SBI Doorstep Banking App | Charges | Registration | Eligibility

In this article, we will take close look at availing SBI Doorstep Banking services via YONO App. But before discussing the services let’s check out the services, eligibility, and charges applicable for each service type.

Also Read YONO SBI Registration with & without Internet Banking – A Complete Guide

SBI Doorstep Banking App

Amid the covid 19 crisis, banks are trying their best to delight their customer and taking extra steps to ensure fewer footprints in the SBI branch to stop the spread of the novel Corona Virus. In May 2021, SBI has launched doorstep banking services for their senior citizen clients to ensure their safety.

The Doorstep Banking Services will include the facilities like delivery of cash, drafts, term deposit advice. In addition, it offers pickup of cash, cheque, cheque requisition slip, form 15H, life certificate, KYC documents.

This service can be availed by registering on SBI YONO App, Internet Banking, or by submitting an application cum request form at your Home branch. Post successful registration, you can call the toll-free number of customer care and place the service request accordingly. To offer this service, SBI has joined hands with third-party agencies like Atyati and Integra.

On behalf of SBI, these alliance companies arrange agents that facilitate customers to access different accounts and associated services at the convenience of their Doorstep. This facility caters to both the financial & non-financial banking needs of the customers.

Alternatively, I’m attaching the application form also in case one wishes to do it via manual mode:

Also Read SBI Loan Against FD : Interest Rate | Features | Benefits | Online | Repayment

Eligibility

Let’s check out the eligibility before you register to avail yourself the doorstep services

- Service is applicable for senior citizens of more than 70 years of age and differently abled or suffering medically from chronic illess or disability. In addition, it include visually impaired customers.

- Customers having registered address within a specified limit of 5kms from the Home branch.

- Account should be fully KYC compliant.

- Customer should be register a valid mobile number with account. Most importantly, sms facility should be opted for the same.

- Account should be single or joint account woth eiher or survivor.

Also Read Sovereign Gold Bond: Best Returns on Gold Investment | 2022 Dates

SBI Doorstep Banking Registration

Time needed: 1 minute

Here are the steps to register for SBI Doorstep Banking services via the SBI Yono app:

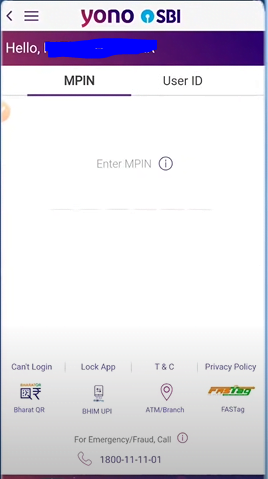

- Login to YONO App

Enter your credentials of Internet Banking or MPIN to log in to the YONO app. In case, you’re not registered on the YONO app please check my other article for SBI YONO registration.

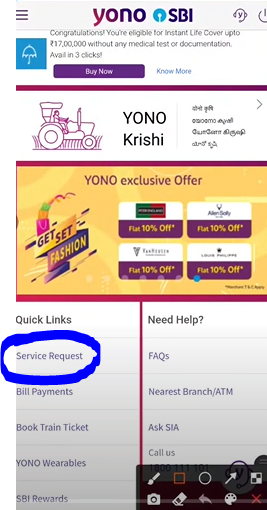

- Search for Service Request Tab on Dashboard

After login, you will find different options on your screen like accounts, YONO Pay, or cash. Just scroll down at the bottom of the current screen. You will find Service Request under the Quick Links tab on the bottom left of the dashboard screen.

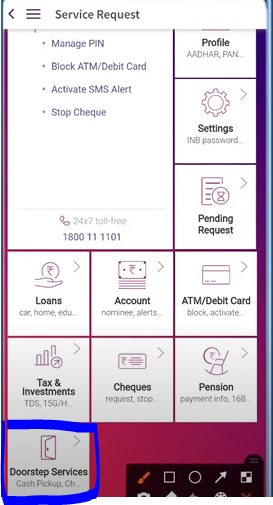

- Click on Service Request

Once you click on the service request option, it will take you to the next page. After that, scroll down on the bottom left you will find a box for Doorstep Services. As a result, click on Doorstep services.

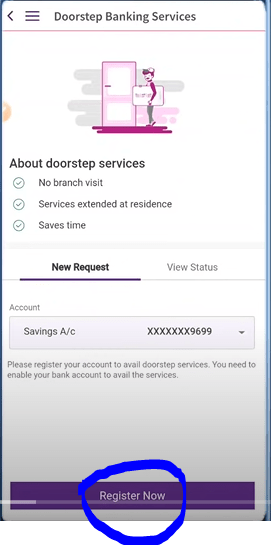

- Choose New Request

On this page select the New request as we wish to register for the service and select the account. After that, click on Register Now.

- Post clicking Register Now

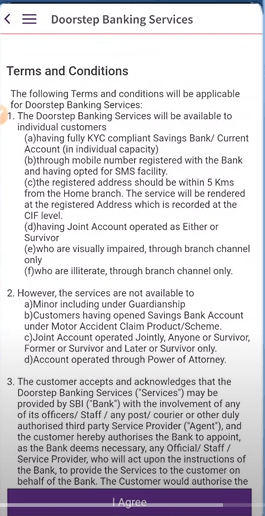

Click on Register Now it will take you to the terms and conditions page.

- Agree to Terms and Conditions

Click on the I agree on the button and you will receive a message that the service for the request has been placed.

- Post Service Activation

Once you get notification from your bank that service has been activated. You can call the toll-free number 1800 1111 03 on working days between 9 am to 4 pm for placing the service request from your registered mobile number.

Also Read SBI Yono Digital Account- How to Open? Registration | Features

Charges

The terms and conditions you agree to while registering for SBI Doorstep Banking Services list you the charges applicable for availing of the services. That’s why SBI asked to agree to these TNC as post availing this service, bank will debit the respective service charges from your bank account.

Here is the list of charges applicable for both financial and non-financial banking transactions:

| Request | Charge | |

|---|---|---|

| Financial Services | Cash Deposit/Withdrawal | Rs.75 + GST/- |

| Non-Financial Services | Pick Up of Cheque/Instrument/Cheque book Requistion Slip | Rs.75 + GST/- |

| Term Deposit Advice and Statement of Saving Bank Account | Free | |

| Statement of Current Account (Duplicate) | Rs.100 + GST/- |

Also Read Post Office Schemes for Sr. Citizens

FAQs

The tat to complete the request is T+1 day (excluding Holidays)

No. of a cash transaction is limited to 1 per day. The Max amount of cash deposit/ withdrawal is Rs.20000/- and the minimum is restricted to Rs.1000/-

Max 100 cheque leaves request you can place in one request.

It will deliver via the standard method of courier or post.

Also Read Plot and Construction Loan From SBI Bank – Process | Tax Benefit | Documents