How to Invest in Nifty BeES? – How does Nifty BeES work?

Today’s article will discuss How to Invest in Nifty BeES? Before that, we will understand what is it with features, returns, and benefits on the same.

Nifty BeES

Nifty BeES, or Nifty Benchmark Exchange Traded Scheme, is an index-based exchange-traded fund (ETF) that tracks the performance of the Nifty 50 index.

The Nifty 50 index is a stock market index that comprises of 50 of the largest publicly traded companies listed on the National Stock Exchange of India.

Investing in Nifty BeES allows an individual to gain exposure to the performance of the top 50 companies listed on the NSE, rather than investing in individual stocks.

How does Nifty BeES work?

Nifty BeES is an ETF that tracks the performance of the Nifty 50 index. The ETF provider creates and redeems shares in the ETF based on demand, and the value of the ETF is based on the value of the underlying index. When an investor buys shares of Nifty BeES, they are effectively buying a small piece of each of the 50 companies included in the Nifty 50 index.

Benefits

Nifty BeES, or Nifty Benchmark Exchange Traded Scheme, offers several advantages to investors:

| Low cost: | Nifty BeES is an index-based ETF, which means that it has lower management fees compared to actively managed funds. |

| Diversification | Nifty BeES tracks the performance of the Nifty 50 index, which comprises of 50 of the largest publicly traded companies listed on the NSE. Investing in Nifty BeES allows an individual to gain exposure to the performance of the top 50 companies listed on the NSE, rather than investing in individual stocks. |

| Liquidity | Nifty BeES is traded on the stock exchange, which means that it can be bought and sold easily and quickly, just like any other stock. |

| Transparency | Nifty BeES tracks the performance of the Nifty 50 index, which is a publicly available index. This means that the portfolio of the Nifty BeES is transparent and can be easily accessed by investors. |

| Low risk | Index funds like Nifty BeES are considered low-risk investments since they are diversified and track an index, which reduces the risk of investing in individual stocks. |

| Tax efficiency | ETFs like Nifty BeES are more tax efficient than mutual funds, since they are not required to distribute capital gains to shareholders, which can result in a lower tax bill for investors. |

Performance of Nippon India ETF Nifty BeES

| Period Invested for | ₹10000 Invested on | Latest Value | Absolute Returns | Annualised Returns |

|---|---|---|---|---|

| 1 Year | 18-Jan-22 | 10155.10 | 1.55% | 1.55% |

| 2 Year | 18-Jan-21 | 13022.50 | 30.23% | 14.12% |

| 3 Year | 17-Jan-20 | 15171.60 | 51.72% | 14.88% |

| 5 Year | 18-Jan-18 | 17797.50 | 77.98% | 12.21% |

| 10 Year | 18-Jan-13 | 33357.90 | 233.58% | 12.80% |

| Since Inception | 28-Dec-01 | 226963.40 | 2169.63% | 15.97% |

| Period Invested for | ₹1000 SIP Started on | Investments | Latest Value | Absolute Returns | Annualised Returns |

|---|---|---|---|---|---|

| 1 Year | 18-Jan-22 | 12000 | 12720.62 | 6.01 % | 11.26 % |

| 2 Year | 18-Jan-21 | 24000 | 26710.87 | 11.3 % | 10.63 % |

| 3 Year | 17-Jan-20 | 36000 | 47309.17 | 31.41 % | 18.54 % |

| 5 Year | 18-Jan-18 | 60000 | 88461.04 | 47.44 % | 15.5 % |

| 10 Year | 18-Jan-13 | 120000 | 243494.31 | 102.91 % | 13.55 % |

How to Invest in Nifty BeES?

Time needed: 1 minute

It is quite easy to invest in a NIFTY BeES. You can invest in them both online and offline. Let's have a look at online modes of investment:

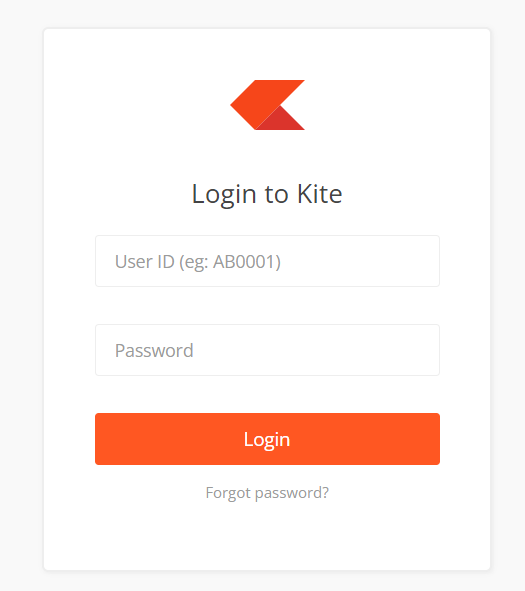

- Open a brokerage account

In order to invest in Nifty BeES online, you will need to open a brokerage account with a brokerage firm that offers online trading. Let me take an example for you

Firstly enter your username and password. Then, key your PIN to log in to the dashboard. Here is the URL for login: https://kite.zerodha.com/

- Research the Nifty BeES

Before investing, it's important to research the Nifty BeES and understand how it works, its past performance, and the risks involved.

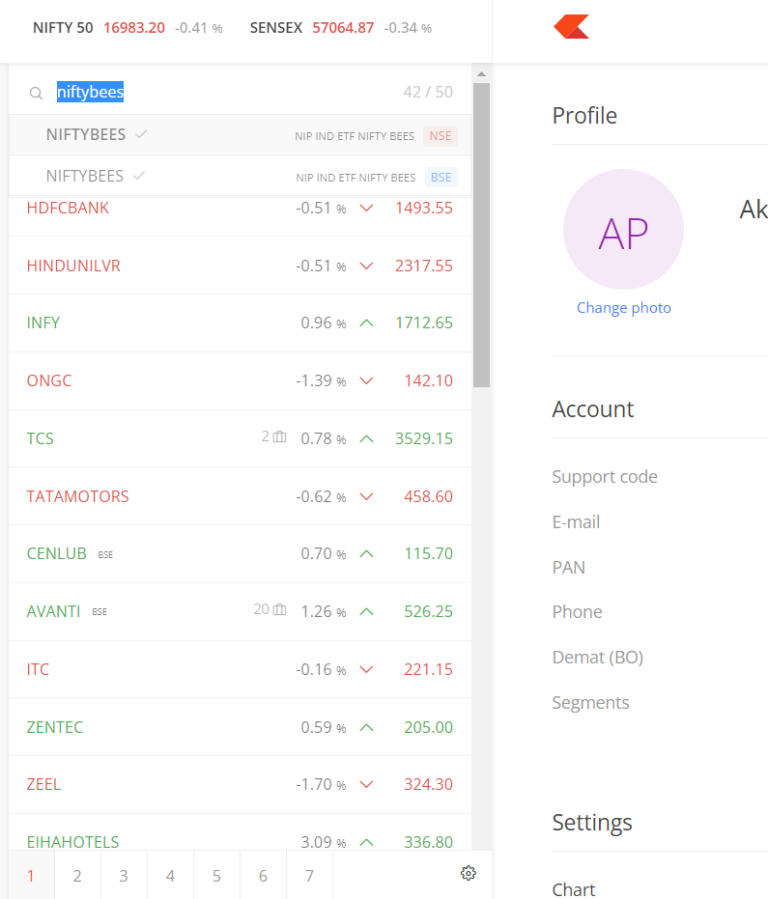

- Search for NIFTYBEES on Dashboard

On top, you can see NIFTY50 is displaying but there is no buy or sell option as it's just an indie. To invest in NIFTY 50 ETF, you can search for NIFTYBEES' best-performing stock of NIPPON India matching the returns of NIFTY50.

- Select NIFTYBEES NSE ETFs

Choose NIFTYBEES from the one reflected in the dropdown indicating NSE one. Further select buy option.

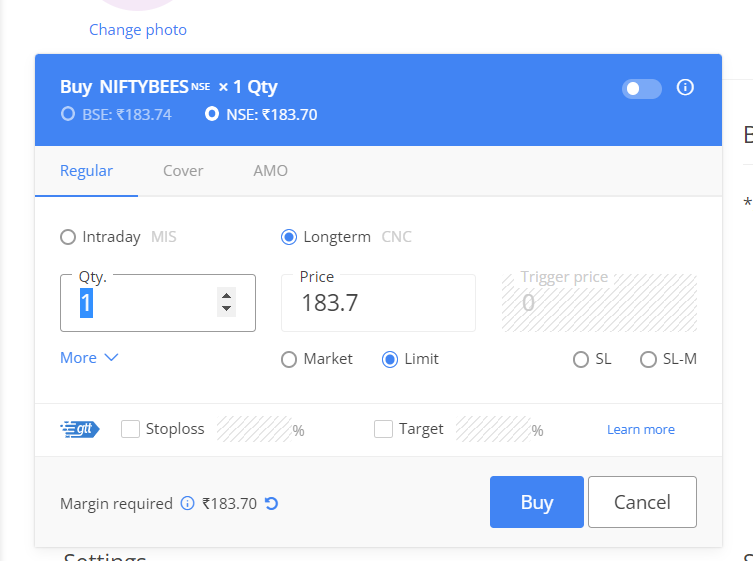

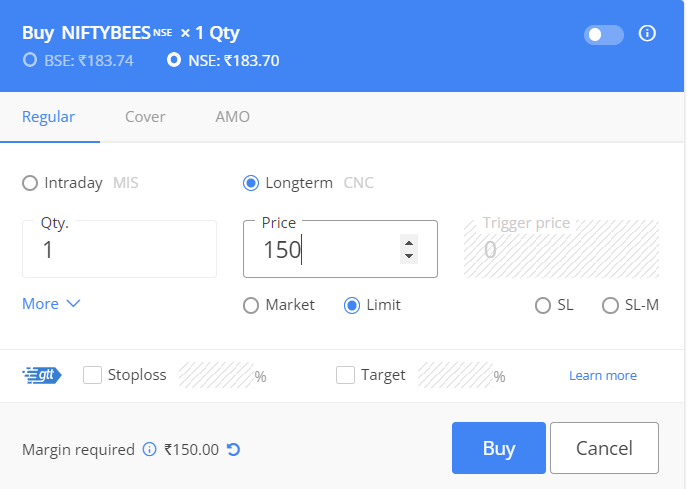

- Enter your Buy Details

On the Buy screen, you can select the quantity of stocks to buy for NIFTYBEES. In case you want to do daily trading then choose Intraday or else choose CNC for long-term investment. Moreover, select the quantity if want to buy at the current market rate then choose the Market radio button to execute the order immediately. On the other hand, choose Limit in case you want to buy at a certain price and then click on Buy Button.

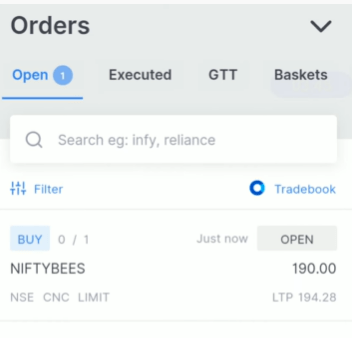

- Go to Orders

Now the order is placed so go into the order section and check under pending order as you have chosen Limit. Once the price reaches 150 then only this order will be executed or else remain in pending orders. At any point in time, if you wish to cancel this order you will have the cancel option.

- Monitor your investment

After you have placed your order, it's important to monitor the performance of your investment and make adjustments as necessary.

FAQs

What are the risks of investing in Nifty BeES?

Like any investment, there are risks associated with investing in Nifty BeES. The performance of the ETF is tied to the performance of the Nifty 50 index, which is influenced by various factors such as economic conditions, company performance, and market sentiment. Additionally, the ETF is subject to market risk, as the value of the ETF can fluctuate based on changes in the value of the underlying index.

How do I invest in Nifty BeES online?

To invest in Nifty BeES online, you will need to open a brokerage account with a brokerage firm that offers online trading. Once you have opened an account, you can research the ETF, place an order to buy Nifty BeES through your brokerage account's trading platform, and monitor your investment over time.

Source - https://www.moneycontrol.com/