How to Invest in Crude Oil Commodity through Zerodha? | 2023

This article will examine how to invest in crude oil as a commodity through Zerodha. First, we’ll define crude oil and explore current prices

Crude Oil Commodity in Zerodha

- Crude oil is a tradable commodity on Zerodha, an Indian online trading platform.

- Futures and options contracts for crude oil can be traded on the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE) through Zerodha’s futures and options segment.

- Crude oil can also be traded through Exchange-Traded Funds (ETFs) or by investing in oil and gas companies listed on stock exchanges.

- To trade crude oil on Zerodha, you must open an account and comply with the platform’s eligibility and documentation requirements.

- The price of crude oil is determined by various factors such as supply and demand, geopolitical tensions, and natural disasters, among others.

- Trading crude oil requires a good understanding of the commodity market and risk management strategies.

However, Zerodha provides various tools and resources to help traders make informed decisions, including market updates, charting tools, and technical analysis. - As with any form of trading, there is risk involved in trading crude oil, and it’s important to carefully consider your investment objectives, risk tolerance, and financial situation before making any trades.

- Assuming you’re familiar with this concept, so now we will start with “How to Invest in Crude Oil Commodity through Zerodha?”

Crude Oil Price in Commodity Market

- Crude oil is one of the most widely traded commodities in the world and its price is closely

watched by markets around the globe. - The price of crude oil is determined by supply and demand dynamics in the global market.

- Factors that can impact the supply of crude oil include production cuts by major oil-producing countries, geopolitical tensions in oil-producing regions, and natural disasters.

- On the demand side, factors such as economic growth, energy consumption patterns, and the adoption of alternative energy sources can impact crude oil prices.

- The Organization of the Petroleum Exporting Countries (OPEC) and its allies play a significant

role in managing the global oil market and influencing crude oil prices.

However, The global oil market is also impacted by speculative trading, where investors buy

and sell crude oil contracts to profit from changes in prices. - The benchmark for crude oil prices is the Brent Crude and West Texas Intermediate (WTI) prices, which are used as a reference for global oil prices.

- Above all, the price of crude oil can be volatile and subject to sudden fluctuations,

making it a challenging commodity to trade for inexperienced investors.

Pros and Cons to Invest

Investing in crude oil can be a potentially lucrative opportunity, but also carries certain risks and considerations. Here are some pros and cons of investing in crude oil as a commodity in India:

Pros:

- High demand:

Crude oil is a major source of energy globally, and is in high demand. This makes it a relatively stable commodity, which can lead to consistent returns for investors. - Economic growth:

India's economy has been growing rapidly in recent years, and is expected to continue doing so. As a result, the demand for energy, including crude oil, is likely to increase,

which can provide a boost to crude oil prices. - Diversification:

Adding crude oil to your portfolio can help to diversify your investments and reduce overall risk.

Cons:

- Volatility:

The price of crude oil is known for being highly volatile and can fluctuate greatly, sometimes in

short periods of time. This can result in substantial losses for investors. - Geopolitical risk:

Crude oil prices are often affected by geopolitical events and conflicts, particularly in oil-producing countries. This can lead to uncertainty and instability in the market, affecting crude oil prices. - Environmental concerns:

There is growing concern about the impact of oil production and consumption on the environment. This could potentially lead to regulations that could limit demand for crude oil, negatively affecting prices.

How to Invest in Crude Oil Commodity through Zerodha?

Time Needed : 5 minutes

To invest in crude oil through Zerodha, you can follow these steps:

Open a Zerodha account

To start investing in crude oil through Zerodha, you'll need to open an online trading account by providing the required personal and financial information.

After your account is activated, you'll need to transfer funds to your account to start trading.

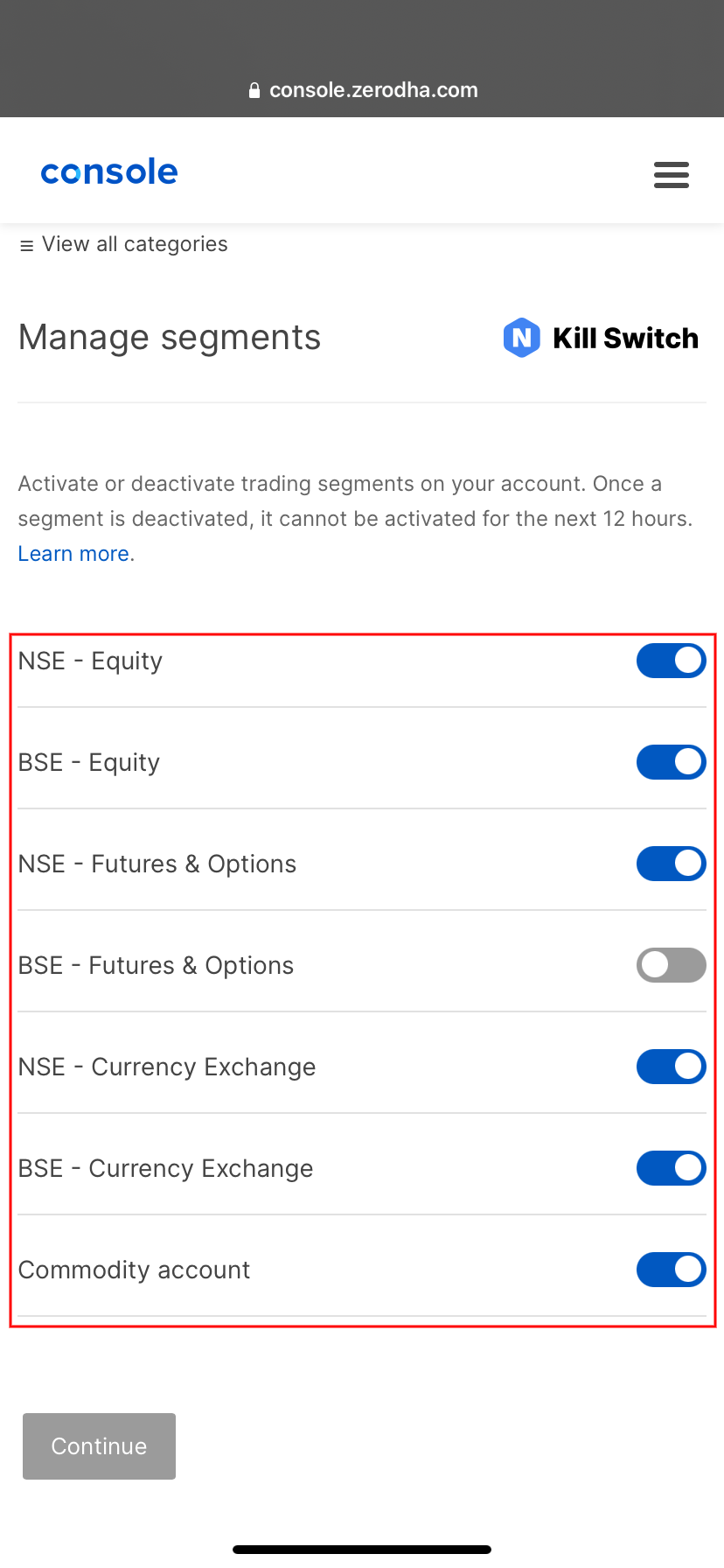

Commodity segment

Now, select activate segment under the commodity tab.

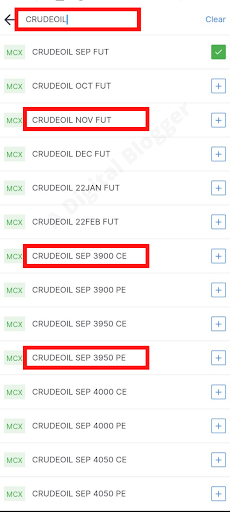

Choose your investment option

After you have logged in to the account, you will see the dashboard with a search bar on the top.

You can now search crude oil in this search bar.

You will see FUT, CE, and PE options that stand for futures, call options and put options, respectively.

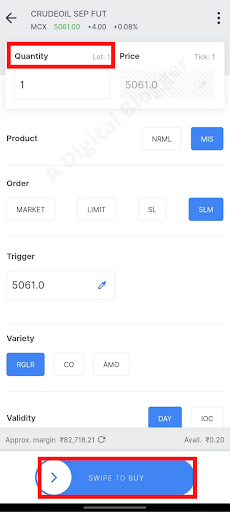

Place your trade

Once you have selected the desired strike price and date, you will see a buy window.

Enter the necessary details like quantity, order type, and then click on buy.

Monitor your investment

After placing your trade, you should regularly monitor your investment to stay informed of market updates and make informed decisions.

FAQs

What are the fees and charges for trading crude oil through Zerodha?

The fees and charges for trading crude oil through Zerodha will depend on the type of investment you choose and the number of trades you make. Zerodha charges brokerage fees, transaction charges, and other fees such as taxes, stamp duty, and exchange charges. You can view the fees and charges on the Zerodha website or by contacting their support team.

What is the minimum amount required to invest in crude oil through Zerodha?

There is no set minimum amount for investing in crude oil through Zerodha. The amount required to invest will depend on the type of investment you choose and the contract size of the futures or options contracts you trade.

What is Crude Oil Commodity in Zerodha?

Crude oil commodity in Zerodha refers to the buying and selling of crude oil futures and options contracts on the Zerodha platform. Zerodha allows traders and investors to access the commodity market and invest in crude oil through its online trading platform.

How can I trade Crude Oil Commodity in Zerodha?

To trade crude oil commodity in Zerodha, you'll need to open an online trading account, complete the verification process, and fund your account. Then, you can choose the crude oil contract you want to trade, place your trade, and monitor your investment.

Is it safe to trade Crude Oil Commodity in Zerodha?

Zerodha is a regulated and well-established online trading platform. It takes security measures to protect its clients' personal and financial information. However, trading crude oil commodity carries inherent risks, and it's important to understand the risks and carefully consider your investment objectives, risk tolerance, and financial situation before making any trades.