How to do Intraday Trading in ICICIdirect? – Strategies | Trading Risks

This article will examine How to do Intraday Trading in ICICIdirect? Firstly, we’ll define what Intraday Trading is and discuss strategies for trading. Additionally, we will outline the risks associated with trading in ICICIdirect.

What is Intraday Trading in ICICIdirect?

Here are the key points to know about Intraday Trading in ICICIdirect:

- Intraday Trading in ICICIdirect is a type of trading where you buy and sell securities within the same trading day.

- ICICIdirect allows you to do intraday trading in stocks, derivatives, and currencies.

- To place an intraday order in ICICIdirect, log in to your account and select the stock you want to trade. Click on the “Buy/Sell” button and select “Intraday” as the order type. Enter the quantity and price, and confirm the order.

- ICICIdirect charges a flat brokerage fee of 0.05% or Rs. 25 per executed order, whichever is lower, for Intraday Trading in stocks and currencies. For derivatives trading, the brokerage fee is 0.05% of the trade value.

- ICICIdirect offers margin trading, which means you can trade with a margin of up to 10 times your trading capital. The margin required for Intraday Trading depends on the stock, derivative or currency you are trading.

- Some tips for successful Intraday Trading in ICICIdirect include having a disciplined approach to trading, using technical analysis and charts to make trading decisions, keeping a watchful eye on the market and news, and having a clear risk management strategy.

- The risks of Intraday Trading in ICICIdirect include market risk, execution risk, technical risk, leverage risk, regulatory risk, and operational risk. It’s important to have a clear understanding of these risks and to have a disciplined approach to trading. It’s also recommended to consult with a financial advisor or professional trader before starting Intraday Trading.

The Strategy of Intraday Trading in ICICIdirect

Here are some common strategies for Intraday Trading in ICICIdirect:

- Momentum trading strategy:

This strategy involves identifying stocks that are likely to move significantly during the day, based on market news or technical analysis. Traders can take a position in these stocks at the start of the day and exit when the stock reaches a predetermined target or stop loss level. - Breakout trading strategy:

This strategy involves identifying key levels of support and resistance in a stock's price chart, and taking a position when the stock breaks out of these levels. Traders can enter long or short positions based on the direction of the breakout. - Trend following strategy:

This strategy involves identifying the direction of a stock's trend using technical indicators such as moving averages or trendlines. Traders can take long or short positions based on the direction of the trend, and exit when the trend shows signs of reversal. - Scalping strategy:

This strategy involves taking advantage of small price movements in a stock by making multiple trades during the day. Traders can enter and exit positions quickly, with a focus on minimizing risk and maximizing profits on each trade. - News-based trading strategy:

This strategy involves monitoring news and events that may impact the stock market, and taking positions based on the expected impact on individual stocks. Traders can enter and exit positions quickly based on the news flow and market sentiment.

Risk in Trading

Here are some common risks associated with trading:

- Market risk:

This is the risk of losses due to adverse movements in market prices, such as changes in interest rates, exchange rates, or stock prices. - Liquidity risk:

This is the risk of not being able to exit a position in a timely manner or at the desired price due to a lack of buyers or sellers in the market. - Credit risk:

This is the risk of losses due to the default or non-payment by a counterparty or issuer of a financial instrument. - Operational risk:

This is the risk of losses due to errors, omissions, or system failures in the trading process. - Regulatory risk:

This is the risk of losses due to changes in laws, regulations, or policies that impact trading activities. - Technology risk:

This is the risk of losses due to disruptions or failures in the technology systems used for trading. - Leverage risk:

This is the risk of magnifying losses due to the use of leverage or borrowing money to invest in financial instruments.

How to do Intraday Trading in ICICIDirect?

Time Needed : 3 minutes

Here are the steps to do Intraday Trading in ICICIDirect:

Login to ICICIdirect

Open an account: To trade on ICICIdirect, you need to open a trading and demat account with ICICI Securities.

Fund your account: Transfer funds into your trading account from your bank account using NEFT/RTGS or other online payment methods.

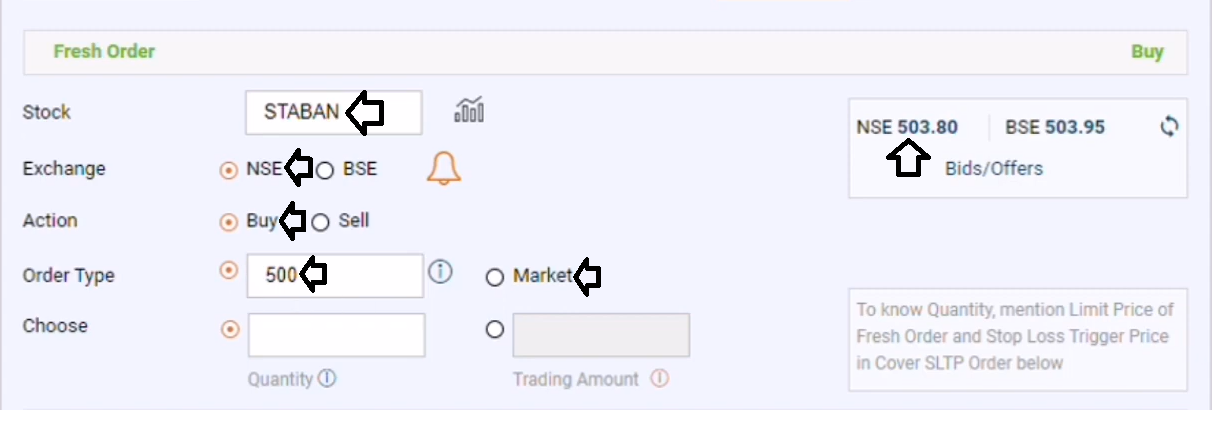

Go to the 'Place Order' option and then select 'Margin Plus' at the top of the menu.

Fresh Order

Stock:

Choose the stock that you want to trade. You can either search for the stock using the search bar or browse through the list of stocks available on the platform.

Once you have selected the stock, you will see the price chart for that stock. You can analyze the chart to determine the entry and exit points for your trade.

Action:

Select the buy or sell option based on technical analysis and risk

Set your order type:

Choose the order type you want to use, such as market order, limit order.

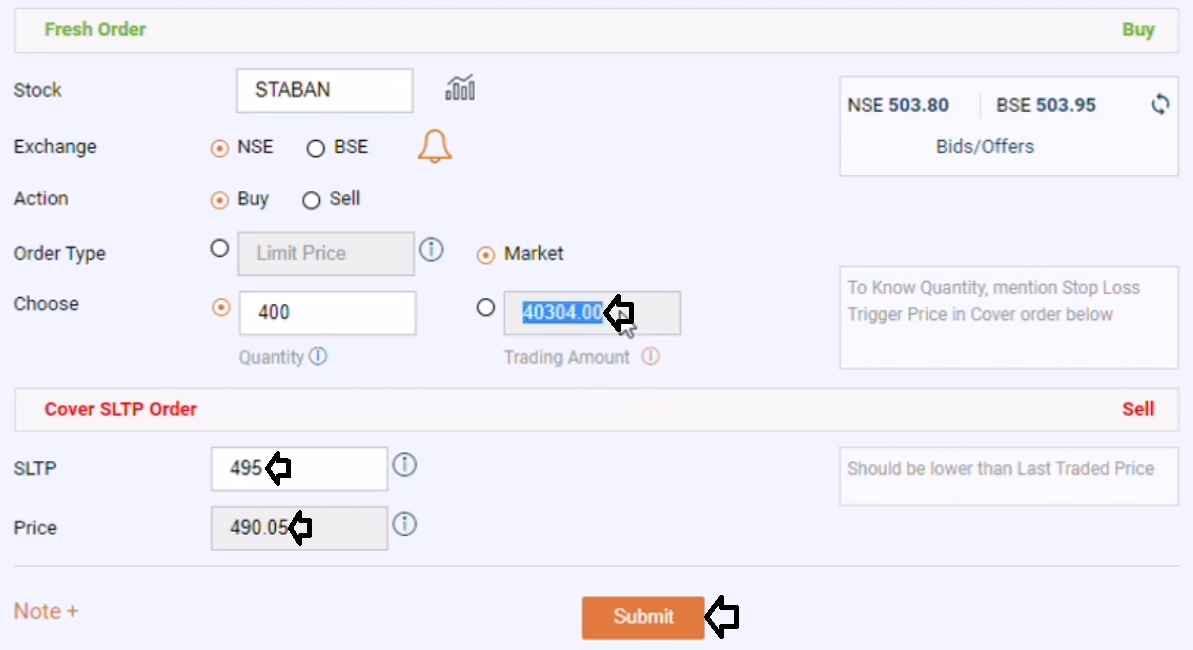

Quantity and Stop Loss

Specify your quantity or Set your price:

Enter the quantity of shares you want to buy or sell.

OR

Enter the price at which you want to buy or sell the shares.

SLTP:

In case of a Sell Order, the SLTP for Stop Loss Buy order should be greater than the Last Traded Price (LTP) and in case of Buy Order, the SLTP for Stop Loss Sell order should be less than the LTP.

Price:

The value for Limit Price of your Cover SLTP order will automatically appear in the Limit Price field based on the Stop Loss Trigger Price (SLTP) entered by you and minimum difference % defined for the particular scrip. You can view the minimum difference % for various scrips by visiting the Stock List page under Equity section.

Confirmation

Confirm your order: Review your order details and confirm the trade.

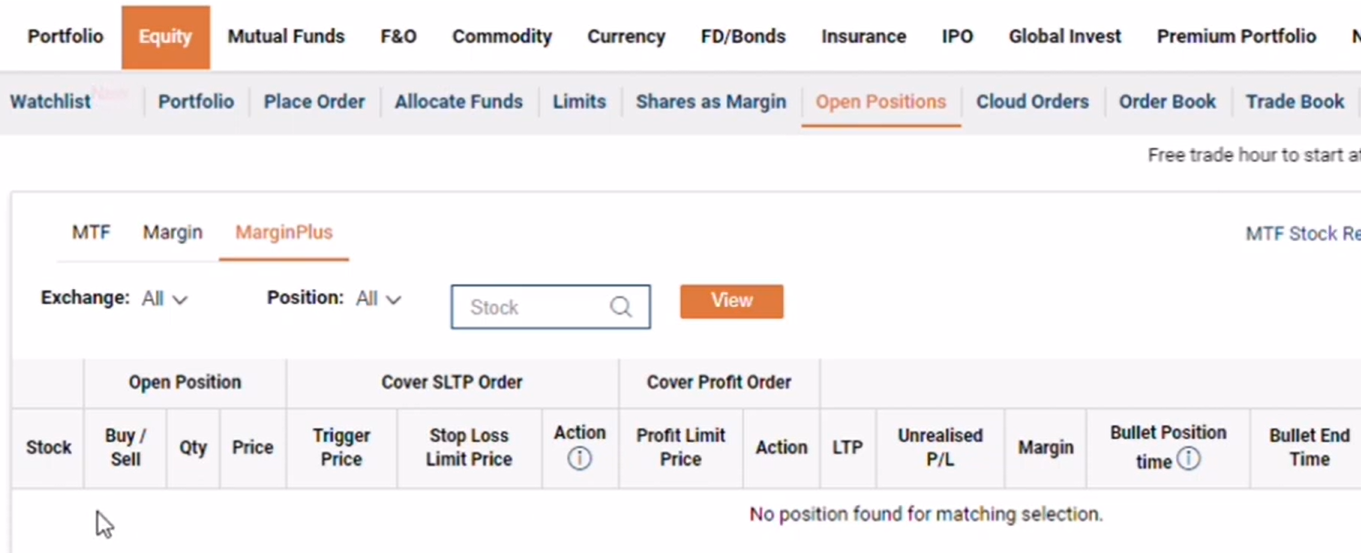

Monitor your trade: Monitor your trade throughout the day to ensure it is performing as expected.

Exit your position: At the end of the trading day, exit your position by selling or buying the shares, depending on your trade.

FAQs

What is Intraday Trading in ICICIdirect?

Intraday trading is a type of trading where you buy and sell shares on the same trading day to make profits from short-term price movements. ICICIdirect is a platform that enables investors to trade in Indian stock markets, including Intraday trading.

What are the charges for Intraday Trading in ICICIdirect?

ICICIdirect charges brokerage fees for Intraday trading, which is a percentage of the trade value. Other charges include transaction charges, demat debit transaction charges, and securities transaction tax.

How much margin is required for Intraday Trading in ICICIdirect?

ICICIdirect offers margin trading, which allows you to trade with a portion of the total trade value. The margin required for Intraday trading depends on the stock and the volatility of the market.

What are the risks associated with Intraday Trading in ICICIdirect?

Intraday trading involves high risks due to the volatility of the market and the short-term nature of the trades. It's important to have a clear risk management strategy in place and to avoid taking undue risks.

Can I trade in multiple stocks in Intraday Trading in ICICIdirect?

Yes, you can trade in multiple stocks in Intraday Trading in ICICIdirect. You can place buy and sell orders for different stocks and monitor your trades throughout the day.

How can I access trading tips and research for Intraday Trading in ICICIdirect?

ICICIdirect provides access to trading tips and research reports through its website and mobile app. You can also consult with a financial advisor or professional trader for guidance on Intraday trading.