What is VIX in Stock Market? How is the Volatility Index Calculated in India?

Over a course of time, we have learned lot more terminologies associated with Stock Market. In the same series, today we will learn What is VIX in Stock Market and in India how we calculate VIX? Let’s check out the same.

What is VIX in Stock Market?

VIX stands for Volatility Index and it is the index that determines volatility in the market. When I was young have came across this term in Chemistry subject. Which used to mean a substance that evaporates very easily at room temperature. Since then I have seen its usage in varied contexts outlining that it is unpredictable in nature. Similarly, in the 1990s CBOE( Chicago Board Options Exchange) introduced the concept of VIX that measures market expectations of price fluctuation in the next 30 days.

The volatility index measures the market’s expectation of volatility in the short term. Volatility is the”rate and magnitude of price changes”. In terms of finance, risk is the synonym for volatility. The Volatility Index is a measure of the amount by which an underlying Index expects to fluctuate in the near term.

In other words, VIX measures the level of risk, fear, or stress in the market when making investment decisions. In India, we know there are two prominent indexes are there to determine the sentiments of investors SENSEX and NIFTY. Nifty 50 is based on the weighted average of the 50 largest companies in terms of market capitalization. Therefore, the India Volatility index indicates the degree of volatility investors expect over the coming 30 days in the NIFTY50 Index.

How is Volatility Index Calculated in India?

Across the globe, traders calculate VIX using Black Scholes Model. To determine the ‘fair price’ of an option contract, the Black Scholes model considers five key variables: the strike price of the contract, the market price of the stock, the time to expiry, the risk-free rate, and volatility. The VIX calculates the volatility expected by market participants by back-working from the buy-sell prices of Nifty options contracts.

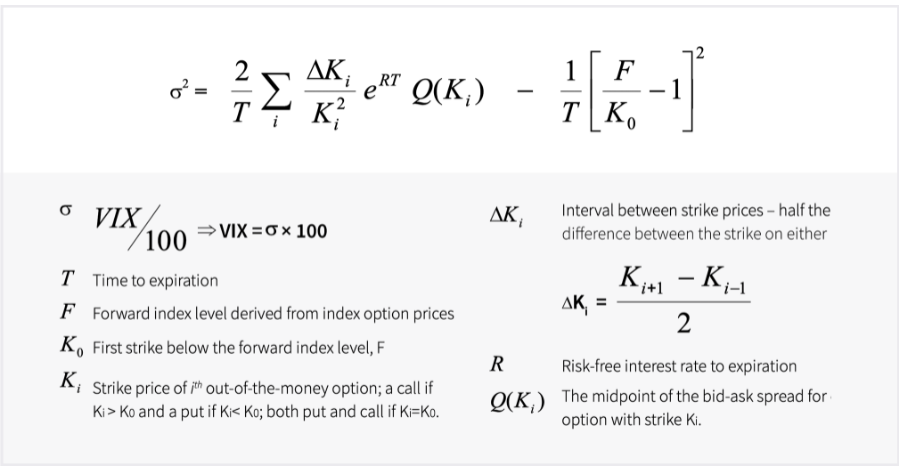

You can calculate India VIX using the best bid and ask for quotes of out-of-the-money near and mid-month NIFTY option contracts traded on the NSE’s F&O segment. Here is the mathematical formula to derive VIX:

However, to derive India VIX, a few amendments have been made to the original concept to adapt to Nifty Options. Therefore, I would suggest no need to do such complex calculations end up making mistakes. Instead, you can refer NSE website for its values to make a wise investment decision.

Volatility and the VIX price have moved in opposite directions. A higher India VIX value indicates higher volatility expectations in the Nifty, while a lower India VIX value indicates lower volatility expectations.

Let’s take a look at an example:

Assume the India VIX is 10 points. This means that traders anticipate 10% volatility over the next 30 days. In other words, traders expect the Nifty to be worth between 10% and 10% more than it is now in the next year over the next 30 days.

Furthermore, historical trends indicate a negative correlation between the Nifty and the India VIX. The Nifty rises whenever the India VIX falls. When the India VIX rises, the Nifty falls.

The VIX index can tell you whether market participants are fearful or confident about the market in the short term. The VIX index provides a more accurate picture of market volatility.