How to Sell shares in a Buyback offer by the company? | Pros & Cons | Methods | Online

Introduction

These days we are hearing the term buyback too often. As 2022 has been a roller coaster ride for the stock market. Due to so many highs and lows in the market, the Sensex could only rise to 62k by this year-end even though it started its journey with 58k. Index returns are barely 8% over a year’s time. Amid neutral global cues and negative FIIs cues, the positivity is there in the stock market in a short term. Considering the current situation, we might see more companies announcing buybacks in near future.

So let’s understand what is buyback of shares in the share market, and how to sell shares in a buyback offer by the company.

Buyback is the process in which a company decides to purchase back its shares from the existing shareholders at a premium price that is higher than the prevailing market price.

Thus, it reduces the number of shares available in the open market resulting in the increase of the value of remaining shares, and also increases control of promoter stake on shareholding.

Therefore, it reduces the chances of takeovers and mergers and provides confidence to the shareholders when the stock price is falling. It is like a dividend or return on net worth for the shareholders. These shares get extinguished by the corporation once they are returned. Companies that have extra cash on hand and don’t have any specified investment or other deployment requirements may think about buybacks. Sec 68 of the companies act, 2013 governs this buyback offer.

On the other hand, it is also one of the ways of rewarding their employees and management by offering them stock options. By doing this, the existing stockholders’ interests are not diluted.

Let’s see whether it’s beneficial for you to apply for a buyback or not followed by how to sell shares in a buyback offer.

That totally depends on the outlook you hold for the stock, as the company is not forcing you but rather giving you the option to sell off your shares at a premium.

You need to understand company fundamentals, how they align with your investment goals and your risk appetite that will show the true picture of whether you should stay invested or participate in the buyback offer.

In my opinion, a buyback offer is an unnecessary option for long-term investors who purchase the stock of a company due to its strong fundamental as this falsely increase the share price and is only temporary.

As per statistics, in many of the companies which offered buybacks, their share prices rose higher than the premium price after the closure of buybacks.

As I said in the beginning, it depends on your outlook on the stock whether it’s short or long-term. If it’s short terms, then opt for buyback, or else opt-out and remain invested.

In this section, we will discuss how you can sell your shares for buyback offered by the company. Generally, there are two ways of availing of this offer, one is a Tender offer and the other is Open Market Offer. In today’s article, we will cover the Tender offer more in detail.

Before understanding what these two offers are. Let’s understand the eligibility to participate in a buyback process:

- Firstly the investors should hold the shares in Demat form.

- Secondly, as an investor, you should hold these shares at least for 2 days before the record date announced by the company in the buyback offer.

- Thirdly, retail investors have a reservation of 15% in the total buyback offer.

- Tender Offer Buyback

- It’s the way by which a company invites its existing shareholders to sell their shares at a specified price and within defined timelines. The price at which shares will sell will be at a premium usually higher than the prevailing market price. Therefore, providing an incentive to shareholders for selling off their shares. This option can be availed online as well offline by submitting a physical application mentioning the no. of shares you want to tender with the price of the shares.

But the number of shares that you can tender should have been purchased at least 2 days before the record date, in Demat form, and should be over min number of shares for tender buyback offer.

Once you place a request for a tender offer, that number of shares will be blocked in your Demat account. Post tender validation, the company will proportionality approve the tender shares.

Whatever number of shares doesn’t get approved, get unblocked in your Demat account, Thereby, the consideration amount for the approved shares will be credited to your bank account.

- It’s the way by which a company invites its existing shareholders to sell their shares at a specified price and within defined timelines. The price at which shares will sell will be at a premium usually higher than the prevailing market price. Therefore, providing an incentive to shareholders for selling off their shares. This option can be availed online as well offline by submitting a physical application mentioning the no. of shares you want to tender with the price of the shares.

- Open Market Offer

- In this offer, the company announces a buyback period that usually lasts for a month time so there is no significant change in the price due to the buying activity, and purchases back its shares from a seller on the stock exchange at the market price. Usually, seen after the announcement of the buyback, the stock price shoots up signaling positive sentiment among the investors.

Time needed: 3 minutes

Now we fully understand what is buyback how it works and what it offers to us. Let’s check out the steps involved in applying for a buyback offer:

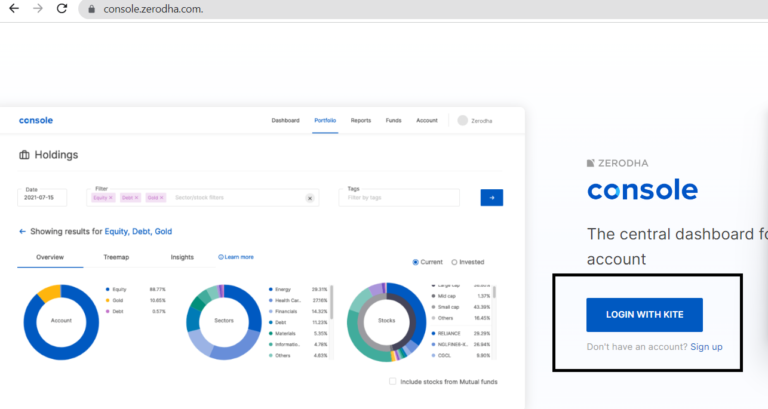

- Login to Zerodha Kite App or their webpage:

Use this hyperlink to log in with your zerodha credentials: console.zerodha.com.

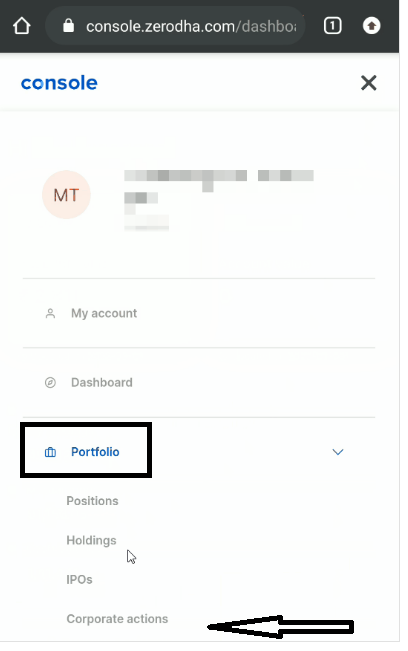

- Click on the Context Menu and Choose Portfolio Option

Once you log in to the console, go to the menu option and choose Portfolio under which you will get Corporate actions. Just select the same.

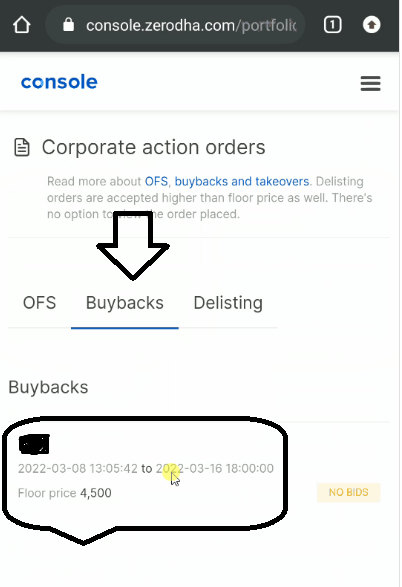

- Choose the Buyback option and choose the Stock for which the Buyback offer is running

Under Corporate action, you will have three options, but you need to select the buyback option and then choose the stock for which you want to apply for a buyback tender.

- Enter the quantity and place a request for a Buyback

Now enter the quantity you wish to tender and click on submit button. Post placing the order, you can check your order status in the order section.

Bottomline

In my view, buyback doesn’t hold a good perception of the business as they are left with no avenue of making growth and impacts the financial standing of the company negatively by artificially inflating the share price.

Shareholders are now exempt from paying taxes on profits received through buybacks through the tender process, but they are subject to capital gains tax if the buyback occurs on the open market.