonds in India.

What is the Interest Rate of Sovereign Green Bonds?

The interest rate of sovereign green bonds is fixed and is determined by the government at the time of issuance.

What is the Tenure of Sovereign Green Bonds?

The tenure of sovereign green bonds is usually longer than 10 years, usually 15-20 years.

Are the Interest earned on Sovereign Green Bonds Taxable?

The interest earned on sovereign green bonds is tax-free under Section 10(15)(iv)(h) of Income Tax Act 1961.

Are the Sovereign Green Bonds tradable in the Secondary Market?

Yes, sovereign green bonds are tradable in the secondary market and can be bought and sold on stock exchanges, like the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

Is there any Credit Rating for Sovereign Green Bonds?

Yes, sovereign green bonds are rated by credit rating agencies, like CRISIL, ICRA, and CARE, which can provide investors with an independent assessment of the creditworthiness of the issuer.

How can I invest in Sovereign Green Bonds in India?

You can invest in sovereign green bonds in India by opening a trading account with a broker or a trading platform and placing an order to buy the bond.

Are there any benefits of investing in Sovereign Green Bonds in India?

Yes, investing in sovereign green bonds in India offers environmental benefits, investment benefits, market liquidity, credit rating, diversification, long-term growth and encourages transparency.

Is there any Risk involved in investing in Sovereign Green Bonds in India?

Like any investment, there is a risk involved when investing in sovereign green bonds and it is important to consult with a financial advisor and do your own research before making any investment.