ICICI Bank 3-in-1 Account – Charges, Minimum Balance & Opening Online Account

ICICI Bank 3-in-1 Account

ICICI Bank 3-in-1 Account Trading accounts combine the features of your Demat, savings, and trading account to give you a seamless and secure trading experience.

With the help of this account, you can trade in shares, futures & options, currencies, mutual funds, IPOs & Life insurance in one place. Therefore, it becomes easy for you to track your financial portfolio.

Icici Direct’s proposition is one of the oldest and most popular in the market under the 3-in-1 segment. Backed by ICICI Securities with their strong presence across India. Known for transparency and excellent support services by ICICI securities.

With this account you can buy shares via a trading account, at the same time money gets debited from your linked saving bank account. Once the transaction is executed the shares purchased get credited to your Demat account. Similarly, when you wish to sell shares, shares get debited from your Demat account, and the money you make is credited to your bank account. Like all broking firms, icici direct also levies transaction charges on each transaction based on the broking plan one has opted for.

You can experience a wide range of features likewise:

- Live Streaming of Share price with Trade Racer.

- You can access the account via different modes as web, mobile, or over the phone.

- Single window for all your investment needs.

- Varied brokerage plans for various products.

Also Read Zerodha 3-in-1 Account vs Upstox 3-in-1 Account – Review, Features, Brokerage Charges & more

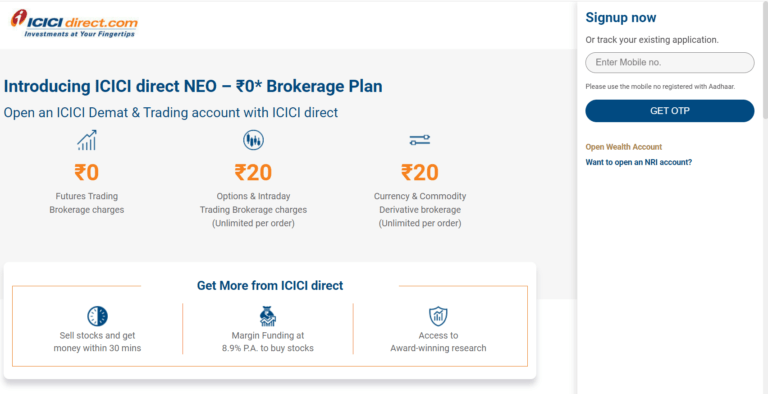

Account Charges

Account opening charges for trading accounts depend on the scheme opted by the customer. In addition, Demat charges will also depend on the Demat account opted by the customer (BSDA / REGULAR). Moreover, for saving account is ₹5000.

The Account opening fee varies from 0 to ₹975 rupees. ICICI Direct offers multiple schemes so the customer can opt as per their trading and investment need. For more details, they can contact the support team of ICICI Direct on this 1860 123 1122

There are no Annual Maintenance charges for the Demat Account for the First Year. However, a charge of ₹700 (excluding taxes) is levied from the 2nd year onwards. Moreover, if the Demat account is under BSDA, no AMC is levied for holding value up to ₹50000

Also Read Upstox 3-in-1 Account – Charges, Minimum Balance & Opening Online

Minimum Balance

Minimum account balance has to be maintained as per the saving bank account you opt with ICICI Banks. Therefore, these are charges as per location:

Metro and Urban locations – Rs 10,000

Semi-urban locations – Rs 5,000

Rural locations – Rs 2,000

Gramin locations – Rs 1,000

Also Read Edelweiss Tx3 vs Xtreme Trader [2022]-Review and Features

What are the Steps for Opening ICICI Bank 3-in-1 Account Online?

Time needed: 1 minute

Here is the list of steps that you may opt for while applying online.

Please click on this URL: https://secure.icicidirect.com/accountopening

- OTP

Enter your Phone number followed by OTP verification.

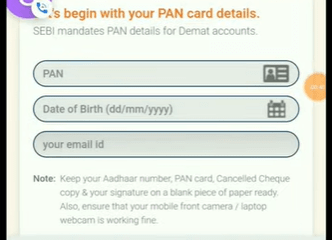

- PAN

Key PAN number, date of birth, and email address. After that click on the Next button.

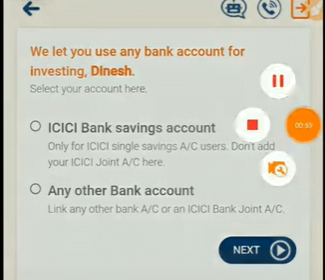

- Bank Account

The next page will ask you to select a bank account: ICICI Bank or any other bank account

.

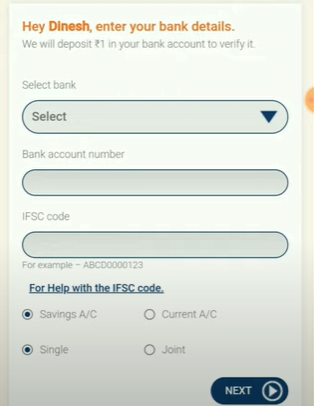

- ICICI Bank

Enter your bank details like an account number for ICICI Bank and any other bank: name of the bank, account number, and IFSC code. In addition, choose the account type with membership.

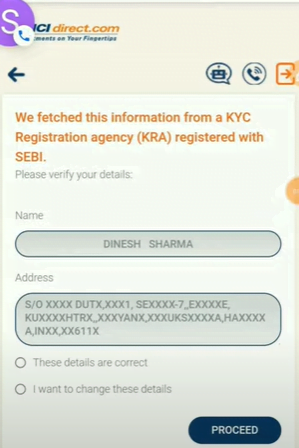

- KYC

ICICI direct will flash your KYC details registered SEBI if it’s correct or not. Subsequently, click on proceed.

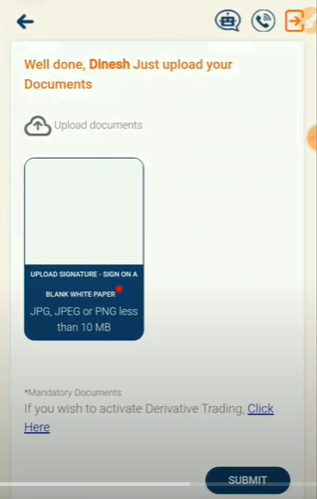

- Digital Signature

Upload your digital signature in jpg, jpeg, or png file less than 10MB and click on submit.

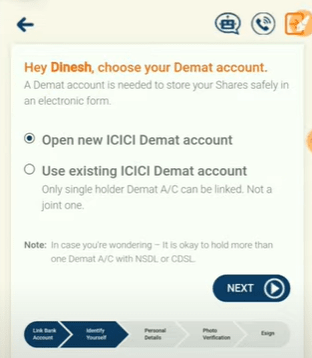

- Demat account

Choose Demat account if already holding with ICICI or wish to open a new one.

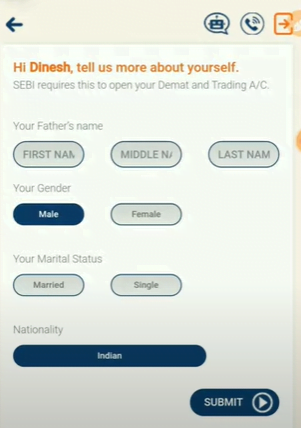

- Status

If you open a new one just click next. After that, select your gender and marital status.

- Mobile number

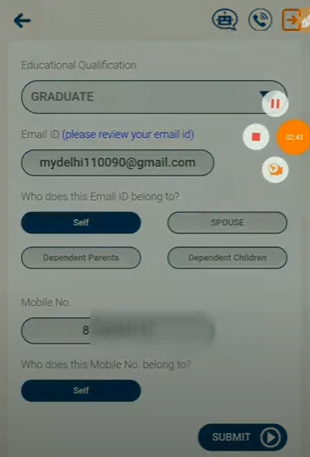

Click on submit button and key in your educational qualification, email address, and mobile number belonging to whom.

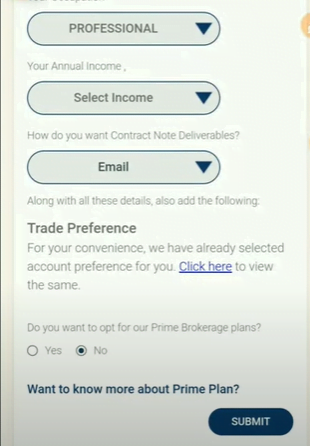

- Income

On the next page, you can fill in your qualification and answer general questions about your income.

You can select No if don’t want to opt for their prime plan. Thus, proceed to the next page.

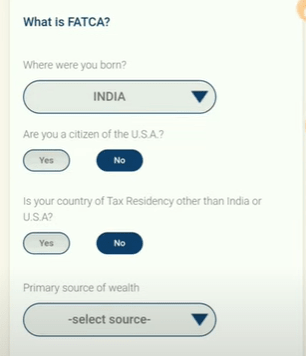

- FATCA

Provide FATCA declaration.

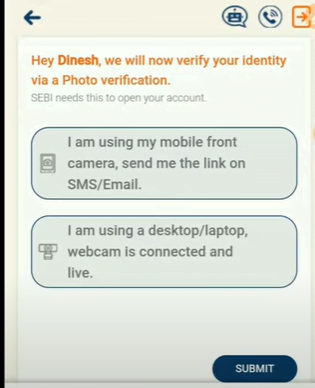

- SMS

The user will receive a link via SMS on your mobile to complete your in-person verification.

- E-sign

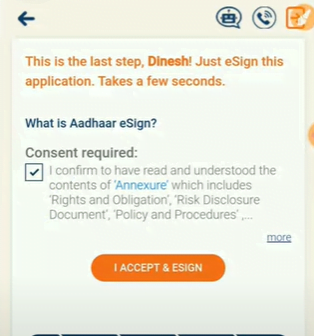

You will receive an SMS to complete the e-sign process. Post completing the above steps it will ask you to enter your email address and verify with OTP.

- OTP and T&C

Choose your user id as mobile number or email address and click on next with T&C acceptance. Verify your Aadhar for NSDL with OTP verification.

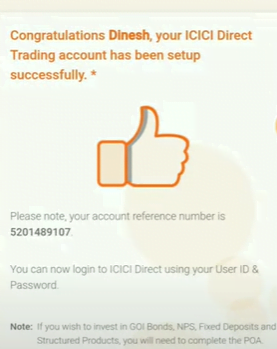

- Account

Now your account is open you can log in post 24 hours with a username and password.

Also Read How to Open SBI 3-in-1 Account Online? | What is SBI 3-in-1 Account?

Conclusion

In today’s scenario, more than 20 broking firms are offering 3-in-1 accounts more or less with the same feature. I have only one suggestion for my customer please choose the account as per your trading need and opt for the right brokerage plan to reduce the transaction charges.

Hope you like the article as explained most simply. In case still, have any queries please do contact us.

Also Read List of Government Bonds in India – Short-Term and Long-Term Bonds