Post Office Savings Account | Online | ROI 2023 | Features |

Introduction

Post Office Savings Account is similar in many ways to a normal savings account.

It is considered to be a highly secure instrument to deposit money into and offers the choice of full or partial liquidation of money at very short notice in case the need arises.

There are numerous benefits of investing in a Post Office Savings Account. If you want to invest your hard-earned money without risk, then opt for opening an account in Post Office bank.

Post Office deposits are considered to be a safe and secure mode of savings along with an online experience.

Recommended Articles

Post Office Schemes for Sr. Citizens

Post Office Savings Account

PO Fixed Deposit | Interest Rates

Senior Citizen Savings Scheme

Kisan Vikas Patra: Double the Money

Doorstep Banking Services for Senior-Citizens

Post Office Savings Account

The good thing about PO saving accounts is that they offer a specified return on investment. Citizens in rural and semi-rural areas are the major beneficiaries of Post Office accounts.

India Post Payments Bank-IPPB has come up with three types of savings accounts, each with a dissimilar set of features and benefits. Choose the one that suits your needs.

Also Read National Pension System: Secure Your Retirement without Stress

Digital Savings Account

PPB’s Digital Savings Account is the perfect way to onboard yourself through the IPPB Mobile App.

Any citizen above the age of 18 years, having Aadhaar and PAN card, can open this account.

Also Read Government of India Pension Scheme for Old Age or Parents

Features

| Banking at your convenience and Instant self on-boarding. |

| No monthly average balance needed to be maintained and an account can be opened with zero balance. |

| Complete the KYC(Know Your Customer) formalities within 12 months. |

| Digital account is subject to closure if the KYC is not completed within 12 months of account opening. |

| KYC formalities can be completed by visiting any of the access points or with the assist of the GDS (Gramin Dak Sevaks) or Postman, after which the Digital Savings Account will be upgraded to a Regular Savings Account (RSA). |

| A maximum yearly cumulative deposit of Rs 2 lakhs is allowed in the Digital account. |

| No commitment of minimum balance. |

Also Read Atal Pension Yojana [APY] in Post Office

Basic Savings Account

The basic savings account has all the features and benefits (except that it allows only 4 cash withdrawals in a month).

The goal of the basic savings account is to provide primary banking services at a very nominal charge.

Features

- Instant and paperless account opening using Aadhaar with a registered mobile number as per the applicable rules.

- No monthly average balance is required to be maintained and also Free monthly e-statement.

- The account can be opened with a zero balance.

- Instant money transfer by IMPS and easy bill payment and recharges.

- Free account opening and availability of funds at your doorstep.

- Assisted services by the GDS(Gramin Dak Sevaks), as and when required.

- Bill payment facility at your doorstep.

- 4 cash withdrawals are allowed in a month.

Also Read SBI Bank Pension Plan – ADS | NPS | APY | Special Term Deposit

Regular Savings Account

The Regular Savings Account can be opened at the bank’s access points and also at your doorstep.

This account can be used to keep money secure, withdraw cash, deposit funds, perform easy remittances, and besides a host of other benefits.

Interest can be earned on the money kept in this account and the cash withdrawals allowed in this account are unlimited.

Features

- All features are the same as Basic Savings Account.

- Additional, unlimited cash deposits and withdrawals.

Post Office Savings Account Interest Rate

| Savings Account | Interest Rate |

|---|---|

| Regular Savings Account (RSA) | 4.00% p.a |

| Digital Savings Account (DSA) | 4.00% p.a |

| Basic Savings Account (BSA) | 4.00% p.a |

Also Read Post Office Interest Rates

Post Office Savings Account Online

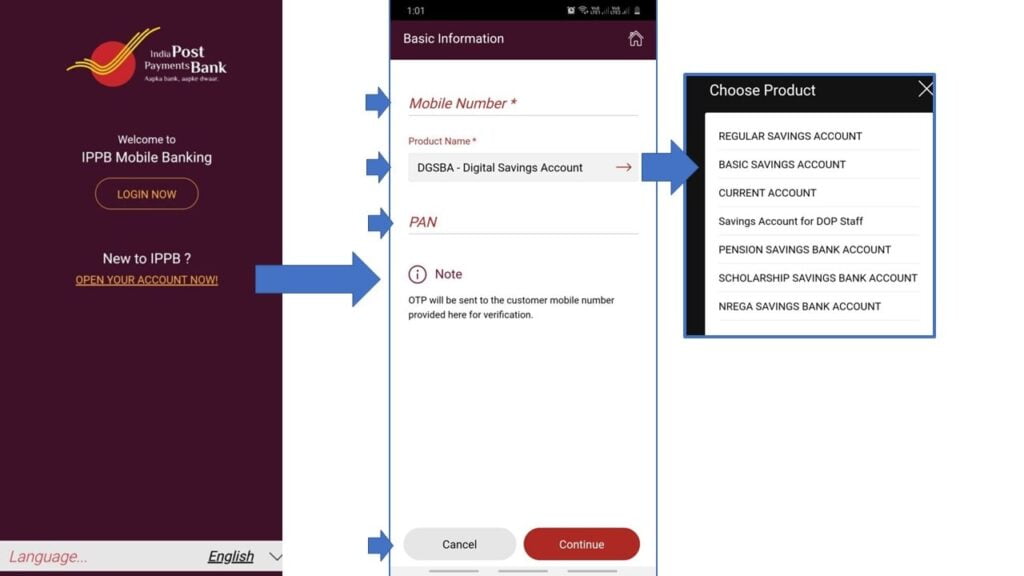

To open a PO savings account online, you have to follow the below steps.

First Step

- You can download the IPPB Mobile App from the play store or app store OR

visit the official website of IPPB. - Click on “Open Your Account Here”

- Fill the required details like Mobile Number, Pan Card number and choose the “Product Name” manes Account Type then click on “Continue” as shown below screenshot.

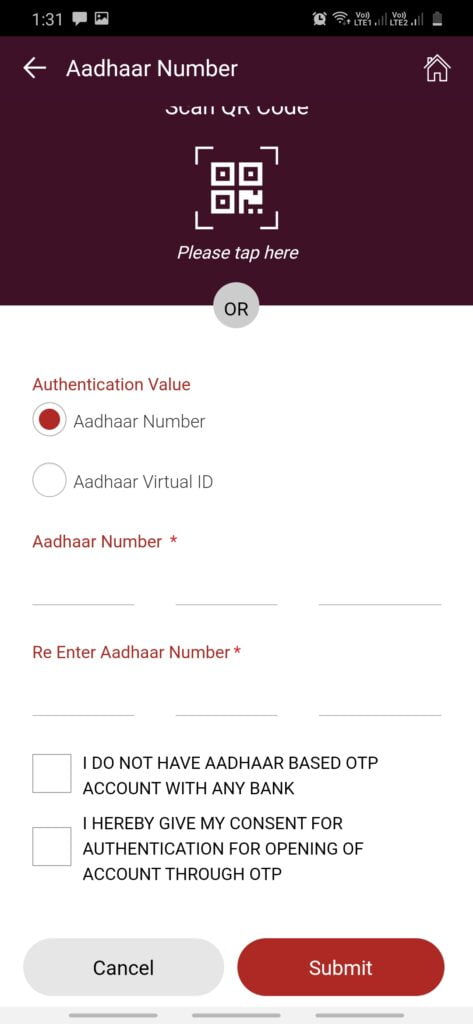

Second Step

- Select the “Aadhar Number” option for authentication.

- Fill the required detail of Aadhar Number then click on “Submit”.

Last Step

- Enter the received OTP and then click on “Submit” button.

Post Office Savings Account Balance Check

Below are steps to download the PO savings account statement and check the balance.

Using Mobile Banking

- Login to the India Post Mobile Banking app and click on the account option.

- Click on Savings Account and then Transaction History.

- Click on Download your Statement.

Using Internet Banking

- Login to India Post Internet Banking on the website https://ebanking.indiapost.gov.in/

- Click on Navigate accounts and then click on Balance & Transaction Information.

- Click on the Savings account option and then click on ‘My Transactions’ and download your statement.

How to close a post office savings account

To close the PO savings account, fill out the closure form.

Source – IPPB