What is Stop Loss in the Share Market? How does Stop-Loss Work?

I know you guys were trying to learn new terms associated with the Share Market to make an informed decision. So here we are let’s learn What is Stop loss in the share market and How does Stop Loss work?

Also Read Lifetime Free Demat Account without AMC in 2022

Let’s get started!

Stop loss is the advance order you give to your broker to sell a security when it reaches a particular price point. Generally, it is used to limit your losses in short term. However, this order can be placed for the long-term horizon as well. An investor can place an advance order by paying a certain amount of brokerage. Alternatively, this stop loss is also known as “stop order” or ” stop market order”. By placing this order you issue an instruction to the broker to sell stocks when it reaches a preset price.

Also Read What are Alpha and Beta in Stock Market? | Alpha vs Beta in Stocks

Stop-loss is a mechanism by which investor doesn’t want to take the pressure of monitoring security on a day-to-day basis. Thereby, placing an advance order with a broker to trigger the order execution when the security reaches a certain pre-defined limit.

For example, you own shares of Wipro and want to sell them and you place a stop-loss order with your broker stating when the price of the stock reaches a certain high or low then execute this order. Accordingly, when the market behaves in such a way then automatic order will get triggered once the price range matches the set limit.

Also Read What is Call and Put in Stock Market with Example?in Rules in 2022

Hence, by placing this order an investor can easily limit your losses up to his appetite.

How does Stop-Loss Work?

Now we know What is Stop Loss Order and Why do we need to place such orders. Let’s understand how it works in Zerodha and how you can place such an Order.

Time needed: 1 minute

Here are the steps for placing Stop Loss Order on Zerodha

- Login to Zerodha Kite App

Enter your user credentials and log in to Zerodha Kite App.

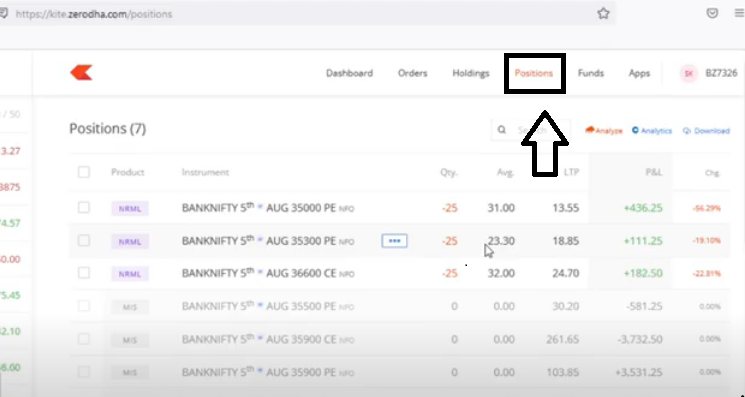

- Go to the Position Tab

Once you log in on Kite App, locate the Position tab on top of the window. Click on Position tab and it will show all your open positions as on date.

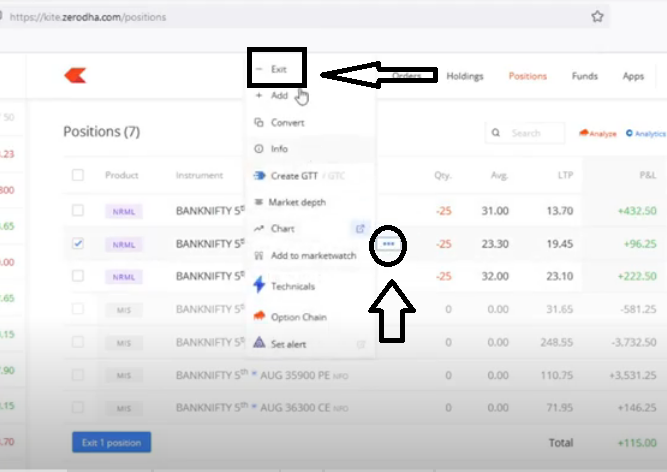

- Choose the stock

Now choose the stock for which you like to place a stop-loss order and click on the three dots appearing next to your stock column. When you right-click on it, a dropdown will open from there you can choose the exit option.

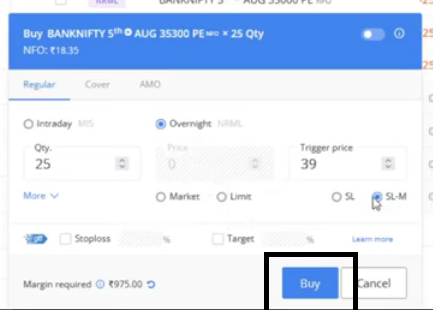

- Fill in Order Detail

You can simply enter the quantity field and choose either SL order or SL-M order as there are two types of stop-loss orders you can place on Zerodha.

a. SL-M order type – A Sell SL-M order with a trigger price of their choice will be placed.

When stock price reaches the trigger price, in this case, a sell market order will be sent to the exchange, and your position is squared off at market price.

b. SL order type – A Sell SL order with a price and a trigger price will be placed. Because your order must be triggered first, the (trigger price.) This order type provides you with a Stop-Loss range.

- Click on Buy or Sell Button

Post filling order detail, just swipe the buy or sell button and place your order. When the price of the stock reaches the trigger price your order will be executed by the stock exchange.

Conclusion

Also Read What are Alpha and Beta in Stock Market? | Alpha vs Beta in Stocks

A stop-loss order is a simple tool that, when used correctly, can provide significant benefits. This tool prevents excessive losses or locks in profits in almost all investing styles. Consider a stop-loss order as an insurance policy: You hope you never have to use it, but it’s nice to know you’re covered if you do.

Also Read Best Dividend Paying Stocks in 2022 – What is Dividend in the Stock Market?