How to Withdraw Money from ICICI Direct Demat Account? | Example

Last month I struggled with my finances due to sudden requirements arising due to medical difficulties. And this exigency amount was way high as compare to the emergency amount. But as the market was bullish and my portfolio was all in green and so had to withdraw money. Therein ICICI Direct Demat account came as a rescue. So I thought why not put up an article as many of us face a hard time at some point in our lives? So instead of taking personal loans or helps from others, let’s rely on savings. In today’s article, I will cover How to withdraw money from an ICICI Direct Demat Account with an example.

ICICI Direct Demat Account

ICICI has already made a name in the market due to its legacy of being in the financial market for over two decades. And ICICI Direct is recognized among India’s largest Retail brokers and has brought a revolution in the world of online investing. With ICICI Direct you can open your Demat account totally free of cost. They have several brokerage plans created keeping in mind the need of every investor and trader. ICICI Direct offers a 3-in-1 online trading account that links your Demat, trading, and bank account. Thus, give you a seamless trading experience and provides flexibility to pay when you trade. It’s always easy to manage one account rather than three therefore you will have complete control over the money and the trade you carry out.

With this account, you can easily track your portfolio by using different features like portfolio tracking, and a watchlist with an SMS alert to notify you of the rule you set in for carrying out the trade. Their site calls out zero account opening charges but that is not totally true as the base plan might not give any benefits so it’s better to evaluate all the schemes they have in their kitty and then choose as per our needs.

We already discussed these schemes in our previous series you may refer to the same for detailed information. Let’s get to the objective of the article for which I penned this article.

There could be two scenarios in which you might require to withdraw money from your ICICI Direct Demat account to your bank account. One could be und lying idle in a trading account and you need it so you can withdraw.

Secondly, if the available funds are not sufficient in the account you might have to sell your securities first. Then you can place a withdrawal request once funds get credited for the selling of securities.

How to Withdraw Money from ICICI Direct Demat Account?

Time needed: 3 minutes

The procedure of withdrawal remains the same.

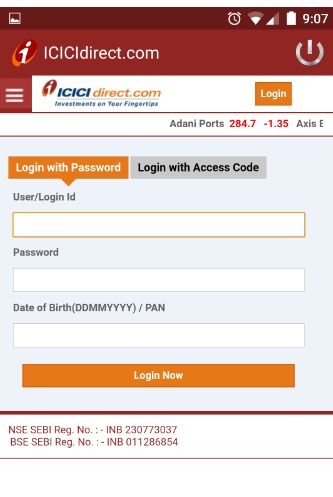

- Login to your ICICI Direct Demat account via app or web mode

You can search the mobile app on your device if installed. If not, first install from the play store or use the webpage to log in with your user id and pin: https://secure.icicidirect.com/customer/login

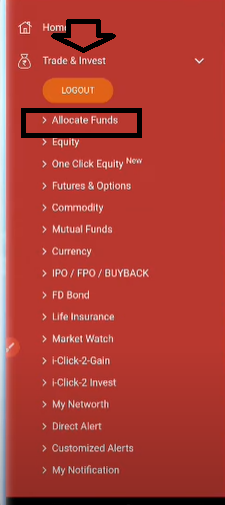

- Click on 3 bar and choose Trade & Invest

Once you log in to the ICICI Direct App, you will see different opens on your screen like the current market status, watchlist, top gainers, and losers. In the left-hand corner, you will notice 3 bars click on those 3 lines and select Trade and Invest.

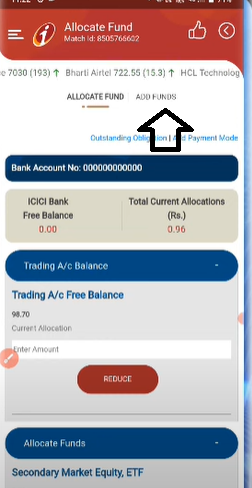

- Under Trade & Invest Choose Allocate funds

After choosing to allocate funds, you will get the option of adding a fund option at the top. Click on add fund, you will see another option on the same screen as withdraw funds.

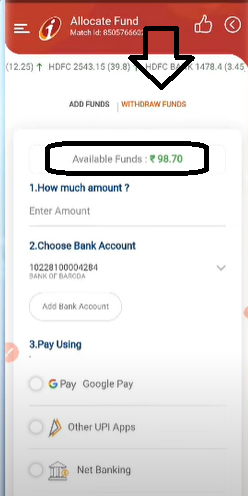

- Click on Withdraw Fund

When you see withdraw fund options, you can see available funds in your trading account in case it’s sufficient then firstly you can sell your securities and make the fund available in trading. Post which you can place a withdrawal request.

- Enter the amount you wish to transfer and choose the mode of Transfer

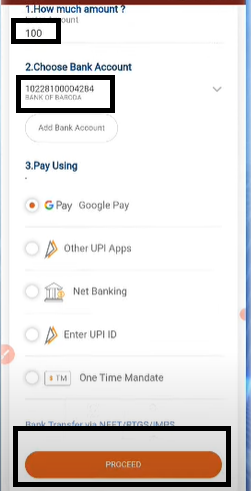

The last step would be to enter the amount you plan to transfer as my bank account is already linked so I will choose a Bank account. Or else you can pay using other accounts by using UPI or net banking. And click proceed it will ask you to verify your MPIN for authentication and you’re done.

These are the very basic steps that I tried exemplifying with the help of the screenshot. Hardly you can withdraw the money within a couple of seconds.

Let’s have a look at a few FAQs which might cross your mind while carrying out this transaction on ICICI Direct.

FAQs

You can expect the credit within T+3 days in your bank account.

You can use the e-atm option also while selling the shares so that payout can be credited the same day of the transaction. But this is at the discretion of the ICICI Direct.

No, you will earn any interest on the fund kept in the Trading account. It’s advisable to keep only the amount you wish to trade in allocate fund account.