How to do Intraday Trading in Zerodha? – Strategies | Trading Risks

This article will examine how to do Intraday Trading in Zerodha. Firstly, we’ll define what Intraday Trading is and discuss strategies for trading. Additionally, we will outline the risks associated with trading in Zerodha.

Intraday Trading in Zerodha

Here are the key points to understand Intraday Trading in Zerodha:

- Intraday trading is a type of trading where you buy and sell securities on the same trading day, with the aim of making a profit.

- Zerodha is a popular online brokerage firm in India that offers a trading platform for intraday trading.

- To start intraday trading in Zerodha, you need to open a trading account and have sufficient funds in your account to cover the margin requirements for intraday trading.

- Intraday trading on Zerodha can be done using the Kite web trading platform or the Kite mobile app.

- Intraday trades on Zerodha are settled on a T+1 basis, which means that if you buy and sell shares on Monday, the settlement will take place on Tuesday.

- Zerodha charges a brokerage fee of 0.03% or Rs. 20 per executed order, whichever is lower, for intraday trades.

- Zerodha also offers margin trading facilities for intraday trading, where you can trade with a margin amount that is higher than the available funds in your account. However, margin trading involves higher risks and requires a thorough understanding of the market and the trading platform.

- It’s important to note that intraday trading involves significant risks and requires a disciplined approach and a sound trading strategy. It’s recommended to consult with a financial advisor or professional trader before starting intraday trading.

Strategies

There are various strategies that you can use for intraday trading in Zerodha. Here are a few popular intraday trading strategies:

- Scalping:

This strategy involves making multiple trades in a short period of time to make small profits on each trade. The aim is to make a high volume of trades to accumulate profits over time. - Breakout trading:

This strategy involves identifying stocks that are trading in a range and waiting for a breakout. When the stock breaks out of the range, you can buy or sell the stock with the expectation that the price will continue to move in the same direction. - Momentum trading:

This strategy involves identifying stocks that are showing strong momentum in one direction and taking a position in the same direction. The aim is to ride the momentum and make a profit before the trend reverses. - News-based trading:

This strategy involves trading based on news and events that can affect the stock market. For example, if a company announces good quarterly results, you can buy the stock with the expectation that the price will go up. - Swing trading:

This strategy involves taking a position in a stock and holding it for a few days to a few weeks. The aim is to capture the price movement over a longer period of time.

The Risk Associated with Trading in Zerodha

Here are some of the risks associated with trading in Zerodha:

- Market risk:

The value of stocks, commodities, and other securities can be highly volatile, and can fluctuate based on various economic, political, and other factors. There is a risk of losing money if the market moves against your trade. - Execution risk:

There is a risk of order execution errors, delays, or failures, which can result in losses. It's important to have a reliable internet connection and to double-check your order before placing it. - Technical risk:

There is a risk of technical glitches or system failures, which can result in losses or missed opportunities. Zerodha is a technology-driven platform, and it's important to have a basic understanding of the platform and its features. - Leverage risk:

Margin trading involves using borrowed funds to trade, and can amplify both profits and losses. There is a risk of losing more money than you have in your trading account. - Regulatory risk:

The stock market is regulated by various authorities, and changes in regulations or policies can affect the market and your trades. - Operational risk:

Zerodha is a brokerage firm, and there is a risk of financial fraud, theft, or other operational risks. It's important to have a strong password and to monitor your account regularly.

How to do Intraday Trading in Zerodha?

Time Needed : 2 minutes

Here's a step-by-step guide on how to do intraday trading in Zerodha:

Trading Account with Zerodha

Open a trading account with Zerodha and log in to your account.Once you have logged in, you will see the Kite web trading platform. This is the platform where you can place your trades.

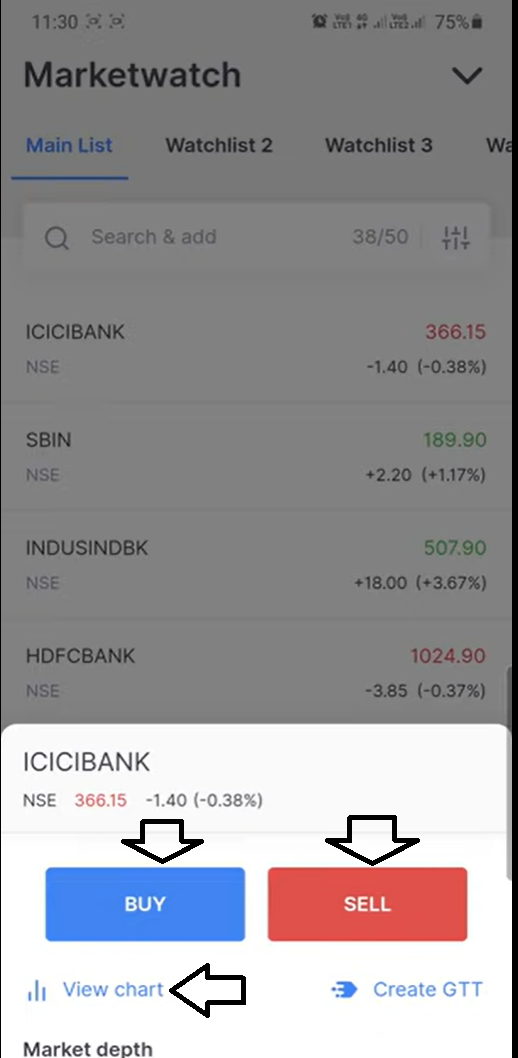

Choose the Stock and do the needful Action

Stock:Choose the stock that you want to trade. You can either search for the stock using the search bar or browse through the list of stocks available on the platform.Once you have selected the stock, you will see the price chart for that stock. You can analyze the chart to determine the entry and exit points for your trade.Action:Select the buy or sell option based on technical analysis and risk

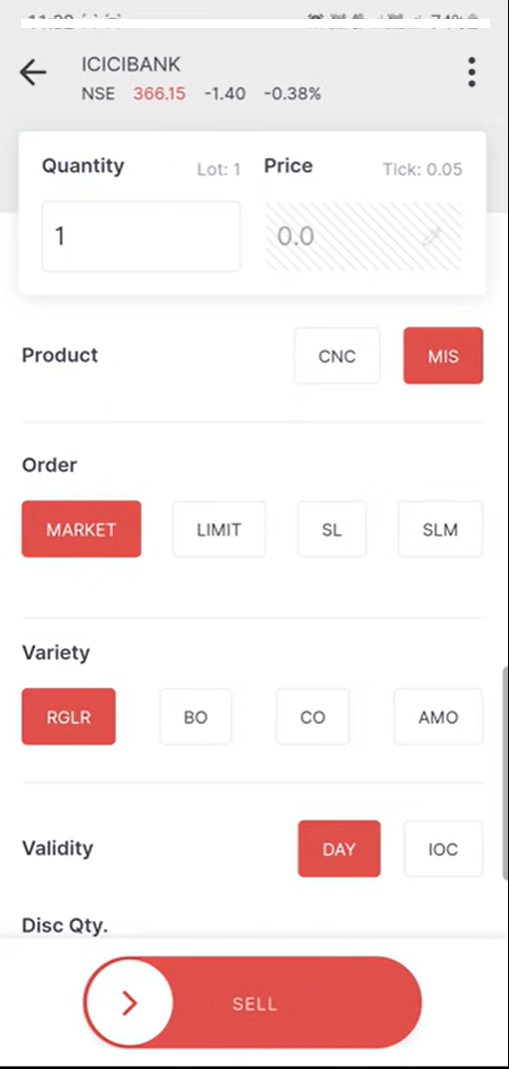

<strong>Order Type & Price</strong>

Set your order type:Choose the order type you want to use, such as market order, limit order.Enter the quantity of shares that you want to trade and select the order type as 'Intraday' (MIS) from the menu.Set the price at which you want to buy or sell the stock. You can choose the market price or set a limit price.

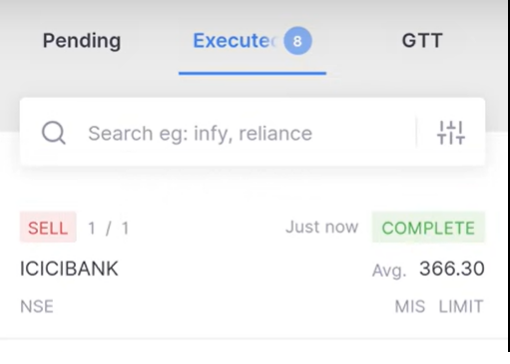

Review your order

Review your order and click on the 'Place Order' button to execute the trade.Once your trade is executed, you can monitor your position using the 'Positions' tab on the platform. You can also modify or cancel your order if necessary.At the end of the trading day, all intraday trades are automatically squared off by Zerodha. This means that if you have bought a stock, you will have to sell it before the market closes, and if you have sold a stock, you will have to buy it back before the market closes.

FAQs

What is intraday trading in Zerodha?

Intraday trading is a type of trading where you buy and sell securities within the same trading day. In Zerodha, you can do intraday trading in stocks, commodities, and currencies.

What are the brokerage charges for intraday trading in Zerodha?

Zerodha charges a flat fee of 0.03% or Rs. 20 per executed order, whichever is lower, for intraday trading in stocks, commodities, and currencies.

What is the margin required for intraday trading in Zerodha?<br>

Zerodha offers margin trading, which means you can trade with a margin of up to 10 times your trading capital. The margin required for intraday trading depends on the stock, commodity, or currency you are trading.

Can I do intraday trading in Zerodha using a mobile app?

Yes, Zerodha offers a mobile trading app called Kite, which you can use to do intraday trading from your smartphone.

What are some tips for successful intraday trading in Zerodha?

Some tips for successful intraday trading in Zerodha include having a disciplined approach to trading, using technical analysis and charts to make trading decisions, keeping a watchful eye on the market and news, and having a clear risk management strategy.

What are the risks of intraday trading in Zerodha?

The risks of intraday trading in Zerodha include market risk, execution risk, technical risk, leverage risk, regulatory risk, and operational risk. It's important to have a clear understanding of these risks and to have a disciplined approach to trading. It's also recommended to consult with a financial advisor or professional trader before starting intraday trading.