Sovereign Gold Bond through Kotak Mahindra Bank | Taxation and Selling

Gold Bonds Scheme

Sovereign Gold Bonds were launched by the Central Government in Nov’2015, under the Gold Monetization Scheme.

In this gold bond, the issues are made open for subscription in tranches by the Reserve Bank of India in consultation with the government of India.

Also Read Loan against Sovereign Gold Bond | Interest Rate | Eligibility

However, the RBI notifies the terms and conditions of the bond from time to time.

RBI will declare the rate of this bond before every new tranche by issuing a press release.

It is the safest & the perfect way to buy and store gold, and no physical lockers are required to store it.

Kotak Mahindra Bank offers customers the opportunity to invest in the SGB scheme through all of its branches in the country.

Before we discuss the “How to invest in sovereign gold bond through Kotak Mahindra bank?“, let us briefly touch upon the features of bonds.

Also Read Sovereign Gold Bond Calculator : Return Calculation 2021

10 Key Features of SGB Scheme

- The bonds will be denominated in units of one gram and multiples thereof.

- In a fiscal year, an individual and HUF can invest for a minimum of 1gm and a max of 4kgs wherein for trusts and similar entities max ceiling is 20kgs.

- Investors will be paid interest on the initial investment at the rate notified by RBI for each tranche and is paid semi-annually.

- The redemption price will be decided on the average closing price of gold of 999 purity for the last 3 Business days from the date of redemption.

- Premature withdrawal is applicable only after the 5th year onward on the coupon payment date and is also tradeable if held in Demat form.

- As per the RBI guidelines, granting a loan to SGBs would be subject to the decision of the bank or financing agency.

- The nomination facility is available as per the provisions of the Government Securities Act 2006 and Government Securities Regulations, 2007. A nomination form is available along with the Application form.

- Payment for the Bonds will be through cash payment (up to a maximum of Rs. 20,000) or demand draft, cheque, or electronic banking.

- Know-your-customer (KYC) norms will be the same as that for the purchase of physical gold. KYC documents such as Voter ID, Aadhaar card/PAN, or TAN /Passport will be required.

- To buy this gold bond you had to be either of the following mentioned below:

An Individual

An individual on behalf of a minor

An individual jointly with another individual

HUFs

Trusts

Universities and Charitable Trusts

Read More – Sovereign Gold Bond – Features

Sovereign Gold Bond Next Issue Date

| S. No. | Tranche | Date of Subscription | Date of Issuance |

| 1. | 2023-24 Series I | June 19 – June 23, 2023 | June 27, 2023 |

| 2. | 2023-24 Series II | September 11-September 15, 2023 | September 20, 2023 |

Read More – Sovereign Gold Bond through SBI

How to Buy Sovereign Gold Bond through Kotak Bank?

Time needed: 5 minutes

Follow the steps given below for buying Sovereign Gold Bond through Kotak bank

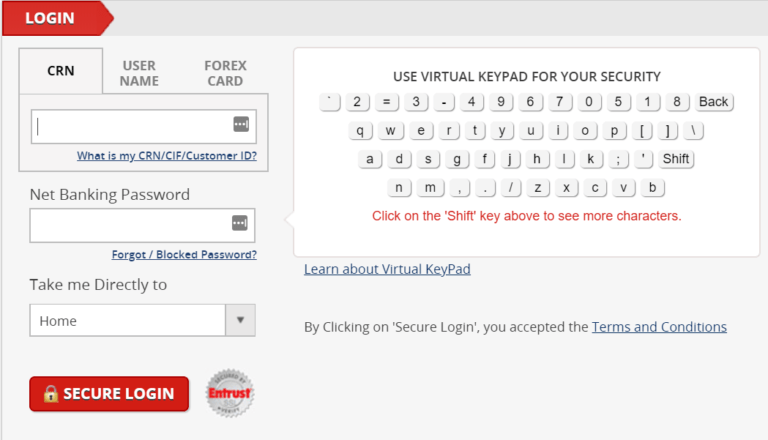

- Login to Net Banking

Visit Kotak Net-banking Portal and log in to your account

Customers can invest in government-issued SGBs through Net-Banking and avail INR 50/- discount per gram.

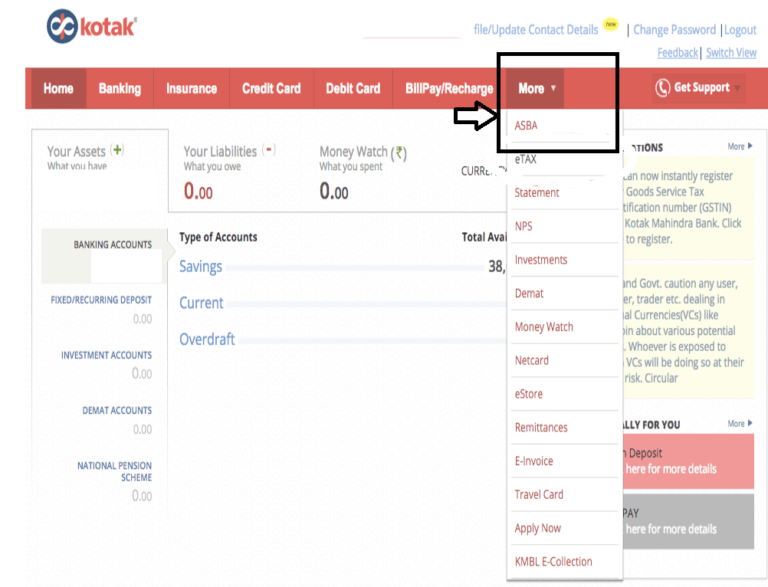

- Sovereign Gold Bond

After logging in, You need to More – ASBA tab. Thereafter you need to click on the “Sovereign Gold Bond” to apply for the bonds.

- Certificate of Holding

The bonds can be held in the Demat account. A specific request for the same must be made in the application form itself. In other words, If you have a Kotak Demat account, you will get bonds in demo format, else you will get physical or e-certificate.

- Application Form

You need to fill out the application form with some mandatory or optional inputs.

You will see some inputs are already filled. All you need to fill in the remaining inputs.

Input the number of bonds you want to buy in the Quantity input box and click on the “Submit” button after checking the “Terms and Conditions” check box. - Allotment

After successfully applying. You will see details on the next screen. Keep a note of the details to avoid any inconvenience in the future. However, you need to wait for the issue date to see the allotment in your bank account.

You can have only one unique investor Id linked to any of the prescribed identification documents. The unique investor ID is to be used for all the subsequent investments in the scheme.

Also Read How to Buy Sovereign gold Bond from ICICI Bank or ICICI Direct?

Sovereign Gold Bond Taxation and Selling Before Maturity

- This is a key tax benefit that has been offered by the RBI to make the tax bonds more attractive and encouraging.

Although, the tax treatment is unbeneficial if you exit the bonds premature than that. - The first option can use the premature redemption option that opens at the end of 5 years where you can redeem your bonds.

- The next option is to sell your SGBs in the secondary market using the Kotak Securities account.

- SGBs issued will list on the national stock exchange with a unique ISIN on completion of 6 months from the date of the issue. In both these conditions, the capital gains will be taxable.

- The normal taxation definition of short-term capital gain (<3 years) and long-term capital gains(>3 years) will be applicable.

Read More – RBI Bonds 2021 vs Tax Saving Fixed Deposits vs Sovereign Gold Bonds